US Dollar, AUD/USD, NZD/USD, IG Client Sentiment Outlook - Talking Points:

- US Dollar has been struggling to capitalize on haven demand vs AUD, NZD

- IG Client Sentiment is offering a bearish outlook for AUD/USD, NZD/USD

- Key downtrend holds in the Aussie, will Kiwi follow bullish technical hints?

Join me on Wednesdays at 01:00 GMT as I cover what IG Client Sentiment is saying about the prevailing trends in financial markets!

The haven-linked US Dollar has been struggling to rally against the sentiment-linked Australian and New Zealand Dollars despite broad weakness in global equities as of late. Fundamentally driving the S&P 500 and Dow Jones lower since the end of last week has been rising fears of global trade wars. Can this dynamic continue? Today I look at what trader positioning and technical analysis have to say about that.

To learn more about using IG Client Sentiment in your own analysis, check out our free trading guide !

AUD/USD Sentiment Outlook

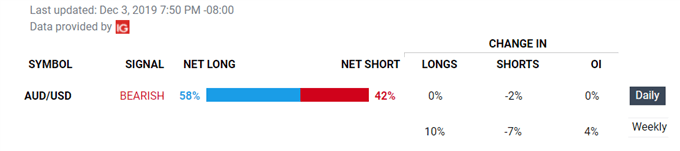

About 58 percent of AUD/USD traders – as reported via IG Client Sentiment (IGCS) – are net long. Over a weekly basis, this represents a 10% uptake in those biased to the upside as investors who are short seem to be dwindling – see chart below. As a result, the combination of current sentiment and recent changes is offering a stronger bearish contrarian trading bias for the Australian Dollar.

AUD/USD Client Positioning

*Times listed are in Pacific Standard

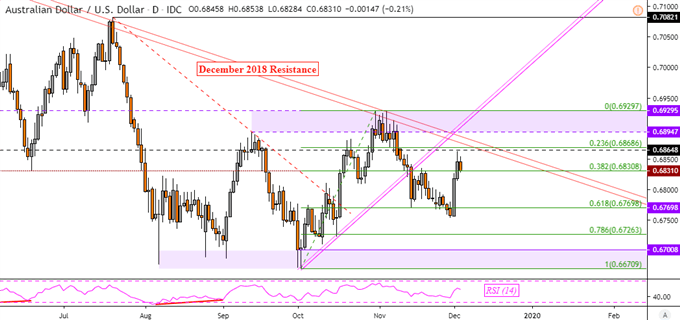

From a technical standpoint, AUD/USD appears to now be heading lower after prices stalled under the 23.6 percent Fibonacci retracement level at 0.6868. The dominant downtrend still holds and is being kept intact by descending resistance from December 2018. From here, a turn lower places the focus on near-term support at 0.6769 should price action adhere to the outlook via signals from trader positioning.

AUD/USD Daily Chart

AUD/USD Chart Created in Trading View

NZD/USD Sentiment Outlook

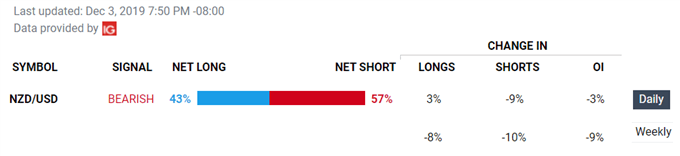

Meanwhile, we are seeing similar positioning dynamics unfold in NZD/USD. From a weekly and daily basis, net-short positioning in Kiwi is increasingly unwinding – see chart below. This leaves about 43 percent of traders net long and the IGCS outlook bearish. If we continue to see this ratio increase, speaking to a greater share of traders attempting to pick the top in Kiwi Dollar, prices may see selling pressure.

NZD/USD Client Positioning

*Times listed are in Pacific Standard

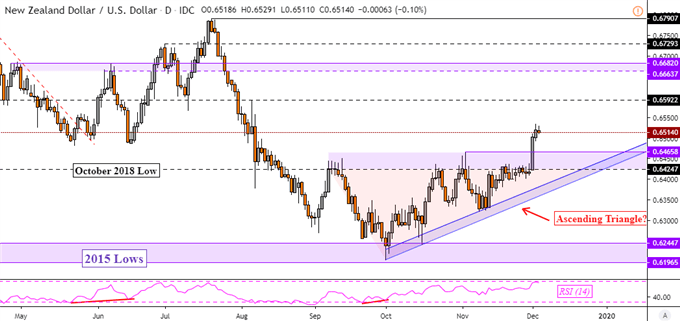

That would overturn the bullish implications via an Ascending Triangle in NZD/USD. Prices have found an upside breakout above resistance at 0.6465 with confirmation. If this technical signal prevails, we may see the New Zealand Dollar continue unwinding its downtrend from July to the beginning of October. Looking back at trader positioning though, conviction analysis signals to treat recent gains with a side of caution.

NZD/USD Daily Chart

NZD/USD Chart Created in Trading View

*IG Client Sentiment Charts and Positioning Data Used from December 3 Report

AUD, NZD, USD Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter