Talking Points:

- US inflation rose last month, with headline CPI printing at 1.8% after last month’s 1.6% print, and Core CPI printing at 2.2% after last month’s 2.1%.

- The Fed cut rates last month for the first time in a decade even as Core CPI remained above target. Will this months pickup in inflation further hamper the Fed from a more aggressive dovish swing later this year?

This morning brought the release of CPI numbers for the month of July out of the Untied States. This release takes place amidst a backdrop of considerable concern as a recent fall in headline inflation has pushed the FOMC away from the hawkish pattern exhibited in 2018 and into a dovish position in 2019. The big question at this point is how dovish the Fed might get in the remainder of this year and markets have already built-in heavy expectations for another cut in September and, likely, another 25 basis points of softening in December.

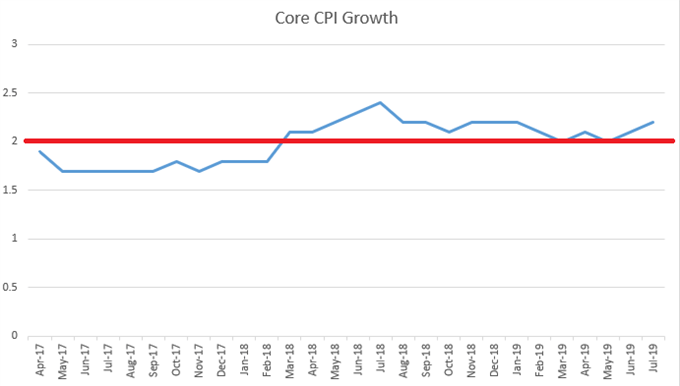

At the core of this quandary is inflation in the United States. After coming very close to 3% in the summer of last year, headline inflation has experienced a brisk fall as last month produced a 1.6% print. Core inflation, however, stripping out food and energy, has been considerably more stable, with 16 consecutive months above the Fed’s 2% target. Last month produced a 2.1% print, and this creates a bit of difficulty for a Central Bank expected to move towards a more-aggressive stance of softening.

This morning brought another print above the Fed’s 2% target, extending the streak in Core CPI to now 17 months above 2%. July Core CPI printed at 2.2%, the highest level since January.

US Core CPI Since January, 2017

Chart prepared by James Stanley

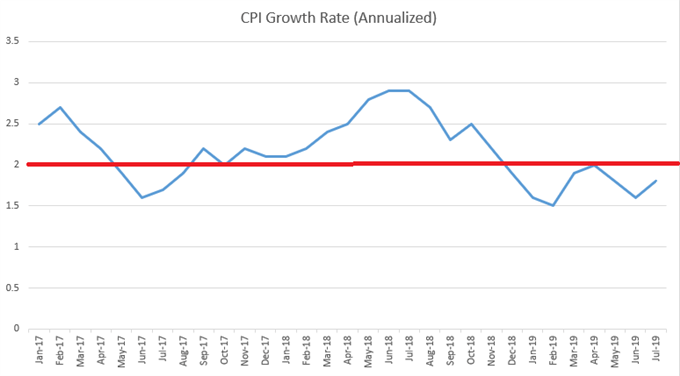

Headline inflation, however, remains a bit less positive. Headline CPI spiked to 2.9% a year ago and this came despite the fact that the Fed was continuing to hike rates. But as the year progressed, inflation slowed and by the time we got to December, headline CPI had already pushed back below the 2% level. This year has so far been marked by more struggle, as February saw CPI fall down to 1.5% and this hasn’t pushed back above 2% since.

This morning brought another below-2% print with headline CPI for the month of July coming in at 1.8%, rising from the 1.6% print from last month and beating the expectation for a 1.7% release.

US Headline CPI Since January, 2017

Chart prepared by James Stanley

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX