Talking Points

-Dow Jones Industrial Average (DJIA) sold off on Friday as Fed rate hike odds rise to 42% for September

-Technical picture remains bullish so long as prices are above 17,800

-18,300 is the next level of support to watch

Fed Chairwoman Janet Yellen has been talking up the possibility of September being a live meeting, suggesting a rate hike is possible sooner than later. If this happens, logic would dictate that the hike may become a head wind for DJIA which was why we saw stocks sell off a bit on Friday.

Taking a step back, Fed Fund futures are pricing in the chance of a rate hike at 42% for the September 21 meeting which is the highest odds in over the past 3 months. This suggests the markets have worked through the Brexit risks and worry and are coming out on the other side ok. This should come as no surprise as we highlighted the bullish potential and patterns 3 business days after the Brexit vote was cast, on June 29.

Additionally, with the US presidential elections a mere 2 months away, why is the Fed appearing to be in a hurry to raise rates? I have to wonder if this is more talk than action for September which opens the door for a rate hike disappointment on September 21.

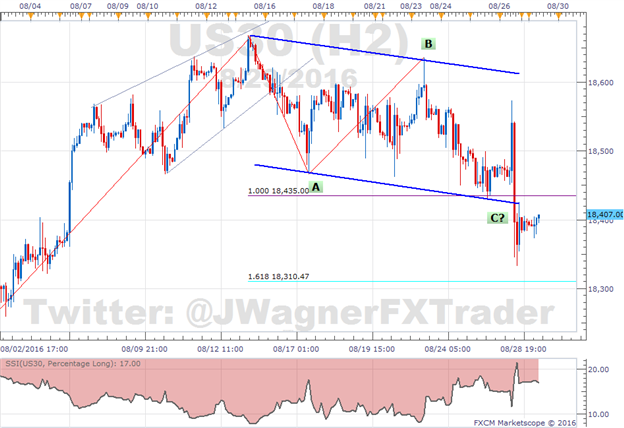

Chart prepared by Jeremy Wagner

From a technical perspective, prices did break down below the equal wave measurement and outside of the blue price channel. Therefore, we may see another drop towards 18,300. However, the medium term bullish patterns remain as this appears to be a technical correction. Therefore, we are anticipating these dips to be bought on an eventual push higher towards 19,700.

In fact, so long as prices remain above 17,800, we can look for support to form on an eventual break higher towards 19,700. Below 17,800 does not negate those bullish opportunities, but does begin to open the door to more immediate term bearish scenarios.

Bottom line, don’t let the near term noise distract from the medium term patterns. With the medium term patterns suggesting higher prices, use dips to position to the bullish side and establish better risk to reward ratios.

Interested in a longer term outlook for equities? Download our quarterly forecast here.

Good luck!

---Written by Jeremy Wagner, Head Trading Instructor, DailyFX EDU

Follow me on Twitter at @JWagnerFXTrader .

See Jeremy’s recent articles at his Bio Page.

To receive additional articles from Jeremy via email, join Jeremy’s distribution list.