Asia Pacific Market Open Talking Points

- S&P 500 still ends week lower on late Friday recovery as USD soared

- GBP/USD may see 1985 low, UK economy contracts in second quarter

- Anti-risk Japanese Yen may gain as new week begins if sentiment sours

Not sure where the British Pound is heading next? Check out the third quarter fundamental and technical forecast !

The Double Take in Risk Trends

Risk trends experienced a wild ride to wrap up last week as US-China trade tensions waxed and waned. It began with US President Donald Trump threatening to cancel trade talks with China as the S&P 500 declined over 1.2%. Then, there was a partial recovery as the White House clarified that Trump’s decision to hold off on allowing US companies to do business with China’s Huawei referred to government agencies.

Still, the S&P 500 ended 0.66% and 0.50% to the downside compared to Thursday and the previous week respectively. The US Dollar also launched a recovery towards the end of the session, supported by rising front-end government bond yields as near-term aggressive Fed easing bets cooled. The pickup in sentiment was not enough to fully offset prior declines in the pro-risk Australian and New Zealand Dollars.

British Pound Sinks Towards 1985 Low as UK Inches Towards Technical Recession

Meanwhile, the British Pound overwhelmingly underperformed against its major counterparts after the UK economy unexpectedly contracted 0.2% q/q in the second quarter according to preliminary estimates. It was the first contraction since 2012 amidst rising worries over the economic consequences of a “no-deal” Brexit. A second consecutive quarter of declines will place the nation in a technical recession.

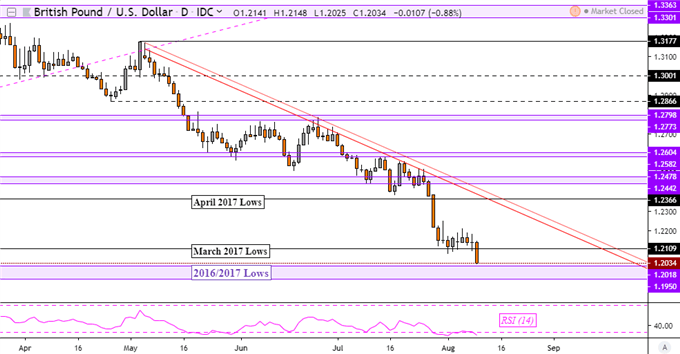

British Pound Technical Analysis

GBP/USD thus closed under March 2017 lows on Friday as it looked to extend the dominant downtrend. Ahead lays the psychological barrier between 1.1950 and 1.2018. This area contains the lows Pound Sterling achieved in 2016 which if breached, expose levels not seen since 1985. In the event of a turn higher, keep an eye on the falling channel of resistance from May which may keep the downtrend intact.

GBP/USD Daily Chart

Monday’s Asia Pacific Trading Session

Despite the last-minute upside push on Wall Street, Asia Pacific markets are still vulnerable to risk aversion at the beginning of the new week. A lack of prominent economic event risk for the major currencies places the focus for them on sentiment. The anti-risk Japanese Yen could extend gains from the end of last week as the US Dollar follows suit.

FX Trading Resources

- See how the S&P 500 is viewed by the trading community at the DailyFX Sentiment Page

- See our free guide to learn what are the long-term forces driving Crude Oil prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter