EUR/USD pares the rebound from the monthly-low (1.1107) as European Central Bank (ECB) officials strike a dovish tone, and the Euro Dollar exchange rate may struggle to hold its ground ahead of the next meeting on June 6 as the Governing Council keeps the door open to further insulate the monetary union.

Recent remarks from ECB board member Olli Rehn suggest the central bank will retain a dovish forward-guidance for monetary policy as the official warns that ‘market participants may have in general lost their faith in central banks’ ability to raise inflation closer to the target.’

In turn, the ECB may continue to rely on non-standard measures as the central bank prepares to launch another round of Targeted Long-Term Refinance Operations (TLTRO) starting in September, and the Euro stands at risk of facing a more bearish fate over the coming days if Governing Council shows a greater willingness to implement a negative interest rate policy (NIRP).

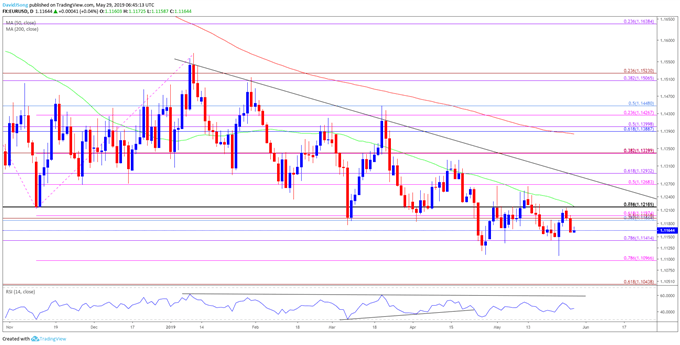

EUR/USD Rate Daily Chart

Keep in mind, the broader outlook for EUR/USD remains tilted to the downside as both price and the Relative Strength Index (RSI) continue to track the bearish formations from earlier this year, with the near-term outlook mired by the failed attempt to push back above the Fibonacci overlap around 1.1270 (50% expansion) to 1.1290 (61.8% expansion).

More recently, EUR/USD has started to carve a series of lower highs & lows after struggling to hold above the 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) region, with a move back below 1.1140 (78.6% expansion) opening up the 1.1100 (78.6% expansion) handle.

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

Additional Trading Resources

For more in-depth analysis, check out the 2Q 2019 Forecast for the Euro

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong.