- Join Michael for Live Weekly Trading Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

- Click Here to be added to Michael’s email distribution list.

Here's an update on the setup's I’ll be tracking into the weekly / monthly open. Find a detailed, in-depth review of all these setups and more in this today’s Strategy Webinar.

USD/CAD 120min Chart

Price continues to hold above critical near-term support at 1.2415. A longer-term trendline extending off the 2012 lows (around 1.2330) rests just lower. Bottom line: The pair is at downtrend support and the immediate short-bias is at risk near-term while above these levels. From a trading standpoint I’ll be looking for short-side exhaustion / fade weakness early in the week. Interim resistance stands at 1.2576 backed by 1.2680 & broader bearish invalidation at 1.2740.

Join Michael on July 21st for a Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

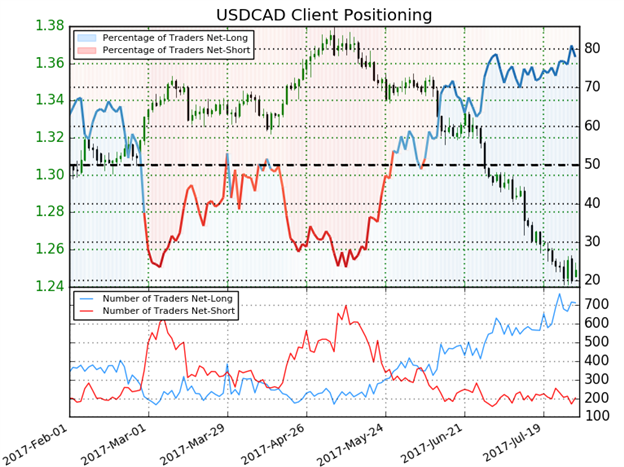

- A summary of IG Client Sentiment shows traders are net-long USD/CAD - the ratio stands at +3.53 (77.9% of traders are long)- bearish reading

- Retail traders have been net-long since June 7th- Price has moved 7.3% lower since then

- Long positions are 0.1% lower than yesterday but 11.4% higher from last week

- Short positions are 8.6% higher than yesterday and 11.4% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDCAD prices may continue to fall. That said, retail is less net-long than yesterday but more net-long from last week and the combination of current positioning and recent changes gives us a further mixed USDCAD trading bias from a sentiment standpoint.

Track what retail positioning is hinting about the USD/CAD trend. Learn how Sentiment can help your trading in this free guide !

GBPJPY: The Bank of England (BOE) is on tap this week with the interest rate decision & quarterly inflation report released on ‘Super Thursday.’ GBPJPY rebounded off slope support in Asia last night with the rally now trading just below slope resistance. The levels / outlook remains unchanged from last week and heading into the monthly open the focus remains higher while within this formation.

See our New 3Q projections in the DailyFX Trading Forecasts.

EUR/JPY:The pair has continued to consolidate just below the 2016 open at 130.69. I’ll be looking for a resolution to this range this week. Note that longer-term up-slope resistance stands just higher (currently around 131) with a breach there needed to mark resumption of the broader uptrend. From a trading standpoint, I’ll favor fading weakness while above last week’s low (128.88) OR buying a breach & retest of slope resistance as support. Click here to review the latest scalp targets.

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or