Fundamental Forecast for USOIL: Bearish

- Crude Oil supported on report by IEA showing stronger demand expected for H2 2017

- Crude Oil inventories fell on Wednesday per the DoE report by 7.56mln barrel

- Per Baker Hughes, US Oil Rig count rises 2 to 765 total active US oil rigs

- IGCS showing increase in retail short oil positions, contrarian view favors further gains

While Crude Oil rose this week to the tune of ~5%, there were other factors that caught the attention of investors like the surprisingly weak US CPI on Friday, which shows how difficult of a job the Fed has a head of themselves. It is important to note that a key component of inflation is energy, but we could may still be a respectable distance away from seeing crude put upside pressure on inflation measures.

Despite OPEC cuts Oil remains unable to break $50/bbl. Click here to see our Q3 forecast on what outcomes we're watching!

A few positive developments in the energy sector helped support Crude Oil this week led by the 7.56mln draw per the weekly EIA supply report. On Thursday, an IEA report showed the demand is growing faster than inititially expected. These two developments combined with the US Dollar touching 10-month lows helped spark the 5% gain.

However, storm clouds remain above the oil market when looking at production. On Tuesday, an EIA report showed that U.S. crude production rose by 59,000 barrels to 9.397 million barrels a day in the week ended July 7, which is the highest level in almost two years. At the same time, rebalancing may be delayed as OPEC production is rising that shows compliance to implementing the OPEC cuts continues to weaken throughout the year, and is currently below 80% of what was proposed. Adding to increased OPEC production and a 45% increase of US active shale rigs, Canadian oil-sands producers are said to be running their thermal production sites 28% above capacity further adding to global supply.

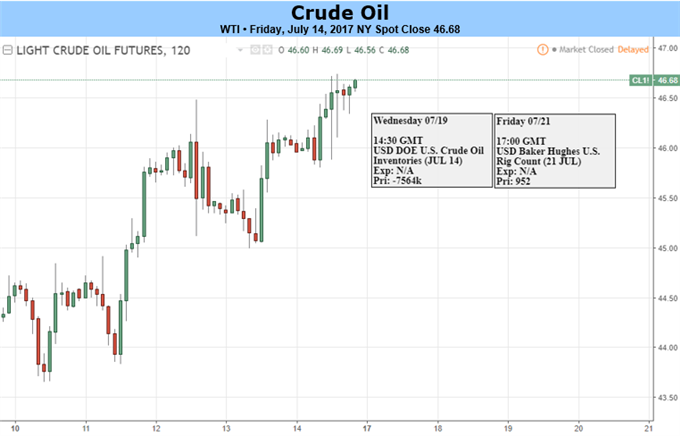

By combining the increased supply pressure with the chart, you can see the importance of the $48 level, that houses multiple forms of price resistance. Next week, traders who consult the charts will likely look to the 55-DMA ($46.70) as a point to see if last week’s momentum will continue.

While re-balancing may happen later as opposed to sooner, a much weaker USD could help support crude oil. However, a weaker USD would likely mainly help US oil exporters, which helps to show that aside from a surge in demand with current production, there appears to be no easy and quick fix to this problem.

Crude Oil has strongly bounced from LT price channel support, focus now turns to 55-DMA

Chart Created by Tyler Yell, CMT

Next Week’s Data Points That May Affect Energy Markets:

The fundamental focal points for the energy market next week:

- Monday 2:00 PM ET: EIA releases monthly Drilling Productivity Report

- Tuesday 4:30 PM ET: API weekly U.S. oil inventory report

- Wednesday 10:30 AM ET: EIA Petroleum Supply Report

- Fridays 1:00 PM ET: Baker-Hughes Rig Count at

- Friday 3:30 PM ET: Release of the CFTC weekly commitments of traders report on U.S. futures, options contracts

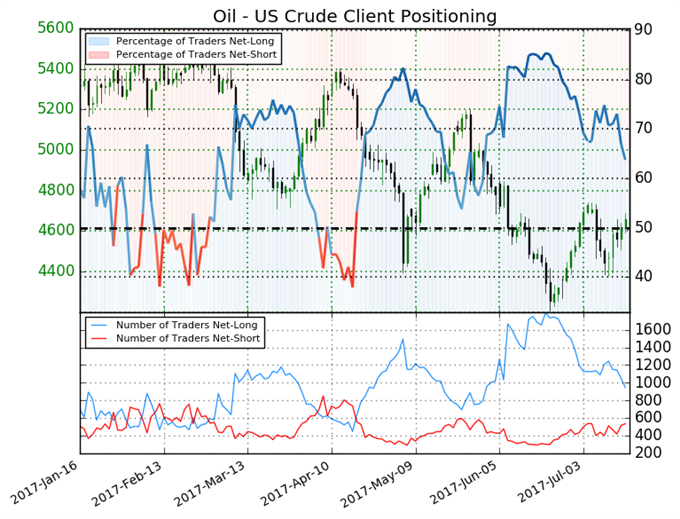

Crude Oil IG Client Sentiment Highlight: Contrarian view favors shor-term Bullish support

Oil - US Crude: Retail trader data shows 63.8% of traders are net-long with the ratio of traders long to short at 1.76 to 1. In fact, traders have remained net-long since Apr 19 when Oil - US Crude traded near 5271.1; price has moved 11.6% lower since then. The number of traders net-long is 19.3% lower than yesterday and 22.1% lower from last week, while the number of traders net-short is 23.1% higher than yesterday and 22.5% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Oil - US Crude prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current Oil - US Crude price trend may soon reverse higher despite the fact traders remain net-long. (Emphasis mine)

The insight derived from this sentiment analysis on Oil is that traders are jumping on aggressively to the short side of the market. This could be a precedent to a bullish continuation of last week’s 5% gain. Only a close below that we will keep you up to date on if price closes below $43.68/bl (weekly opening range low) that is combined with a further rise in net long positions would change that view.

-TY