Stock Market 2020 Forecast: Equities to Watch in Quarter One

The fourth quarter of 2019 saw global equities roar higher as some key headwinds were put on pause and investors seized the opportunity to bid stocks higher. The year’s strong finish compounded an early rebound following the precipitous rout of late 2018. To be sure, the fundamental factors influencing equity returns have shifted considerably, but many of the same themes will look to arrest control of global equity markets in 2020 just as they did in 2019.

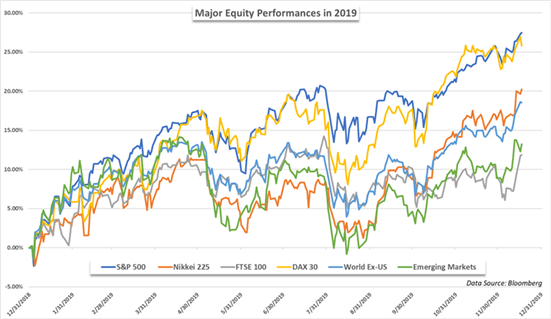

Major Equity Performances in 2019 (Chart 1)

Monetary policy is the paramount theme. At the end of 2018, the Federal Reserve had just recently began exploring lower interest rates as the Dow Jones and S&P 500 plummeted alongside slowing global growth, recession fears and a blossoming trade war with China.

Will the Stock Market Crash in 2020?

Over the course of 2019, the Fed lowered the Federal Funds rate by 75 basis points and restarted the expansion of its balance sheet via the repo market, all the while tariffs have been ratcheted higher. But the Federal Reserve was not alone in its monetary easing, as other major global central banks like the Bank of Japan and the European Central bank looked to inject stimulus and lower rates to revive subdued economic growth.

The accommodative policy was a major contributor to the stellar performance of equities in 2019 and may provide a tailwind in the year ahead.