British Pound, GBP/USD, US Dollar, Wall Street, IMF, Earnings – Asia Pacific Market Open

- British Pound gains as haven-linked US Dollar sinks and stocks soar

- Markets brushed aside economic warnings from IMF and US banks

- GBP/USD uptrend in focus, APAC stocks may rise as Aussie gains

British Pound Gains as US Dollar Sinks and Wall Street Bounce Continues

The British Pound was one of the best-performing major currencies as the haven-linked US Dollar was the worst. Investor sentiment rebounded from Monday as the Dow Jones and S&P 500 closed 2.39% and 3.06% higher respectively. The aggressive bounce on Wall Street off last month’s low continues despite a slew of warnings about the future of economic health.

Over the past 24 hours, the International Monetary Fund (IMF) released its latest world economic outlook report. The institution forecasted that the globe may see the deepest recession since the Great Depression almost a century ago. Meanwhile earnings season kicked off as major US banks envisioned a rough economic recovery. While the S&P 500 climbed, financial stocks relatively disappointed as well as energy ones.

Rather the focus for investors seemed to remain on slowing US coronavirus case growth despite the rise in fatalities. Investors often look to the world’s largest economy as a proxy for global growth. In this regard, markets may be betting on a sooner-than-anticipated reopening of businesses. Meanwhile major local airline stocks received a boost in afterhours trade as the Treasury reached an agreement on aid for large carriers.

Tuesday’s Asia Pacific Trading Session

Asia Pacific benchmark stock indexes may follow Wall Street higher on Wednesday. During Trump’s daily press briefing, he hinted at efforts to reopen the economy. He said that he will authorize each state governor to implement a plan and that some may reopen before May 1.

Prior to his press conference, Anthony Fauci – the director of the National Institute of Allergy and Infectious Diseases - said the target date is “a bit overly” optimistic for many parts of the nation. An upbeat session may bode well for the growth-linked Australian Dollar. This may also keep pressuring the US Dollar.

British Pound Technical Analysis

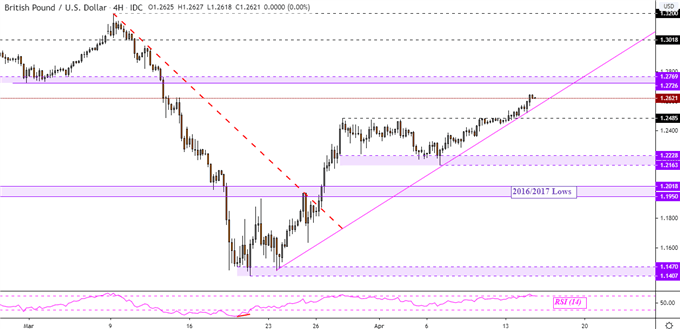

The British Pound continues to adhere to key rising support against the US Dollar – as expected. On the GBP/USD 4-hour chart below, this is the pink line that was formed when the pair bottomed in March. The pair may be on its way to retest lows from early last month which could make for an inflection point between 1.2726 – 1.2769. A close under rising support exposes 1.2485.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

GBP/USD 4-Hour Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter