Asia Pacific Market Open Talking Points

- GBP/USD climbs, the UK Parliament backs bill to block ‘no-deal’ Brexit

- Canadian Dollar fell alongside a decline in crude oil prices, AUD/USD up

- FX markets look to risk trends in Thursday’s Asia Pacific trading session

Find out what the #1 mistake that traders make is and how you can fix it!

GBP/USD Climbs as UK Parliament Blocks No Deal Brexit

The British Pound firmed in early Thursday trade after the UK parliament voted and passed a bill to block a ‘no-deal’ Brexit. The measure, which passed by just one vote, seeks to push back the already-extended April 12th divorce deadline should the government fail to secure a withdrawal agreement. This does mean that UK Prime Minister Theresa May will have to head back to the European Union to discuss it.

Earlier in the day, Sterling was trading sideways as Ms May reportedly had ‘constructive’ talks with opposition leader Jeremy Corbyn. The currency initially rallied on prospects of coordination between the two. From here, the bill heads to the House of Lords where it must be approved there. Newswires suggest that it will be voted on later today.

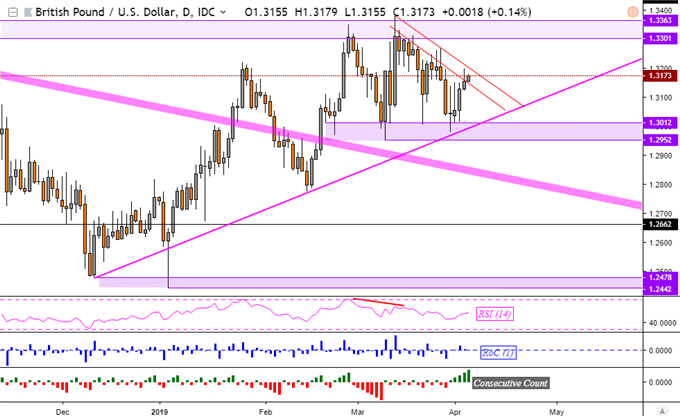

GBP/USD Technical Analysis

There wasn’t enough upside momentum from the Brexit developments to help GBP/USD clear near-term descending resistance on the chart below. It is however approaching the outer boundary of the psychological area. A breakout to the upside would open the door to testing 1.3301 thereafter. A turn lower on the other hand exposes support just above 1.3012.

GBP/USD Daily Chart

Chart Created in TradingView

In other news, the pro-risk Australian Dollar was the best-performing major on Wednesday. This is largely owing to developments earlier in the day which included rosy domestic economic data and welcoming progress in the US-China trade talks. Risk appetite generally swelled throughout the day, working against the Japanese Yen. This did diminish later on as the S&P 500 trimmed some of its gains.

The Canadian Dollar underperformed, falling with a decline in crude oil prices that picked up pace during the European trading session. Then, US weekly oil inventories increased by the most since the middle of January, pressuring the commodity further.

Thursday’s Asia Pacific Trading Session

On Thursday, the economic calendar docket during the Asia trading session is notably thin. This places the focus for currencies on sentiment. S&P 500 futures are now little changed, hinting that upside momentum in equities could take a pause for the time being. As always, keep a close eye out for US-China trade talk updates. You may follow our team twitter handle here @DailyFXTeam for more timely updates.

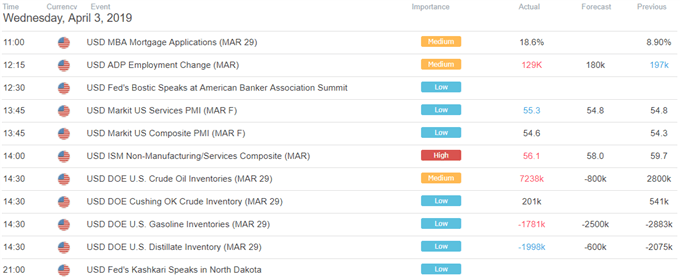

US Trading Session Economic Events

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter