Article Summary: Each Forex trade is placed by selecting the number of lots you would like to control. What many beginner (and some intermediate) traders don’t understand, is that the size of your position depends as much on the currency pair being traded as it does the amount of lots selected.

There is a common misconception out there with new Forex traders; that trade size is only dependent on the amount of lots that the trader selects. These misinformed traders believe that whether they are trading 10k GBP/USD, 10k EUR/JPY, or 10k AUD/CHF that they are trading the exact same size on each position. This is simply not true. To understand the true size of your positions, you have to consider the notional value of the position created.

Consider the following examples to understand how this works:

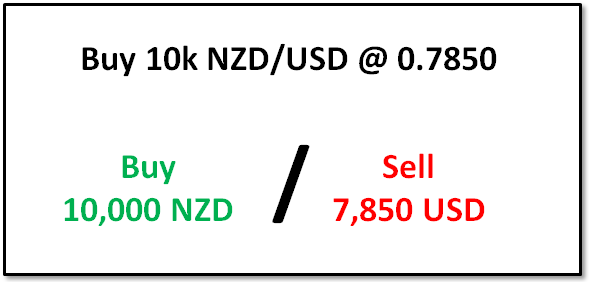

Let’s say we were bullish the NZD/USD and decided to buy 10k @ 0.7850. How much actual currency did we purchase? What does trading 10k actually mean? We need to look closer at the actual transaction to see how the trade breaks down.

Learn Forex: Trade Size Depends on Currency Pair

The graphic above shows that when we Buy 10k NZD/USD, we are buying 10,000 New Zealand Dollars and selling an equivalent amount of US Dollars. By looking at the quote, we know we had to sell 7,850 USD to purchase the 10,000 NZD. This means the notional trade size is $7,850 worth of currency.

Sign up for my email list to receive my latest articles and videos.

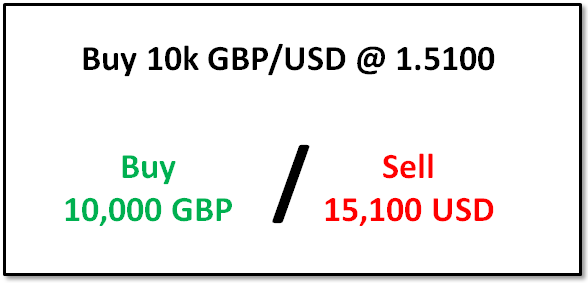

Now let’s take a look at a different pair. Let’s say we were bullish the GBP/USD and bought a 10k lot at 1.5100. How much actual currency did we purchase now? You can see how the trade is much bigger than the previous 10k NZD/USD trade.

Learn Forex: Trade Size Depends on Currency Pair

When we Buy 10k GBP/USD, we are buying £10,000 and selling an equivalent amount of US Dollars. By looking at the quote, we know we had to sell $15,100 to purchase the £10,000. This means the notional trade size is $15,100 worth of currency. This is far different than the 10k NZD/USD.

Why Does This Matter?

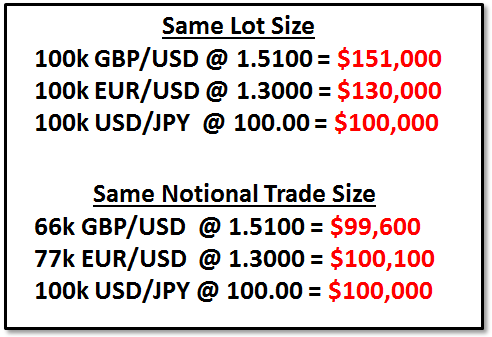

This is an important lesson to understand because it can make a big difference in how you manage your overall account. For example, if you wanted to spread your money out evenly across multiple positions on multiple pairs, you would not want to simply trade the same lot size, you would want to take into account the notional trade size you are taking on.

Learn Forex: Same Lot Size Versus Same Notional Trade Size

So instead of placing 100k trades on GBP/USD, EUR/USD, and USD/JPY to spread your money evenly, you might consider 66k GBPUSD, 77k EURUSD and 100k USDJPY to spread your trades based on the notional trade size ($99.6k worth of GBP, $100.1k worth of EUR, and $100k worth of JPY at the time this article was written).

(As a side note, this is also why margin requirements vary from pair to pair. You’ll find that the margin requirements are higher for pairs that have a higher notional value.)

Learn Forex: Notional Value Affects Margin Requirements

What Now?

Now that you understand the notional value of your trades, you can select smarter trade sizes. Maybe your GBP positions are too large. Maybe your NZD positions are too small. Either way, you should now have a greater understanding in how currency pairs partially determine the size of your positions and not simply the number of lots.

Good trading!

Next: The Importance of Stops (44 of 48)

Previous: FOREX: How to Determine Appropriate Effective Leverage

---Written by Rob Pasche

Interested In Our Analyst's Best Views On Major Markets? Check Out Our Free Trading Guides Here