GBPJPY Price Forecast Talking Points:

- The April UK Consumer Price Index is due on Wednesday, May 22 at 08:30 GMT.

- Even as measures of inflation turn higher – mirroring the rebound in oil prices in the first four months of the year – Brexit means that the Bank of England still won’t be able to act.

- Retail traders are net-long GBPJPY gives us a further mixed GBPJPY trading bias.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

05/22 WEDNESDAY | 08:30 GMT | GBP Consumer Price Index (APR)

The rebound in oil prices in the first four months of 2019 has been a driving factor behind the rebound in inflation readings across the world in recent weeks, and the forthcoming April UK Consumer Price Index should fit this pattern. According to a Bloomberg News survey, the upcoming April UK inflation report is forecast to show headline inflation due in at 2.2% from 1.9% (y/y), while the monthly reading is due in a 0.7% from 0.2%. Core CPI is expected to have increased to 1.9% from 1.8% (y/y).

With Brexit tensions running high again ahead of the European parliamentary elections this week and perhaps the last-ditch effort by UK Prime Minister Theresa May to save the EU-UK Withdrawal Agreement next week, it seems likely that economic data will remain out of the spotlight in the days ahead. In other words, any Brexit-related developments would quickly overwhelm any reaction to the April UK inflation report this week.

Pairs to Watch: EURGBP, GBPJPY, GBPUSD

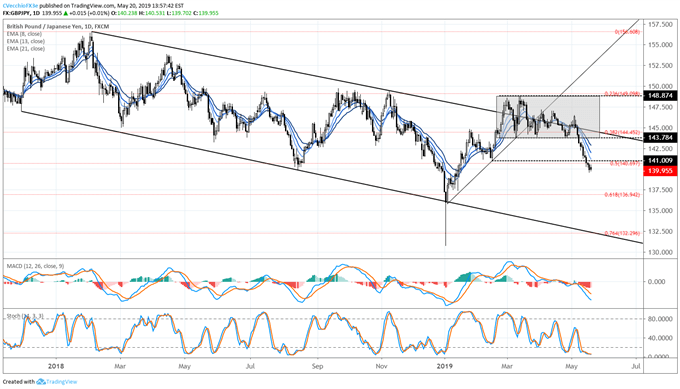

GBPJPY Technical Analysis: Daily Price Chart (December 2017 to May 2019) (Chart 1)

On May 8, GBPJPY prices started to breakout of their sideways consolidation dating back to mid-February, closing below 143.78 for the first time since February 18. Since then, bearish momentum has been strong, with no close back above the daily 8-EMA going back to May 6. Both daily MACD and Slow Stochastics continue to push lower in bearish territory as GBPJPY prices have cleared out the February swing low at 141.01.

With the daily 8-EMA currently at 141.31, there is a strong resistance zone overhead to watch at the start of the week: if GBPJPY moves back above the 141.01/31 area, then it stands to reason that the recent selloff move has reached its exhaustion point. Until GBPJPY moves back above the daily 8-EMA, however, the price forecast remains bearish.

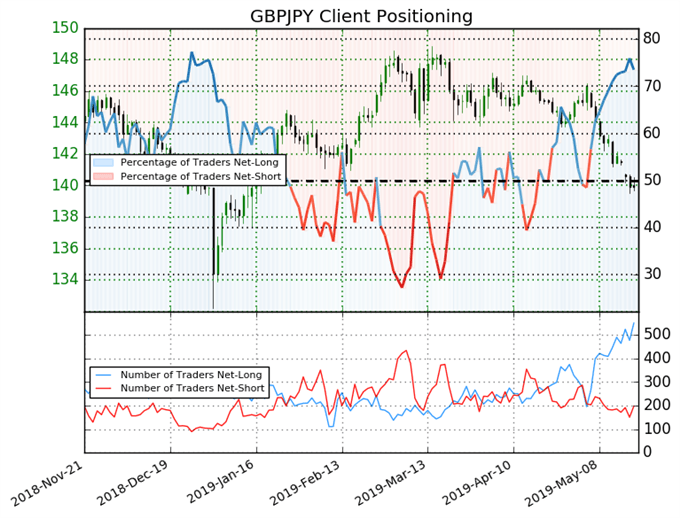

IG Client Sentiment Index: GBPJPY (May 20, 2019) (Chart 2)

GBPJPY: Retail trader data shows 73.5% of traders are net-long with the ratio of traders long to short at 2.78 to 1. In fact, traders have remained net-long since May 06 when GBPJPY traded near 145.886; price has moved 4.1% lower since then. The number of traders net-long is 11.3% higher than yesterday and 23.6% higher from last week, while the number of traders net-short is 13.8% higher than yesterday and 1.5% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPJPY prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPJPY trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX