Talking Points

- EURUSD Retraces in a Downtrend

- Range Resistance Holds at 1.2560

- Range Reversals Triggered Under 1.2416

EURUSD30min Chart

(Created using FXCM’s Marketscope 2.0 charts)

Suggested Reading: Trading Intraday Market Reversals

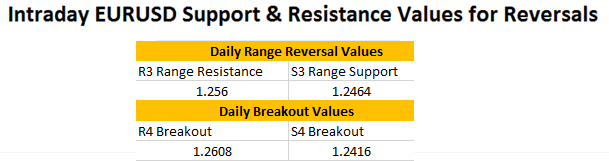

After dropping as much as 174 pips during Fridays trading, the Euro has quietly retraced to a key point of resistance this morning. Currently price sits under the R3 Camarilla Pivot, depicted above at a price of 1.2560. In the event that resistance holds, trend traders will look for price to move back towards support now found at 1.2464. The distance between these two points is 96 pips, which comprise today's reversal range.

In the event of an increase in price momentum, traders can begin positioning for a breakout. A drop below the S4 pivot, at a price of 1.2416, would signal the creation of a lower low and a strong continuation signal with the trend. A move above R4 resistance at 1.2608 would create a counter trend reversal, as the EURUSD would be breaking to a higher high at this point. In either breakout scenario, traders should consider concluding any range bound positioning and trade with the markets new found momentum.

If you would like to be notified as new articles are made available, please click HERE to join my distribution list.

Yesterdays Update

Friday’s reversal article focused on the EURGBP staying within its reversal range. Price tested support shortly after the NFP economic news announcement, but even with news volatility price traded between values of support and resistance through the end of the day. To learn more about Friday’s action, check out the FX Reversal article linked below.

FX Reversals: EURGBP Range Reversal Update

Then, to practice setting up orders using Camarilla Pivots, register for a FREE Forex demo with FXCM. This way you can develop your day trading techniques while tracking the market in real time.

Click HERE to Register Now

---Written by Walker England, Trading Instructor

To contact Walker, email instructor@dailyfx.com. Follow me on Twitter @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information.