Asia Pacific Market Open Talking Points

- Canadian Dollar depreciated after BoC, USD/CAD may rise more

- S&P 500 extends decline to 3 days as sentiment kept deteriorating

- AUD/USD awaits Australian economic data, Japanese Yen may gain

Build confidence in your own USD/CAD strategy with the help of our free guide!

Key FX Developments Wednesday

The Canadian Dollar depreciated across the board on Wednesday after the BoC increasingly dialed down near-term rate hike prospects. After holding benchmark lending rates unchanged at 1.75%, the Bank of Canada said that there is increased uncertainty on the timing for future increases. Their prospects about the economy weakened for the first half of 2019, seeing inflation below 2% for most of this year.

Local front-end government bond yields tumbled as investors priced out rate hike prospects this year, with chances of a cut increasing. With that in mind, the central bank appears to be making a move similar to what we have seen with the Fed. Given the focus on data-dependence, there is increased uncertainty over the timing of future rate moves. We shall see how the Loonie performs on this week’s Canadian jobs report.

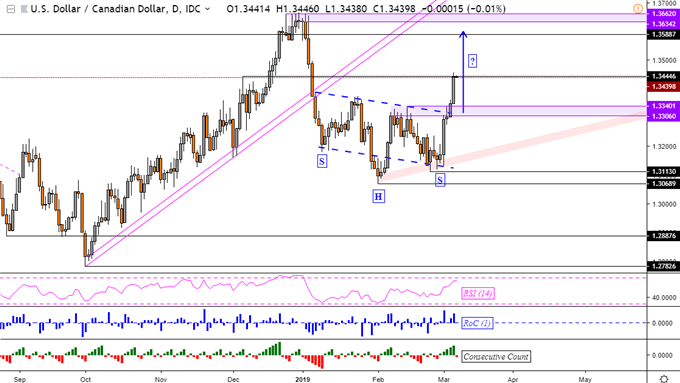

USD/CAD Technical Analysis – More Gains Ahead?

Yesterday, my Canadian Dollar index was at a key pivotal support area which has now been broken, opening the door to more weakness ahead. Meanwhile, USD/CAD could reach December highs given the bullish inverse head and shoulders reversal pattern on the daily chart below. Prices pushed above the neckline and have confirmed an additional close to the upside. The target of the candlestick pattern seems to be just under 1.3634. You may follow me on Twitter here @ddubrovskyFX for updates on CAD.

USD/CAD Daily Chart

Chart Created in TradingView

The pro-risk Australian and New Zealand Dollars underperformed, with the former being weighed down by a softer-than-expected local GDP report. Meanwhile, a deterioration in market mood during the Wall Street trading session furthered weighed against these currencies after the S&P 500 declined for a third day. The US Dollar aimed higher, mostly aided by weakness in AUD, NZD and CAD.

Thursday’s Asia Pacific Trading Session

S&P 500 futures are pointing cautiously lower, suggesting that the risk-off trading dynamic may echo into Asia Pacific benchmark stocks indexes. This may benefit the anti-risk Japanese Yen. The Aussie will look to domestic trade and retail sales data. Markets are becoming more dovish on the RBA, consequently increasing the impact of domestic economic statistics on AUD/USD.

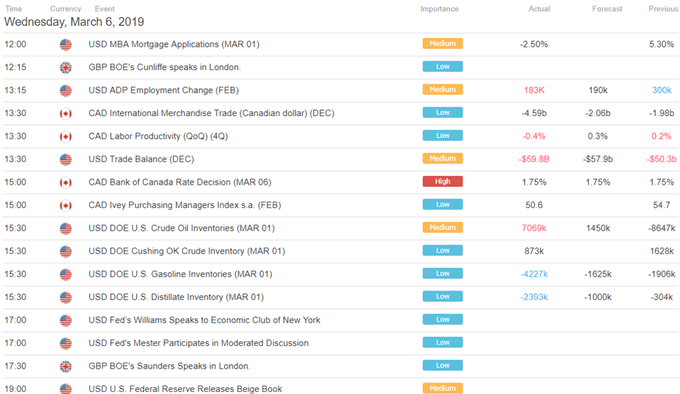

US Trading Session Economic Events

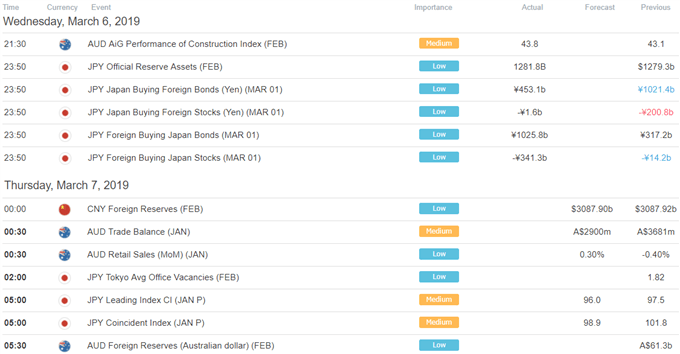

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter