EUR/USD struggles to hold its ground following the Federal Open Market Committee (FOMC) Minutes, but the failed attempt to test the 2018-low (1.1216) may foster a larger rebound even though the European Central Bank (ECB) remains in no rush to remove the zero-interest rate policy (ZIRP).

The account of the January meeting suggests the ECB is bracing for an economic slowdown as officials warn ‘incoming data had generally surprised on the downside and the near-term growth momentum would likely be weaker than previously anticipated.’

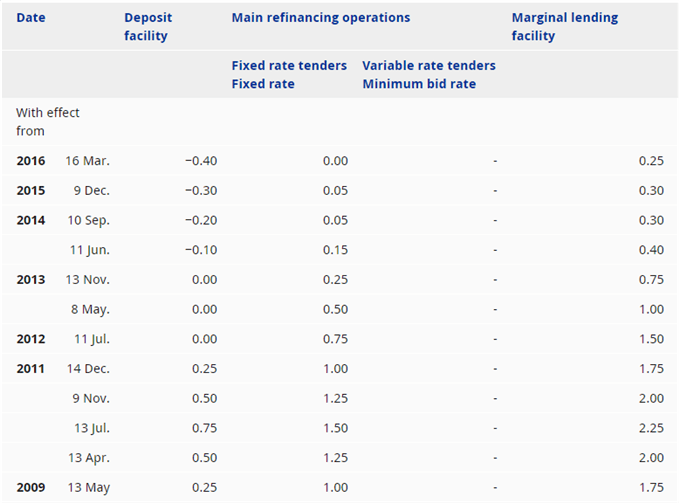

In turn, the ECB points out that ‘the forward money market curve was notably flatter than in October 2018, suggesting that expectations of a first ECB deposit facility rate increase had shifted from September 2019 to April 2020,’ and the Governing Council may continue to tame bets for higher interest rates as ‘uncertainty regarding the euro area economy had risen recently – pertaining to both the growth outlook and inflation.’ Moreover, the ECB may keep the door open to further support the monetary union amid the renewed discussion surrounding the Targeted Longer-Term Refinancing Operations (TLRO), and President Mario Draghi & Co. may continue to offer a dovish outlook at the next meeting on March 7 as the central bank struggles to achieve its one and only mandate for price stability.

As a result, the wait-and-see approach by both the Fed & ECB may keep EUR/USD within the range from late-2018, with the failed attempt to test the 2018-low (1.1216) raising the risk for a larger rebound in the exchange rate. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

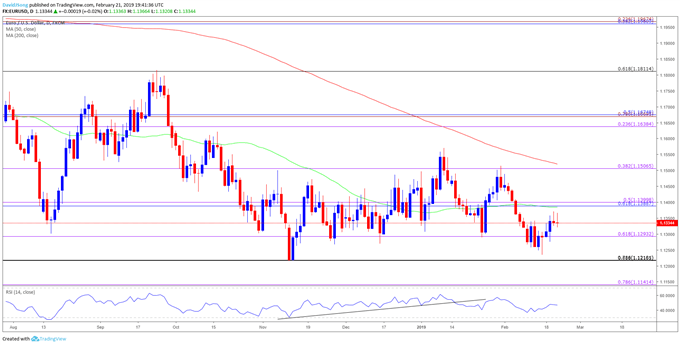

EUR/USD Daily Chart

The 1.1220 (7.86% retracement) region is no longer on the radar following the failed attempt to testthe 2018-low (1.1216), with the near-term range coming into focus going into the final days of February. In turn, a break/close above 1.1390 (61.8% retracement) to 1.1400 (50% expansion) region raises the risk for a move towards 1.1510 (38.2% expansion), with the next area of interest coming in around 1.1640 (23.6% expansion) to 1.1680 (50% retracement).

For more in-depth analysis, check out the 1Q 2019 Forecast for the Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.