DOW, NASDAQ, S&P 500, FED, BIDEN, GOLD, US DOLLAR - TALKING POINTS:

- US stocks end the day lower despite dovish Fed, firm Q1 earnings reports

- Markets might be angling toward “profit-taking” on recent macro trends

- Biden speech to joint session of Congress could deliver risk-off catalysts

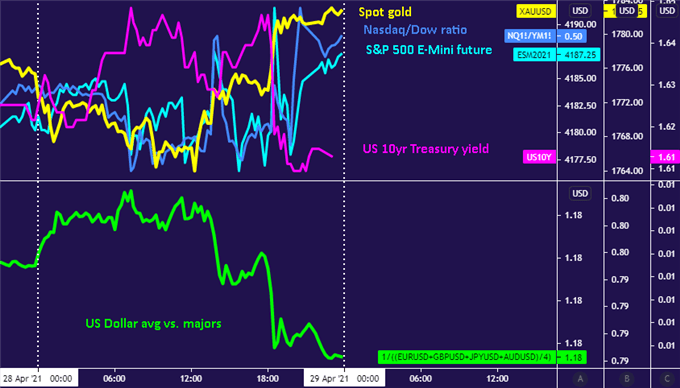

The Federal Reserve proved successful in reaffirming its dovish credentials for financial markets. Treasury bond yields fell alongside the US Dollar while anti-fiat gold prices rose in the aftermath of the latest policy announcement from the steering FOMC committee and the subsequent press conference with Chair Jerome Powell. Worries about earlier-than-expected tightening amid quickening reflation appeared to ease.

This is as good news continued to pour in on the corporate earnings front. The lion’s share of the day’s announcements bested analysts’ forecasts, extending a generally positive first-quarter reporting season. With nearly half of the S&P 500 companies’ releases now in the history books, bottom-line results have beat out expectations by 26.2 percent on average.

Chart created with TradingView

Against this backdrop, it seems somewhat puzzling that stocks did not perform better than they did. All three major US equity benchmarks finished the Wall Street session in the red. That equities were unable to capitalize despite robust results from corporate America and a Fed promise of loose financial conditions that the investors clearly found credible may speak to significant underlying weakness.

More interestingly still, the blue-chip Dow Jones Industrial Average lagged the tech-heavy Nasdaq, suggesting the Fed’s promises of accommodation registered as rotation toward riskier, more rate-sensitive names. Nevertheless, technology names led losses today, shedding nearly a full percentage point. Financials managed gains despite seemingly slim prospects for an expansion of lending margins.

This further clash with incoming news-flow may offer a view to the thrust behind any would-be selloff that might be brewing on the horizon. The operative narrative has been that broadening vaccination will unlock pent-up demand sidelined by Covid-linked restrictions even as generous fiscal stimulus amplifies growth while the Fed remains sidelined. A round of profit-taking on related bets may be due.

Asia-Pacific equities are in a cautiously upbeat mood as regional investors weigh up the overnight lead from North America. Australia’s ASX 200 benchmark is cautiously higher and futures tracking Hong Kong’s Hang Sent Index are pointing upward, but contracts tracking Japan’s Nikkei 225 suggest a lower open. A barebones data docket puts spotlight turns to a much-anticipated speech from Joe Biden.

The President of the United States will be addressing a joint session of Congress in a bid to lay out his ambitious agenda for the months to come. If markets are truly searching for reasons to trigger profit-taking, they may find them in a stern position toward China as well as proposals for a meaningful rise in taxes on the wealthy to fund further fiscal largesse.

TRADING RESOURCES

- Just getting started? See our beginners’ guide for traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Ilya Spivak, Head APAC Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter