KEY POINTS MEXICAN PESO:

- USD/MXN starts the week with a neutral bias, oscillating between small gains and losses around the 19.85 mark

- On Tuesday, traders' attention will focus on U.S. inflation data for the month of June

- The Mexican peso outlook remains constructive over the medium term, although there could be some headwinds in the short run

Most read: Will Hot Inflation Data in the US Spark Treasury Yields Again? How Will the Dollar React?

USD/MXN (U.S. Dollar – Mexican Peso) started the week with a mostly neutral bias, oscillating between small gains and losses around the 19.85 mark, in a context of little macro data of relevance and lower volatility, characteristic of the summer season.Despite the lack of catalysts on Monday, the situation could change in the coming days with a number of key economic reports on the calendar.

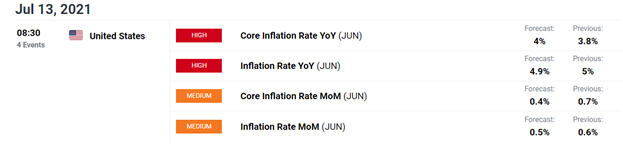

On Tuesday, investors will focus on U.S. CPI data for clues on inflation trends and whether supply bottlenecks are starting to resolve. Markets expect June's consumer price index to cool slightly to 4.9% y/y from 5% y/y in May, but see core CPI accelerating from 3.8% y/y to 4% y/y, a reading that would be the highest level since 1991. It is important to follow these figures closely because any upside surprises could spook investors and convince the "transitory camp" that inflation is becoming more entrenched and pervasive. Needless to say, this scenario could push long-dated Treasury yields higher, strengthen the case for monetary tightening by the Federal Reserve and trigger considerable EMFX losses. On the other hand, if inflation slows and comes in below expectations, traders could position for a delay in the Fed's tapering announcement, an outcome that would weaken the greenback and benefit currencies such as the Mexican peso.

Source: DailyFX Economic Calendar

Taking a broader view, in previous articles, I argued that MXN’s outlook remains constructive, supported by its attractive carry, which is now being enhanced by Banxico’s hiking cycle. This theory remains valid in the medium-term, although it should be noted that short-term headwinds are starting to surface.

Looking at recent price action across multiple asset classes, it appears that the reflation trade is showing signs of exhaustion amid slowing worldwide recovery, just as central banks are discussing removing stimulus. With global economic activity cooling, EMFX appears vulnerable, but to make a more definitive assessment and rule out temporary data noise, we would need to see how the global economy progresses over the next few months.

At the moment, one of the main threats to recovery is an increase in the number of COVID-19 infections by the more transmissible delta variant. If large outbreaks materialize in countries or regions with low vaccination rates, as could be the case, markets could become much more defensive in the blink of an eye, triggering a sell-off of risk assets (EMFX, for example). For this very reason, it is vital to monitor how the coronavirus pandemic evolves and whether further lockdowns and other restrictions are re-imposed. There is no doubt that the light at the end of the tunnel is within sight, but the world is still in the tunnel and the health crisis is not yet over.

USD/MXN TECHNICAL ANALYSIS

From a technical point of view, USD/MXN appears to be in a consolidation phase, trapped between resistance (20.20) and support (19.80). For price action to acquire a short-term directional bias, we would have to see a decisive move beyond either of those levels. That said, if resistance is broken, USD/MXN could head towards the 20.75 area, where the June high converges with a 12-month descending trendline. On the other hand, if the exchange rate falls below 19.80, sellers could take control of the market and drive the pair towards the 2021 low near the 19.55 region. If this support fails to hold, the 19.00 psychological mark would become the next downside level of interest.

Check out DaillyFX Education to learn more about technical analysis

USD/MXN TECHNICAL CHART

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download our beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take our quiz and find out

- IG's client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

- Subscribe to the DailyFX Newsletter for weekly market updates and insightful analysis

---Written by Diego Colman, DailyFX Market Strategist

Follow me on Twitter: @DColmanFX