Asia Pacific Market Open – US GDP, S&P Italy Outlook, Brazil Election, EUR/USD, AUD/USD

- Anti-risk Japanese Yen appreciated amidst broad stock market selloff, NZD trimmed declines

- Euro at risk as banks react to S&P Italy outlook. BRL, emerging markets eye Brazil election

- Active week but quiet Asia open may have Nikkei 225 default to risk aversion as AUD falls

We released our 4Q forecasts for equities in the DailyFX Trading Guides page

The anti-risk Japanese Yen gained versus its major counterparts Friday. Broad declines in Asia Pacific benchmark indexes amidst a lack of prominent event risk saw markets default to a risk averse mood. This preceded a gap lower in the S&P 500 which despite a temporary climb, still finished the day lower as gains were trimmed. Looking to its record high in September, the S&P 500 stopped short of corrective territory.

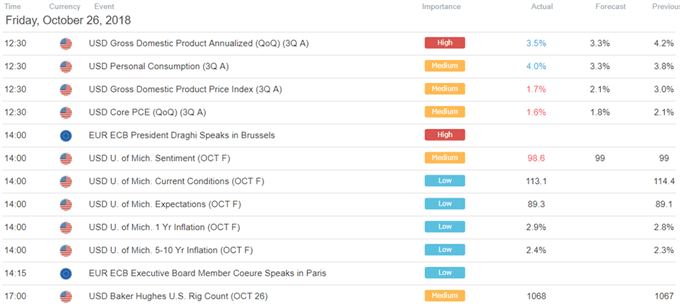

US third quarter GDP data, which saw some mixed results, failed to spark a meaningful reaction in the US Dollar which pared some of its gains as Wall Street temporarily climbed. The passing of event risk may have led to some corrective performance in stocks as we approached the weekend. This allowed the pro-risk Australian and New Zealand Dollars to trim some of their losses.

As we begin the new week, the Euro could be vulnerable when local markets have a chance to respond to Italy’s outlook being downgraded by S&P to negative form stable. Budget clashes between Italy’s anti-establishment parties and the European Union threaten the nation’s credit rating. The announcement crossed the wires long after EU banks closed for the end of the week.

Another source of volatility will be the outcome of the second round of Brazil’s presidential election which took place on Sunday. Jair Bolsonaro, leader of the Social Liberal Party, was ahead in the polls. Over the course of the race, domestic markets and the Brazilian Real favored outcomes that had Mr. Bolsonaro in the lead. However, a win for him would entail long-term political risks that may weigh on emerging markets.

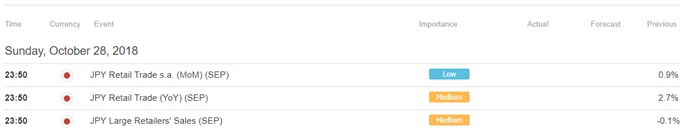

This week is filled with event risk but Monday’s Asia Pacific trading session is notably lacking any. If the favored trading dynamic in the markets during these times is risk aversion, we may see local benchmark stock indexes echo weakness from Wall Street. Declines in the Nikkei 225 may weigh against the Australian Dollar which I still remain short.

Forecasts:

Japanese Yen Fundamental Outlook

Australian Dollar Technical Outlook

US Trading Session

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter