- Update on trade setup we’ve been tracking in USD/JPY and AUD/JPY

- Join Michael for Live Weekly Strategy Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

- Check out our 2018 projections in our Free DailyFX Trading Forecasts

Here's an update on a few of the trade setups we’ve been tracking this week. For a complete breakdown of these trades and more, review this week’s Strategy Webinar.

New to Forex? Get started with our Beginners Trading Guide !

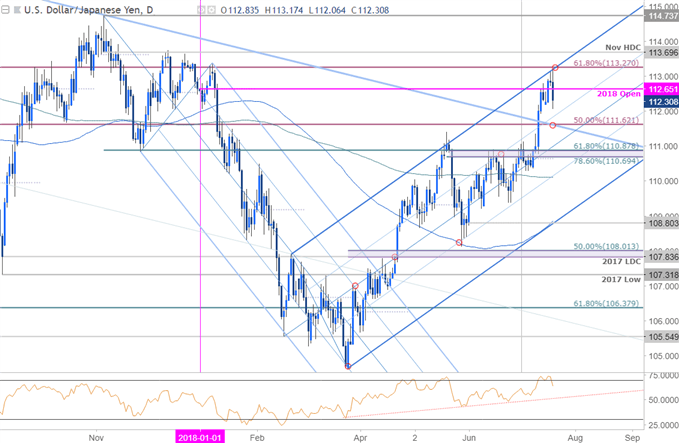

USD/JPY Daily Price Chart

Earlier this week we highlighted a breakout in the USD/JPY with the, “next major resistance target eyed at 113.20/30 where the 200-week moving average converges on the key 61.8% Fibonacci retracement of the late-2016 decline- look for a reaction there.”

Price registered a high today at 113.17 before reversing sharply with the pair poised to post an outside-day if we close at these levels. Note that daily RSI is also set to close below the 70-threshold for the first time this week. The near-term focus is lower against today’s high for now- intraday trading levels remain unchanged from this week’s USD/JPY Technical Outlook.

Learn the traits of a successful trader in our Free eBook!

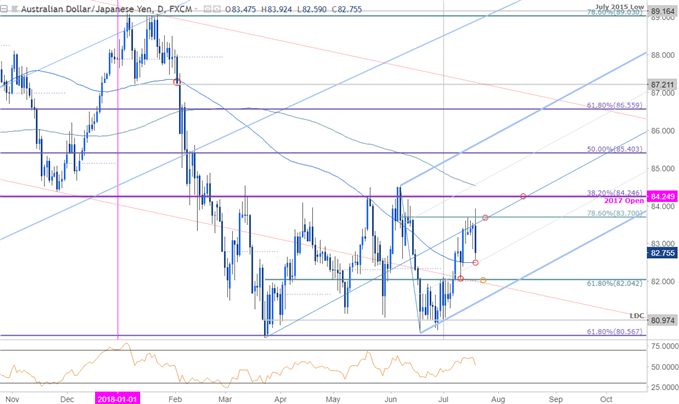

AUD/JPY Daily Price Chart

Price is on course to post an outside-day reversal off slope / Fibonacci resistance at 83.70 with daily RSI failing to break the 60-threshold. Form a trading standpoint, the risk is lower while below the weekly open at 83.24 with initial support objectives eyed at the confluence of the 50-line / 100-day moving average at ~82.50 and the 61.8% retracement / July open at 82.00/04- look for a stronger reaction there for guidance.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

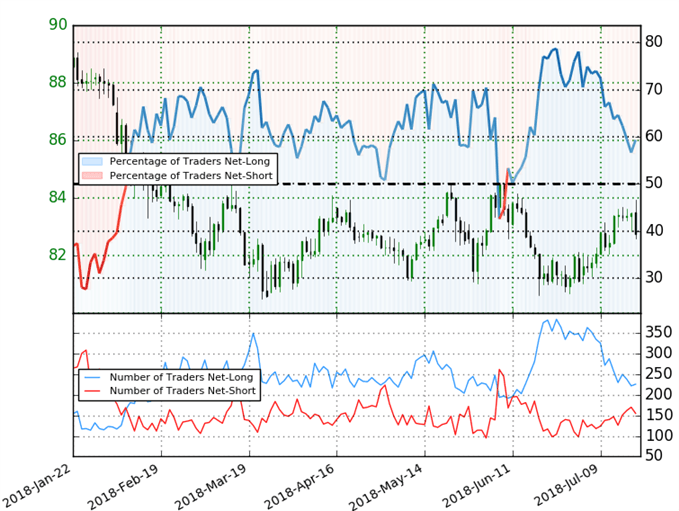

AUD/JPY Trader Positioning

- A summary of IG Client Sentiment shows traders are net-long AUD/JPY- the ratio stands at +1.46 (59.3% of traders are long) – weak bearishreading

- Traders have remained net-long since June 14th; price has moved 0.4% lower since then

- Long positions are 0.9% lower than yesterday and 14.4% lower from last week

- Short positions are 15.3% lower than yesterday and 14.8% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/JPY prices may continue to fall. Traders are more net-long than yesterday but less net-long from last week andthe combination of current positioning and recent changes gives us a further mixed AUD/JPY trading bias from a sentiment standpoint.

See how shifts in AUD/JPY retail positioning are impacting trend- Learn more about sentiment!

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex or contact him at mboutros@dailyfx.com