Gold Price Outlook Talking Points:

- Gold prices remain on their backfoot after the earlier-month failure to hold above the 1550 level.

- Will the Fed broadcast a grander dovish flip at Wednesday’s rate decision? If not, a deeper pullback can develop in Gold that can bring into play some longer-term areas of interest for potential support.

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Gold Prices Grasp to 1500 Ahead of the FOMC

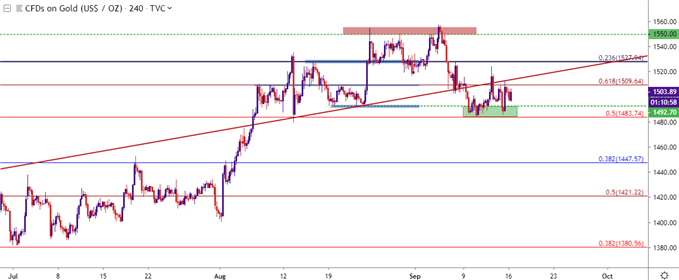

Gold prices had a strong showing this summer, continuing a bullish trend that started to build about a year ago when Gold was trading below the 1,200 marker. The fourth quarter of last year brought a noticeable ramp that lasted into mid-February and after a three-month-pullback in which a falling wedge formation had formed, buyers returned in late-May and continued to drive for the next three months. That theme of strength even lasted through the Labor Day holiday, with Gold prices setting a fresh six-year-high two weeks ago but, again, failing to hold above the 1550 level.

After a quick return back below the 1500 psychological level, Gold prices have spent the past week grasping to hold support. A quick flicker of strength developed around last week’s ECB meeting but Gold price action soon returned to support and has hung there ever since.

Gold Price Four-Hour Chart

Chart prepared by James Stanley; Gold on Tradingview

Gold Prices: Is a Deeper Pullback Around-the-Corner?

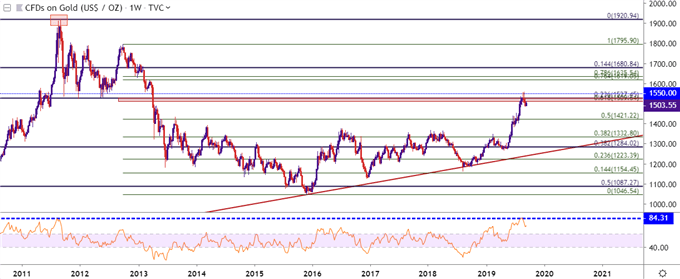

Given the extended bullish trend in Gold prices, the RSI indicator has reached its most overbought since 2011, right around the time that Gold prices topped-out and began to tumble-lower from the post-GFC bullish run. And initially, throughout the month of August, those deeper overbought conditions didn’t look to impede buyers too greatly. But more recently, as expectations for the Fed making a dovish shift have diminished, Gold bulls have softened the approach and a deeper pullback may show should the Fed frame this week’s rate cut as another ‘mid cycle adjustment,’ or fails to highlight additional future cuts via the Summary of Economic Projections.

Gold Weekly Price Chart

Chart prepared by James Stanley; Gold on Tradingview

Given the longer-term bullish trend, traders may want to use any near-term weakness to look for a revisit to longer-term support. The prospect of the Fed hiking rates anytime soon is a distant one and the potential for even softer policy appears to be hinged on a number of factors, such as trade wars or pressures in equity markets. But, at this point, it looks like markets might need to wait for at least a little while before the Fed broadcasts a grander dovish flip.

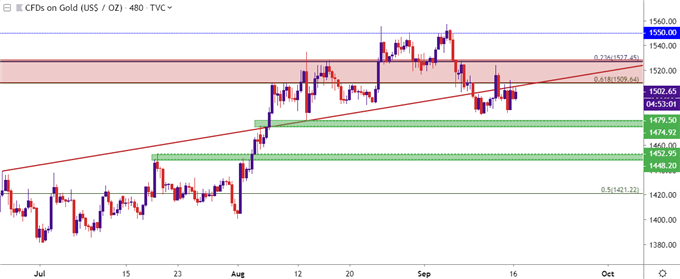

The support levels looked at in our last article remain workable, although given the traffic already seen around the 1493 level, traders would likely want to shy away from hitting that too aggressively. Below that is a zone of potential that runs from around 1475-1480 and, below that, a group of potential support points around the 1450 level. A revisit to with a hold of support at either of these zones re-opens the door for bullish strategies in Gold.

Gold Price Four-Hour Chart

Chart prepared by James Stanley; Gold on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX