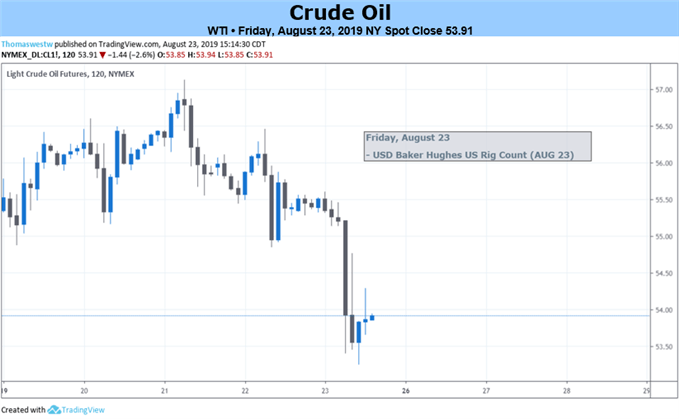

Crude Oil Price Fundamental Forecast:Bearish

Q3 2019 Oil Forecast and Top Trading Opportunities

Crude oil is under the cosh after China imposed a fresh round of tariffs on $75 billion of US goods, reigniting the long-running trade war between the world’s two largest economies. While the outlook for crude oil next week is bearish, especially as China is imposing a 10% tariff on crude oil exports from the US for the first time, the recent ~14% price slump since July 11 may well slow further bearish momentum.

China is slapping fresh trade tariffs on $75 billion of US goods in two parts on September 1 and December 15. The two superpowers are scheduled to meet in early September to hold trade talks and it waits to be seen if US President Trump retaliates further ahead of this meeting in Washington.

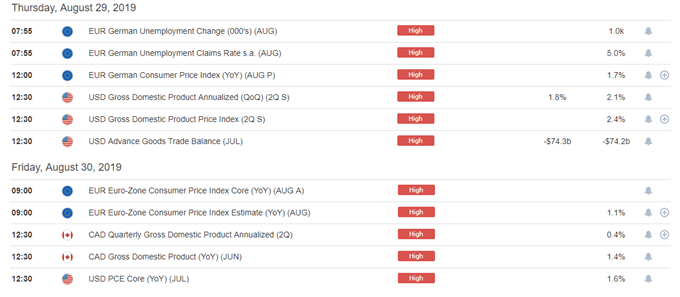

The global growth slowdown continues unabated, weighing on oil, and it is fully expected that both the US and the EU will cut rates at their upcoming monetary policy meetings in September in a further attempt to drive growth, and in the EU’s case to prevent the economy from falling closer to a recession. EU manufacturing is contracting, according to the latest Markit PMIs, with Germany struggling and sparking fears of a recession in Europe’s largest economy. Germany is likely to show another contraction in GDP in Q3, with manufacturing expectations recently hitting a record low.

It is a busy week ahead for economic data, with Thursday and Friday especially full of potentially market moving releases. By the end of next week, we may have a slightly clearer view of how feeble global growth really is and if the ECB and the Fed need to accelerate their monetary easing policies.

WTI vs Brent: 5 Top Differences Between WTI and Brent Crude Oil

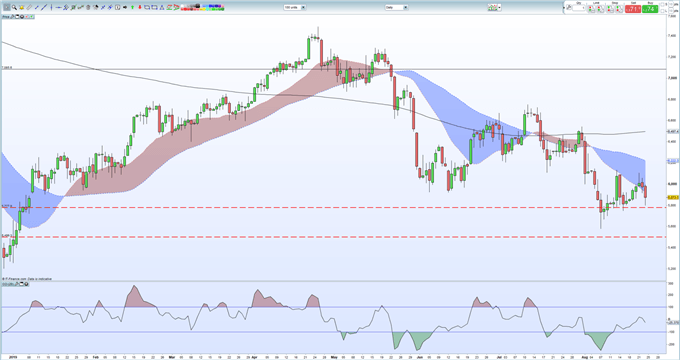

Brent Crude Oil Daily Chart (January - August 23, 2019)

The IG Client Sentiment Indicator shows retail traders are 54.9% net-long US crude oil, a bearish contrarian bias. However daily and weekly changes suggest that US crude oil prices may reverse higher.

How to Trade Oil: Crude Oil Trading Strategies and Tips

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Crude Oil – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.