Australian Dollar Talking Points:

- Australian Dollar weakness has come back as one of the clearer 2020 FX trends.

- AUD/USD is now nearing a big batch of support around the .6700 handle.

- Aussie CPI is due later this week, and next week brings the RBA. Will they cut?

Aussie Slammed to Fresh 2020 Lows; CPI, RBA Coming Up

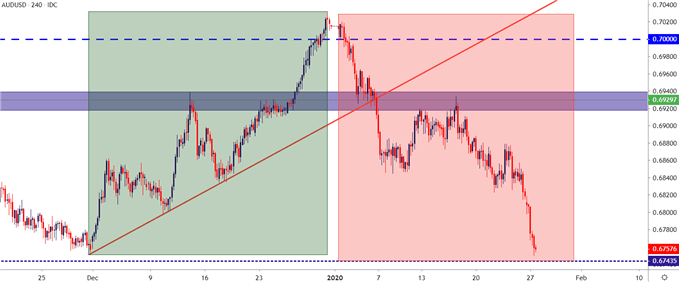

The Australian Dollar came into the New Year clinging to a very visible bullish trend. While the currency had a rather rough first nine months of last year, AUD/USD set a low just after the Q4 open and price action continued to push-higher thereafter, setting a fresh five-month-high on the final trading day of 2019. That marked a 50% retracement of the prior sell-off that started in December of 2018 and spanned to that fresh 10-year-low set on October 2nd; and given a backdrop of weakness in the US Dollar, it looked as though a deeper bullish move could hold as longer-term short positions were further squeezed out of the market.

That didn’t happen; instead, the RBA opened the door to rate cut possibilities shortly after the New Year open, and sellers came back into AUD/USD, with aggression, to push prices back into a down-trend. That sell-off has been ongoing ever since and now AUD/USD is testing a fresh three-month-low.

AUD/USD Four-Hour Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

Aussie in the Spotlight for CPI Release, RBA Rate Decision

Odds for a February cut out of the RBA have softened of recent, helped by some positive employment data. But expectations remain for the bank to cut at some point this year with the big question being one of ‘when.’ A bit of clarity may show on that front in the next week as tomorrow’s CPI release leads into the RBA rate decision on the calendar for next Monday (next Tuesday morning in Australia).

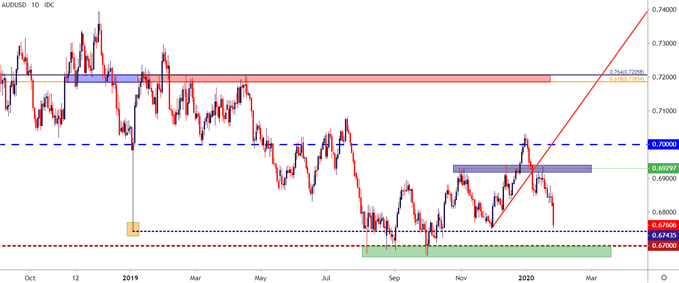

From a price action perspective – the big question is whether sellers can encroach upon the .6700 level that proved so difficult to break last year. This marks the decade-lows in AUD/USD at levels not traded at since the recovery from the Financial Collapse. Sellers attempted to push prices through that support on four separate occasions from August to October of last year, each time failing.

AUD/USD Daily Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

AUD/USD Strategy Moving Forward

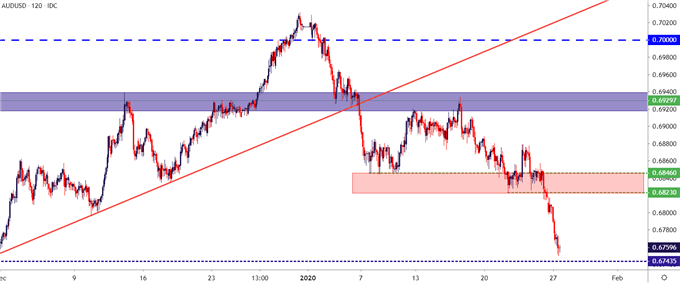

I’ve been following the short-side of AUD/USD of recent as one of the more attractive vehicles for USD-strength. But now that prices are pushed down towards a key area of support, continuation in that theme could be a challenge, especially considering that we have to wait for a week to get to that highly-awaited RBA rate decision.

This can keep the door open for lower-high resistance in the effort of trading shorter-term trends down towards that .6700 support area. Such an area of potential for lower-high resistance exists at a batch of prior short-term support, taken from the approximate .6823-.6846. A hold of resistance here opens the door for short-side scenarios.

AUD/USD Two-Hour Price Chart

Chart prepared by James Stanley; AUDUSD on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX