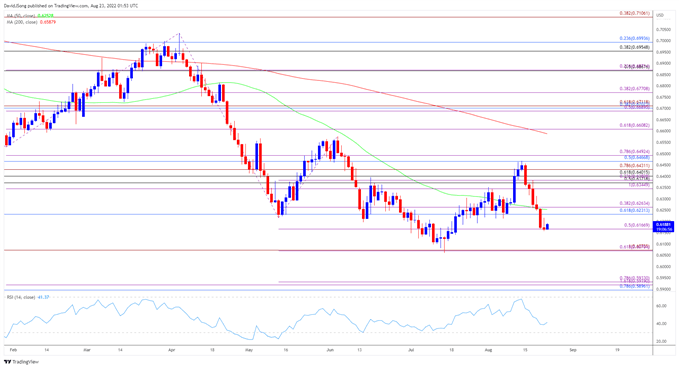

NZD/USD snapped the opening range for August after giving back the advance following the Reserve Bank of New Zealand (RBNZ) interest rate decision, and recent price action raises the scope for a further decline in the exchange rate as it extends the series of lower highs and lows from last week.

In turn, the advance from the yearly low (0.6061) may continue to unravel as NZD/USD trades back below the 50-Day SMA (0.6253), and the exchange rate may track the negative slope in the moving average as it appears to have reversed course after failing to test the June high (0.6576).

NZD/USD Rate Daily Chart

Source: Trading View

The near-term rebound in NZD/USD seems to have stalled following the failed attempt to break/close above the 0.6470 (50% retracement) to 0.6490 (78.6% expansion) region, with the Relative Strength Index (RSI) highlighting a similar dynamic as it falls back ahead of oversold territory.

The recent series of lower highs and lows has pushed NZD/USD to a fresh monthly low (0.6157), and lack of momentum to hold above the 0.6170 (50% expansion) area may send the exchange rate towards the 0.6070 (61.8% expansion).

Failure to defend the yearly low (0.6061) opens up the Fibonacci overlap around 0.5900 (78.6% retracement) to 0.5930 (78.6% expansion), with the next area of interest coming in around the April 2020 low (0.5843).

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong