Article Summary: Finding higher probability entries in the direction of the overall trend is the bread and butter of the Ichimoku indicator. In the last few days, there has been weakness on the EUR that has brought the EURUSD to a significant level of support. This article will highlight some targets with EURUSD to the upside as well as highlight how you can benefit from learning how to use the lagging line that has confused many traders.

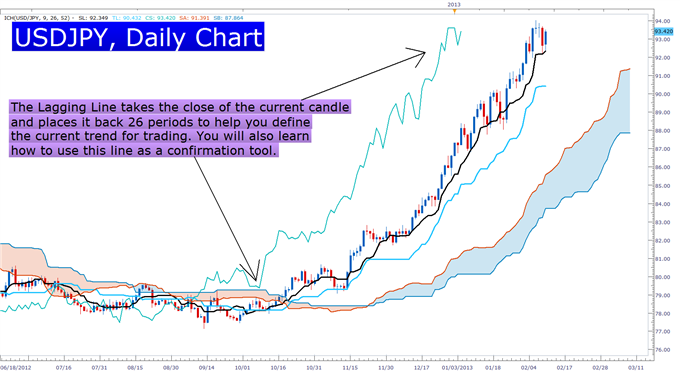

When price is rising and ahead of past price, we’re said to be in a solid uptrend and the reverse is true for a downtrend. This definition of a trend is common knowledge and something that Ichimoku helps simplify with a specific line on the chart. The proper name for this line is the Chikou Span but we’ll call it the lagging line for simplicity’s sake.

The lagging line can provide extra confirmation which has helped many traders in the past. However, over the years, the lagging line has become one of the most important and distinguishing aspects of the indicator and this report will show you another way to use Ichimoku’s lagging line to spot trading opportunities.

Every Thursday, I do a live webinar of Ichimoku to explain the 5 lines that make up the Ichimoku indicator and discuss current high probability trend trades that the indictor is high lighting (email me if you’d like access). When the webinar is opened up for questions, the lagging line is often responsible for the most questions and for good reason. Traders are most always looking forward and rarely looking back so a line displaced back 26 periods has most traders scratching their head.

Learn Forex: The mystery of the Chikou Span or Lagging Line is worth uncovering

A key point regardless of the trading strategy or indicator is that price is the number one indicator. Everything else is second-tier to the information that price gives you in the current state. The lagging line takes the close of the current bar and shows you how it stacks up against price 26 periods ago to give you a clear picture of the strength or weakness of a currency pair.

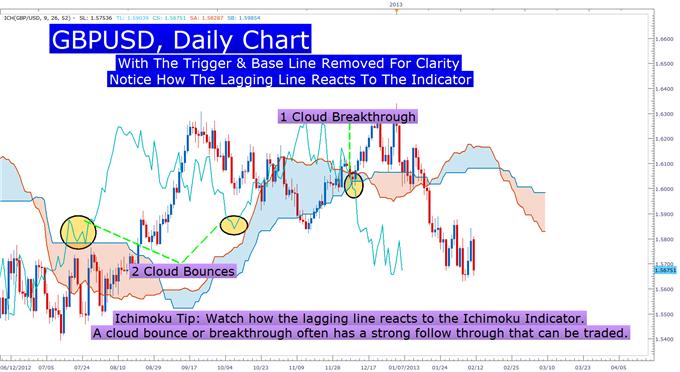

If the lagging line is trading above the candlestick and other aspects of Ichimoku from 26 periods ago, then today’s market is said to be bullish and should discourage you from entering sell trades in an uptrend while confirming buy trades. If the lagging line is trading below the candlestick and other aspects of Ichimoku from 26 periods, then today’s market is in a bearish position. Because the lagging line often reacts to the cloud, trigger or base line before moving steadily, you should take note of how the lagging line is reacting if it comes near a point of support or resistance.

Learn Forex: The lagging line will often respect the support and resistance of Ichimoku

The takeaway for you is that if the lagging line bounces off the cloud, the trigger, or base line to the upside be prepared for price to follow through strongly. In an uptrend, the Ichimoku indicator provides a solid foundation for the lagging line and there should be nothing above the lagging line. The lagging line is seen with nothing on top with all JPY crosses and most EUR crosses.

Ichimoku Weekly Trade: Buy EURUSD Off Of Base Line Bounce to the Upside

Ichimoku Trade: Buy EURUSD as all rules above are aligned on the chart

Stop: 1.3150 (Top of the cloud below current candlestick)

Limit: 1.3800 (as of current price, sets our limit at 1.75 times our risk)

If this is your first reading of the Ichimoku report, here is a recap of the rules for a buy trade:

-Price is above the Kumo Cloud

-The trigger line (black line on my chart) is above the base line (light blue line) or has crossed above

-Lagging line is above price action from 26 periods ago (discussed in depth at top of article)

-Kumo ahead of price is bullish and rising (displayed as a blue cloud)

Much has been made of the recent weakness in the Euro over the last few days. However, the Euro still remains the strongest currency among the majors and the central bank has yet to do much in the currency wars to talk down the currency like we’ve seen from the Japanese Yen (JPY), Great Britain Pound (GBP), & US Dollar (USD). The recent weakness helps position EURUSD for an attractive buy trade as per the Ichimoku strategy rules.

When employing Ichimoku to spot good entries in the direction of a strong trend, bounces off the base line while honoring the other rules can provide great entries which we see with EURUSD. If price remains above the cloud but is currently below base line then you should keep your eye out for price crossing back above the base line on rising strength. This is often a great indication that the trend is back in full swing.

Happy Trading!

---Written by Tyler Yell, Trading Instructor

To be added to Tyler’s e-mail distribution list, please click here.

Take this free 20 minute “Price Action - Candlesticks” course presented by DailyFX Education. In the course, you will learn about the basics of price action and how to use the clues the market is providing to place trades.

Register HERE to start your FOREX learning now!