Sign Up & Join DailyFX Currency Analyst David Song to Discuss Key FX Themes & Potential Trade Setups.

EUR/USD gives back the advance from earlier this month following the string of failed attempts to close above the 1.1860 (161.8% expansion) hurdle, and the pair may continue to consolidate ahead of the next European Central Bank (ECB) meeting on October 26 as President Mario Draghi and Co. show a greater willingness to carry the quantitative easing (QE) program into 2018.

Recent comments from ECB officials suggest the central bank will move away from its easing-cycle as Governing Council member cargues ‘there should be an adequate reduction of our net asset purchases, toward their possible end.’ It seems as though the ECB will start to wind down its non-standard measure as ‘the economic expansion continued to be solid and broad-based across countries and sectors,’ but the recalibration may also keep the QE program rolling beyond the December deadline as the Governing Council struggles to achieve the 2% target for inflation. With that said, EUR/USD stands at risk of facing a more material correction if the ECB extends the timetable for the QE program.

EUR/USD Daily Chart

DailyFX 4Q Forecasts Are Now Available

Keep in mind the broader outlook remains constructive for EUR/USD, but the pair stands at risk of facing range-bound conditions over the near-term as the former-support zone around 1.1860 (161.8% expansion) offers resistance. As a result, price & the Relative Strength Index (RSI) may continue to track the bearish formation carried over from August, with the first downside hurdle coming in around 1.1670 (50% retracement), which largely lines up with the monthly-low (1.1669). Break of the monthly opening range raises the risk for a move back towards the 1.1580 (100% expansion) region.

EUR/USD Retail Sentiment

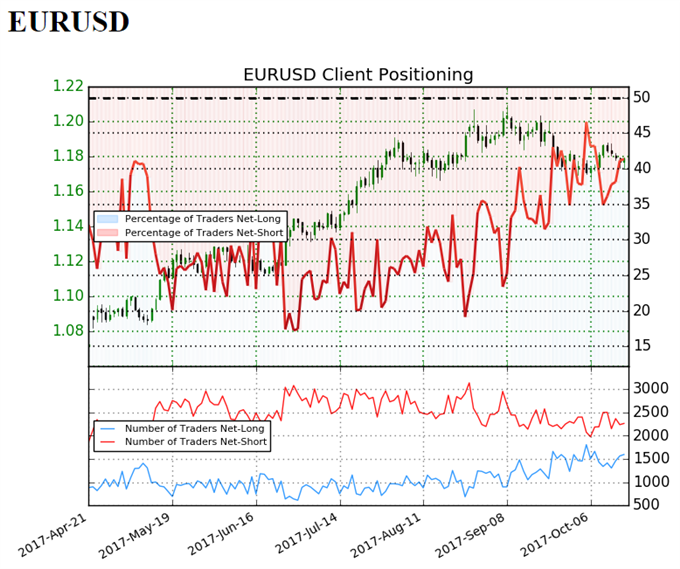

Retail trader data shows 41.4% of traders are net-long EUR/USD with the ratio of traders short to long at 1.42 to 1.

In fact, traders have remained net-short since April 18 when EUR/USD traded near 1.07367; price has moved 9.8% higher since then. The number of traders net-long is 6.7% lower than yesterday and 8.1% higher from last week, while the number of traders net-short is 4.8% lower than yesterday and 8.6% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rise. Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EURUSD trading bias.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.