EUR/USD extends the rebound from earlier this month as the European Central Bank (ECB) sticks to the sidelines, and the exchange rate may stage a larger correction over the coming days amid the failed attempt to test the 2019-low (1.1176).

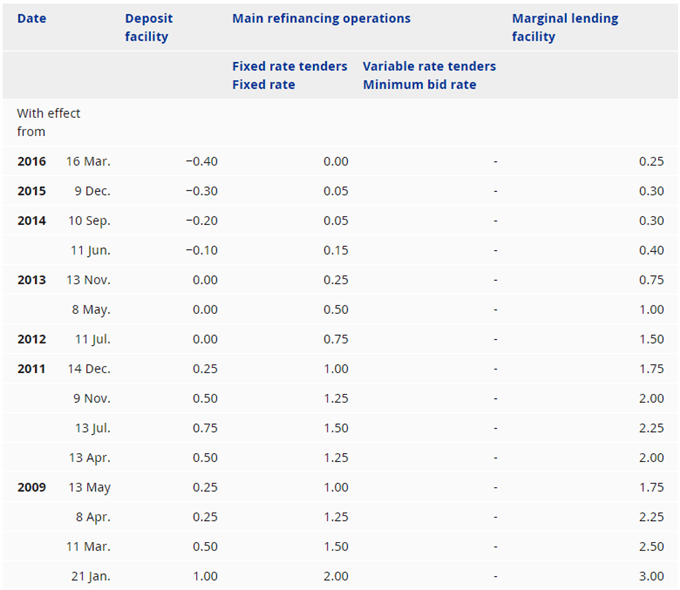

The ECB appears to be in no rush to alter the forward-guidance as the central bank pledges to keep euro-area interest rates ‘at their present levels at least through the end of 2019,’ and it seems as though the Governing Council will keep monetary policy on auto-pilot ahead of the second-half of the year as President Mario Draghi’s term is set to expire at the end of October.

It remains to be seen if the ECB will attempt to buy more time at the next quarterly meeting on June 6 as the current ‘measures, including the new series of TLTROs that we announced in March, will help to safeguard favourable bank lending conditions and will continue to support access to financing, in particular for small and medium-sized enterprises,’ but the ECB may have little choice but to further support the monetary union as ‘the information that has become available since the last Governing Council meeting in early March confirms slower growth momentum extending into the current year.’

Until then, the wait-and-see approach for monetary policy may keep EUR/USD afloat as the ECB insists that ‘underlying inflation is expected to increase over the medium term,’ with the euro-dollar exchange rate at risk of staging a larger recovery in light of the failed attempt to test the 2019-low (1.1176).

Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

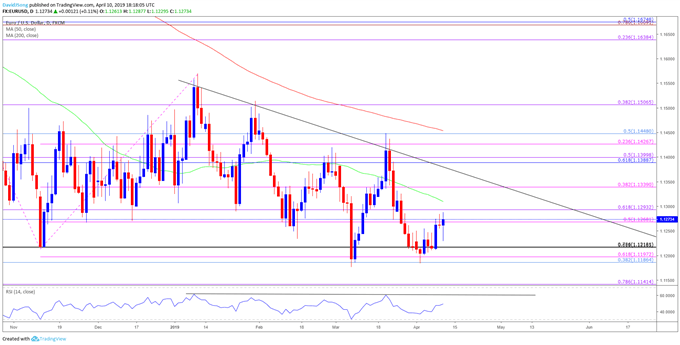

EUR/USD Rate Daily Chart

Keep in mind, the broader outlook for EUR/USD remains clouded with mixed signals as the exchange rate appears to be stuck in a wedge/triangle formation, but the lack of momentum to test the 2019-low (1.1176) paired with the failed attempt to close below the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (78.6% retracement) raises the risk for a larger correction.

Need a break/close back above the 1.1270 (50% expansion) to 1.1290 (61.8% expansion) region to open up the 1.1340 (38.2% expansion) hurdle, with the next area of interest coming in around 1.1390 (61.8% retracement) to 1.1400 (50% expansion).

For more in-depth analysis, check out the 2Q 2019 Forecast for the Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.