Asia Pacific Market Open – British Pound, Brexit, Theresa May, Crude Oil, AUD/USD

- British Pound highly volatile on latest Brexit updates, Theresa May’s deal heads to parliament next

- Crude oil prices paused 1984+ record losing streak on OPEC headlines as Apple hurt US equities

- AUD/USD may look past jobs data for risk trends as anti-risk Japanese Yen may appreciate ahead

Check out our 4Q forecast for the British Pound in the DailyFX Trading Guides page

The British Pound continued being jawboned by the latest Brexit headlines. Earlier this session, reports that a couple of members of parliament could resign sent it lower. Then, Sterling was uplifted as UK Prime Minister Theresa May announced a Brexit deal that her cabinet agreed on. By the end of Wednesday’s session, GBP/USD was little changed.

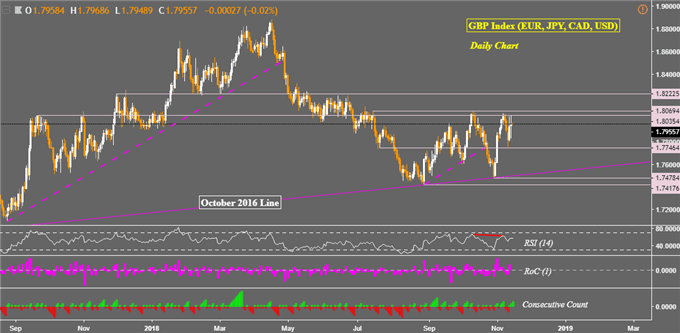

Not only is this trading dynamic the case on a near-term basis, but Sterling in general has been struggling to find direction lately. Looking at an equally weighted basket on the chart below, GBP remains in consolidation mode after it halted its descent in August. More obstacles remain down the road for Brexit talks including Mrs. May getting her draft pushed through parliament and an EU-UK summit some time later this month.

GBP Index (Average Versus EUR, JPY, CAD and USD)

Chart created in TradingView

Crude oil prices halted its longest consecutive losing streak since at least 1984 in the wake of comments from OPEC’s President. United Arab Emirates Energy Minister Suhail Al Mazrouei said that the cartel and its allies will ‘adjust production as needed to balance the market’. The sentiment-sensitive commodity also followed S&P 500 futures higher into Wall Street open.

Speaking of, most US benchmark stock indexes ended the day lower. The S&P 500 dropped about -0.76% as Apple shares slid about 2.82% and entered into bear market territory. As such, we may see Asia Pacific stocks echo weakness from Wall Street. This may bolster the anti-risk Japanese Yen.

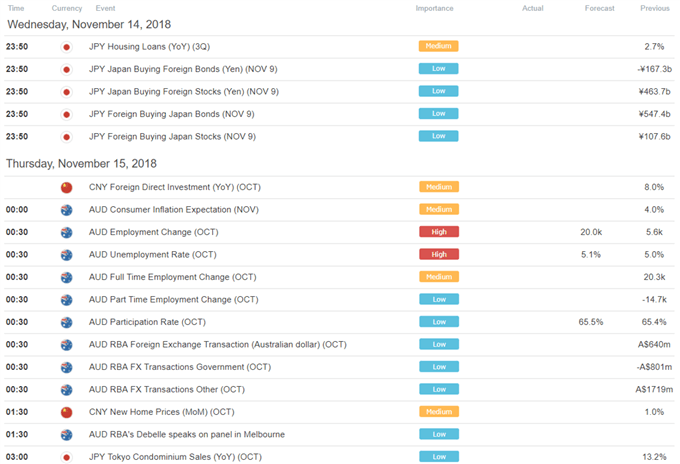

Meanwhile the pro-risk Australian Dollar may look past domestic jobs data in the medium-term given that the RBA is committed to keeping rates unchanged for the time being. AUD/USD is struggling to obtain bullish confirmation after trying to overturn its dominant downtrend.

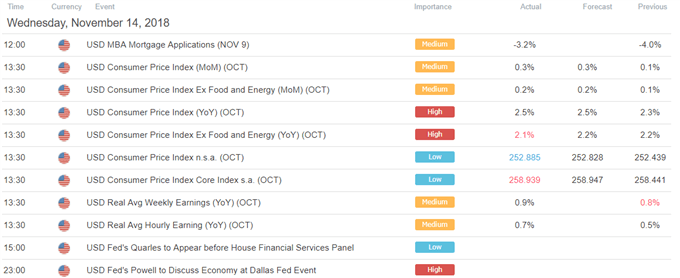

US Trading Session

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter