Price Action Swings

Any chartist that has spent considerable time analyzing candlesticks would agree: Market movements rarely take place in a linear fashion.

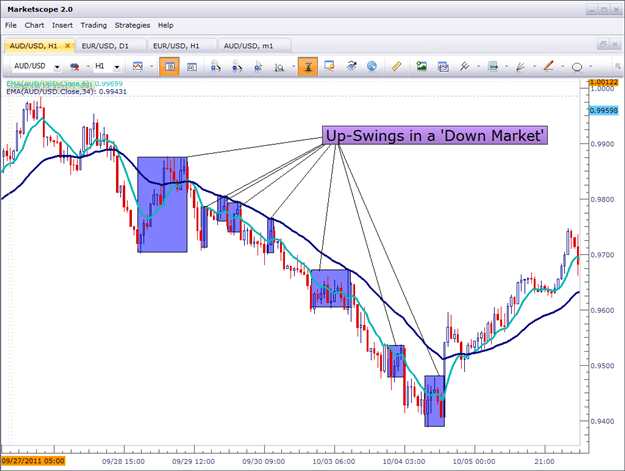

Down-trends are often accented with ‘up-swings,’ as the chart below points out:

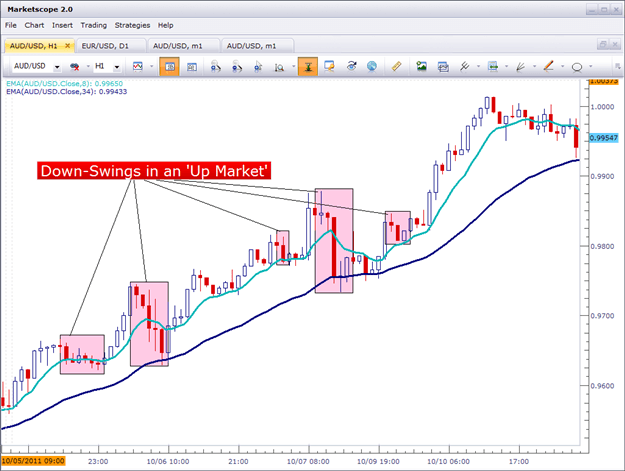

The exact opposite can be said for up-trends, being accentuated with ‘down-swings.’

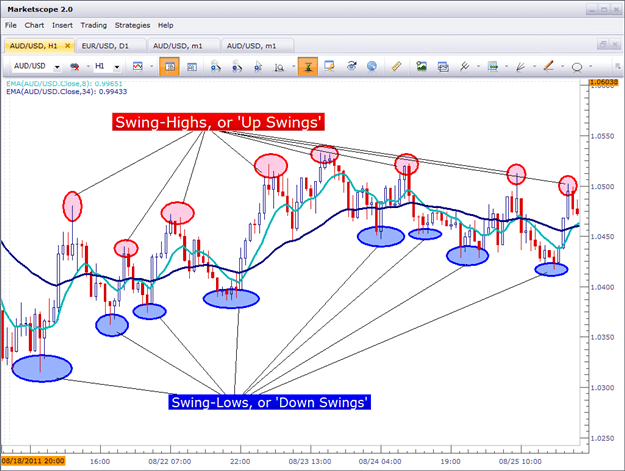

And of course, if we have a range, we can notice both up-swings and down-swings.

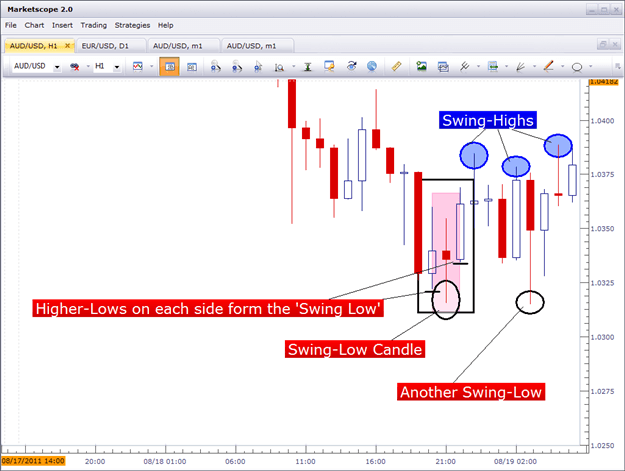

Swings-Lows, or Down Swings, can be classified as a low point of price that is accompanied by a ‘higher-low,’ value in price on each side of the candle.

The multiple swings exhibited by price behavior throughout the day can be used for a multitude of functions.

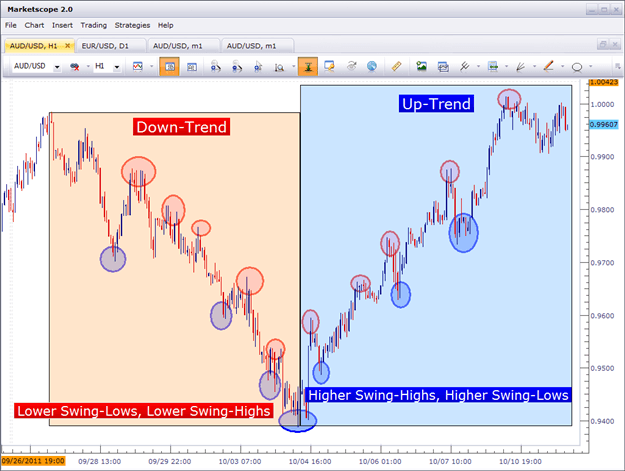

For instance, for traders wishing to grade trend, they can often do so by observing ‘higher-highs, and higher-lows,’ or ‘lower-lows, and lower-highs.’

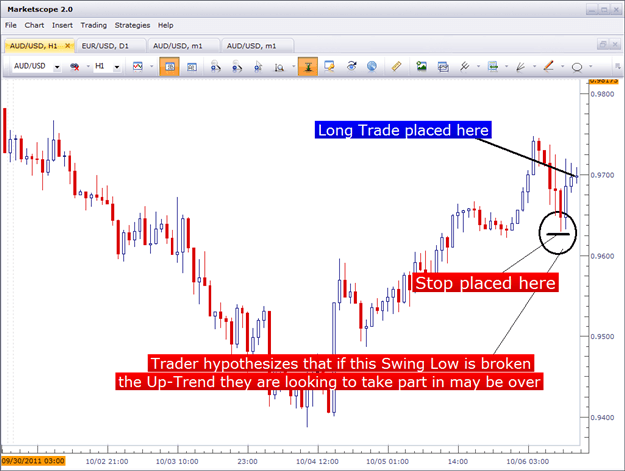

Taken a step further, traders wishing to manage risk can potentially look to these swings for stop placement. For example, in the chart below, the trader looking to take on a long postion can adopt the stance:

“If price breaks this swing low, then I no longer want to be in my trade as the trend may no longer be to the upside.”

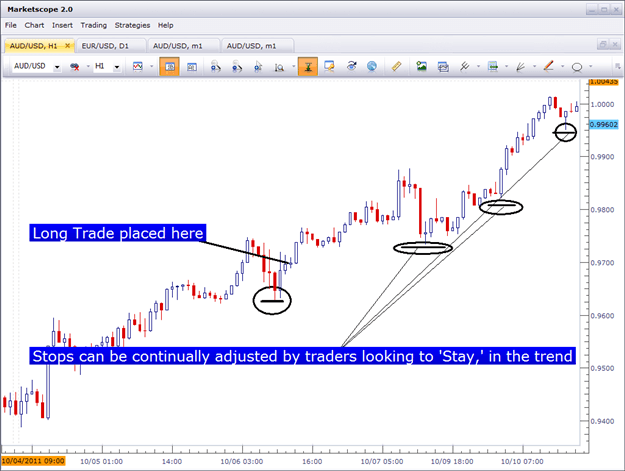

And of course, once a trader is in a position – this same mindset can be used in position management. The chart below illustrates:

We’ve covered 3 of the more popular mechanisms of ‘Swings,’ in the market, but we are just scratching the surface. There are numerous additional mannerisms in which these swings can be used by the price action trader.

In our next piece, we will look at using ‘Swings,’ to enter into positions that may be amenable for ‘big,’ moves exhibited by the market; a market condition that many traders flock to when conditions are right: The Breakout.

Next: Fractals "An Assistant for Locating Swings" (36 of 47)

Previous: How to Trade Fake Pin Bars

Links for Additional Information:

--- Written by James Stanley

You can follow James on Twitter @JStanleyFX.

To join James Stanley’s distribution list, please click here.