Sign Up for the DailyFX Trading Webinars for an opportunity to discuss potential trade setups.

The shift in EUR/USD behavior may continue to take shape over the coming months as the pair preserves the upward trend from late-2016, but the mixed rhetoric coming out of the Federal Open Market Committee (FOMC) and the European Central Bank (ECB) may produce range-bound conditions as market participants weigh the outlook for monetary policy.

It seems as though Chair Janet Yellen and Co. will continue to tame expectations for an imminent rate-hike at the Fed Economic Symposium in Jackson Hole, Wyoming as most officials ‘saw some likelihood that inflation might remain below 2 percent for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside.’ In turn, the FOMC may attempt to buy more time at the next interest rate decision on September 20, with the U.S. dollar at risk of facing a more bearish fate over the coming months as central bank officials remain reluctant to implement higher borrowing-costs.

At the same time, the ECB may carry its asset-purchase program into 2018 as Governing Council start to discuss ‘the risk of the exchange rate overshooting,’ and President Mario Draghi and Co. may come under pressure to carry the non-standard program beyond the current December deadline as inflation continues to run below the 2% target. Nevertheless, the ECB may continue to ‘stress that the economic expansion had strengthened and that risks to the growth outlook were broadly balanced’ as the central bank raises its GDP forecasts, and a growing number of Governing Council officials may look to taper the asset-purchase program over the coming months as ‘reflationary forces, which referred to the recovery of inflation from levels below its long-term trend, had replaced risks of deflation.’

DailyFX 3Q Forecasts Are Now Available

Near-term outlook for EUR/USD remains capped as the pair trades within a downward trending channel after failing to fill-in the gap from January-2015 (1.2000 down to 1.1955). Nevertheless, a bull-flag formation appears to be taking shape, with the broader bias tilted to the topside as the pair preserves the upward trend from late-2016. At the same time, the Relative Strength Index (RSI) reflects a similar dynamic, with the oscillator at risk of flashing a bullish trigger as it appears to be threatening the series of lower-highs carried over from the previous month.

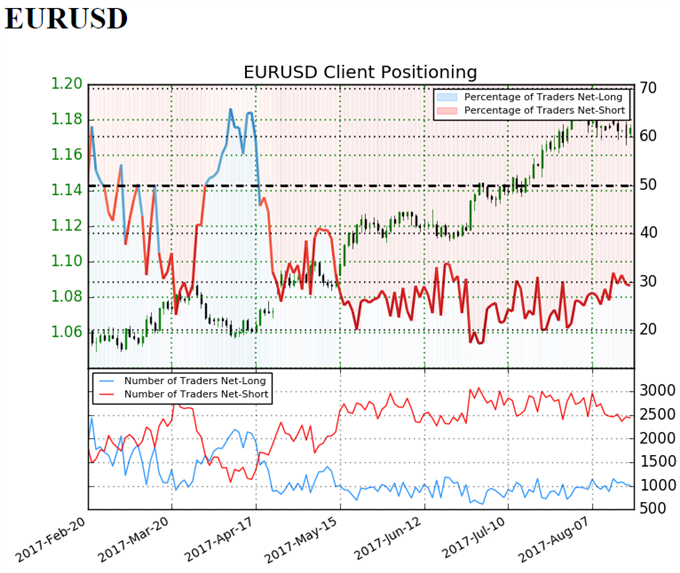

EUR/USD Retail Sentiment

Track Retail Sentiment with the New Gauge Developed by DailyFX Based on Trader Positioning

Retail trader data shows 29.3% of traders are net-long EUR/USD with the ratio of traders short to long at 2.42 to 1. In fact, traders have remained net-short since April 18 when EUR/USD traded near 1.06841; price has moved 10.0% higher since then. The number of traders net-long is 28.4% lower than yesterday and 7.8% lower from last week, while the number of traders net-short is 5.1% higher than yesterday and 1.6% lower from last week.

For More Updates, Join DailyFX Currency Analyst David Song for LIVE Analysis!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.