Asia Pacific Market Open – US China Trade Talks, Japanese Yen, US Dollar, AUD/USD

- Market mood kept improving as Japanese Yen sunk despite US ISM Non-Manufacturing drop

- Upbeat news on US China trade talks lifted S&P 500, USD traded mixed as bonds declined

- AUD/USD extended bullish reversal as expected, JPY to keep falling with Nikkei 225 gains

We recently released our Q1 forecasts for currencies like the US Dollar in the DailyFX Trading Guides page

For yet another day, the anti-risk Japanese Yen was overwhelmingly the worst performing major as market mood improved during the US trading session. Welcoming updates on trade talk news seemed to have supported stocks. This was despite US ISM Non-Manufacturing unexpectedly disappointing as it weakened to it worst outcome since July 2018.

Rather, the S&P 500 and NASDAQ Composite climbed about 0.70% and 1.26% respectively as bond prices collapsed. Later in the day US Commerce Secretary Wilbur Ross said that “there is a very good chance…get a reasonable settlement that China can live with” in an interview with CNBC. Then, reports crossed the wires from Reuters that China is going to buy at least 180,000 metric tons in US soybeans.

The US Dollar, after succumbing to partial selling pressure earlier in the day, then traded mixed on positive US China trade talk updates. This is because opposing forces impacted the greenback. Rising bond yields do make it attractive from an investment perspective, but waning demand for safe havens in a ‘risk on’ trading environment work against it. This is thanks to its status as the world’s reserve currency.

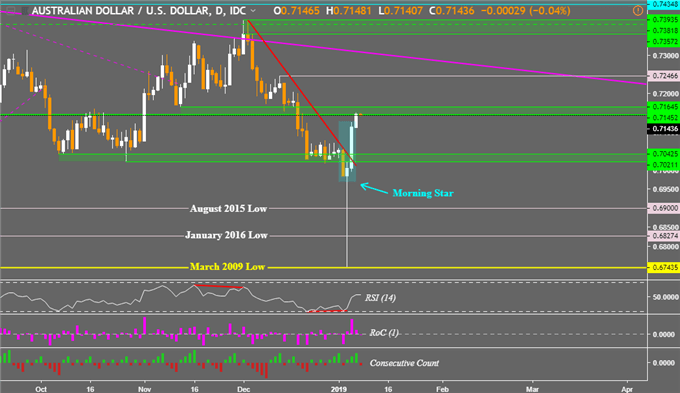

As anticipated in my weekly Australian Dollar technical outlook, AUD/USD prices rose following bullish reversal warnings. On the daily chart below, the Morning Star candlestick pattern has now had confirmation with another close higher. However, prices now find themselves sitting right on a key resistance range between 0.71452 and 0.71645. Clearing this may add fuel to its potentially new dominant uptrend.You may follow me on twitter @ddubrovskyFX for more immediate updates in Aussie prices.

Just getting started trading the Australian Dollar? See our beginners’ guide for FX traders to learn how you can apply this in your strategy!

With that in mind, US China trade talks are entering their second day since the ceasefire back in December. More welcoming progress is likely to add fuel to the improvement in market mood. For now, Asia Pacific benchmark stock indexes (such as the Nikkei 225) may follow Wall Street higher. This risks extending the selloff in the Japanese Yen as the pro-risk Australian and New Zealand Dollars climb ahead.

AUD/USD Daily Chart

Chart created in TradingView

US Trading Session

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter