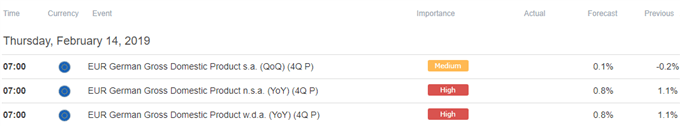

EUR/USD remains under pressure even though a growing number of Federal Reserve officials endorse a wait-and-see approach for monetary policy, and fresh data prints coming out of the euro-area may shake up the exchange rate as Germany, Europe’s largest economy, is expected to avoid a technical recession.

The updated Gross Domestic Product (GDP) report is anticipated to show Germany growing 0.1% in the fourth-quarter of 2018 after contracting 0.2% during the three-months through September, and a positive development may curb the recent decline in EUR/USD as it instills an improved outlook for the monetary union.

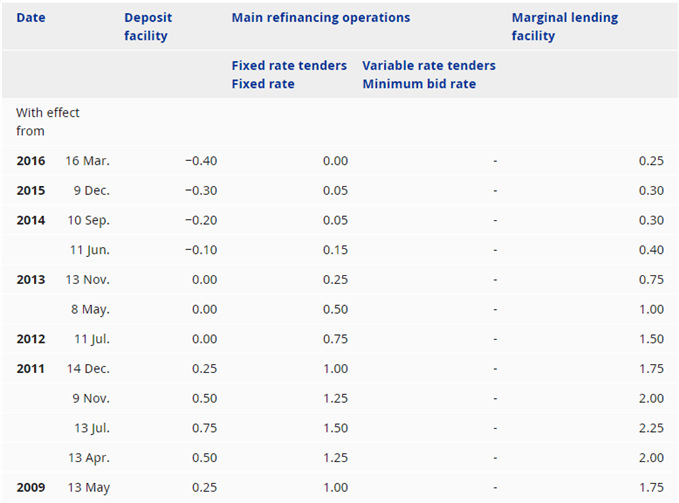

It remains to be seen if the European Central Bank (ECB) will alter the forward-guidance later this year as euro-area interest rates are ‘to remain at their present levels at least through the summer of 2019,’ and the Governing Council may stick to the same script at the next meeting on March 7 as ‘the incoming information has continued to be weaker than expected on account of softer external demand and some country and sector-specific factors.’ In turn, a below-forecast GDP report coming out of Germany may drag on the Euro as it encourages President Mario Draghi & Co. to retain the zero-interest rate policy (ZIRP) beyond 2019, with the exchange rate at risk of making a run at the 2018-low (1.1216) as it snaps the yearly opening range. Sign up and join DailyFX Currency Analyst David Song LIVE for an opportunity to discuss potential trade setups.

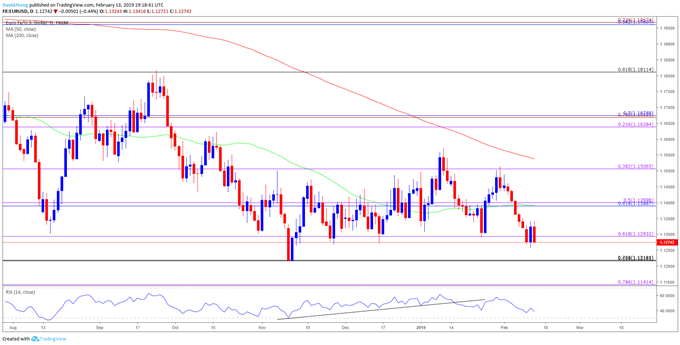

EUR/USD Daily Chart

The advance from earlier this year has unraveled following the failed attempt to trade back above the 1.1510 (38.2% expansion) hurdle, with the break of the January-low (1.1289) raising the risk for a run at the 2018-low (1.1216). In turn, the 1.1220 (7.86% retracement) area sits on the radar, with a break/close below the stated region opening up the next downside hurdle around 1.1140 (78.6% expansion).

For more in-depth analysis, check out the 1Q 2019 Forecast for the Euro

Additional Trading Resources

Are you looking to improve your trading approach? Review the ‘Traits of a Successful Trader’ series on how to effectively use leverage along with other best practices that any trader can follow.

Want to know what other currency pairs the DailyFX team is watching? Download and review the Top Trading Opportunities for 2019.

--- Written by David Song, Currency Analyst

Follow me on Twitter at @DavidJSong.