EUR/USD tumbles to fresh yearly lows as the European Central Bank (ECB) plans to implement another round of Targeted Long-Term Refinance Operations (TLTRO), and the exchange rate may continue to search for support over the coming days as clears the 2018-low (1.1216).

The announcement suggests the ECB will continue to utilize its non-standard measures to counter the risks surrounding the euro-area as the central bank sticks to the zero-interest rate policy (ZIRP), with the Euro at risk of facing a more bearish fate over the coming months as ‘the Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation continues to move towards the Governing Council’s inflation aim in a sustained manner.’

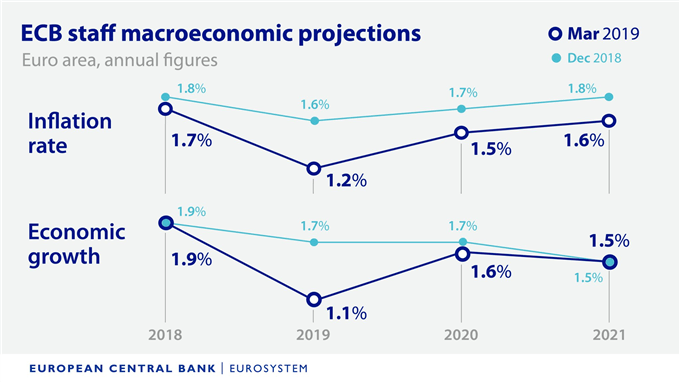

In fact, President Mario Draghi & Co. may adopt a more dovish tone over the coming months as the ECB reduces its growth and inflation forecast for the policy horizon, and it remains to be seen if the Governing Council will restore the asset-purchase program as ‘the risks surrounding the euro area growth outlook are still tilted to the downside.’ As a result, the ECB’s dovish forward-guidance for monetary policy is likely to keep EUR/USD under pressure ahead of the next Federal Reserve interest rate decision on March 20, with recent price action bringing the downside hurdles on the radar as the exchange rate searches for support. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

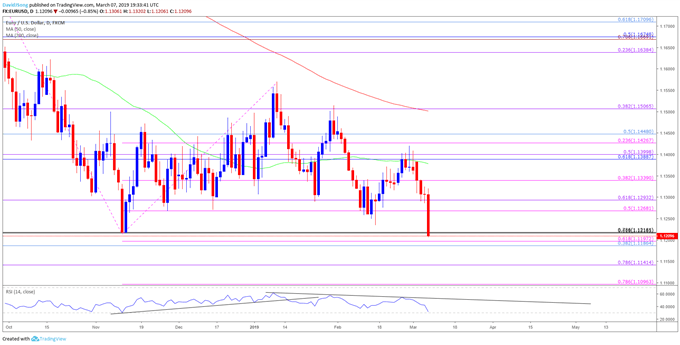

EUR/USD Daily Chart

Failure to hold above the 2018-low (1.1216) raises the risk for a further decline in EUR/USD, but need a break/close below the Fibonacci overlap around 1.1190 (38.2% retracement) to 1.1220 (7.86% retracement) to open up the next downside region of interest around 1.1140 (78.6% expansion).

Will also keep a close eye on the Relative Strength Index (RSI) as it approaches oversold territory, with a break below 30 raising the risk for a further depreciation in the exchange rate as the bearish momentum gathers pace.

For more in-depth analysis, check out the 1Q 2019 Forecast for the Euro.

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.