US Dollar Q3 Technical Forecast - DXY and EUR/USD

US Dollar (DXY) Outlook

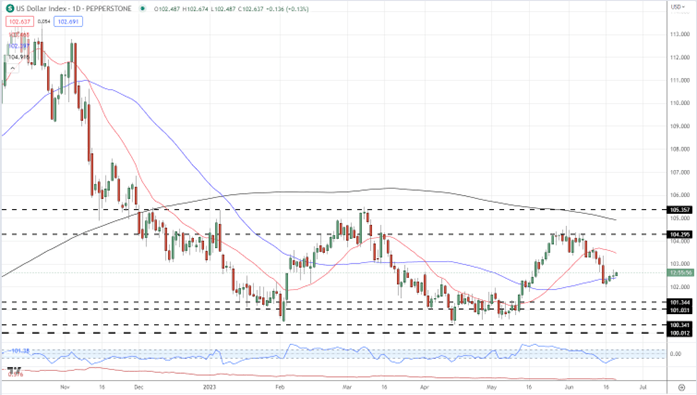

The US dollar has been trapped in a five-point range for the first half of the year and this is unlikely to change as we head into Q3. The Federal Reserve was ahead of most other G7 central banks in the rate-hiking cycle, and it now looks as though it will be one of the first to put rate hikes on hold. Other central banks, including the ECB and the BoE, however, have already made it clear that they will continue to increase interest rates in their fight against inflation, narrowing the interest rate differential against the US dollar.

The US dollar Index is used to measure the value of the greenback against a basket of six other major currencies. The largest currency in the index is the Euro with a weighting of approximately 58%, followed by the Japanese Yen at 13.6% and the British Pound at just under 12%. With the Euro and Sterling expected to be supported further by higher rates, this will weigh on the index.

The DXY is in the middle of a wave pattern within a five-point range and will likely remain that way in the coming weeks. Due to the potential rate narrowing scenario mentioned above, it looks likely that the downside of the range will come under pressure, especially with the index trading below the 50- and 200-day moving average.

US Dollar (DXY) Daily Price Chart

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

EUR/USD Outlook

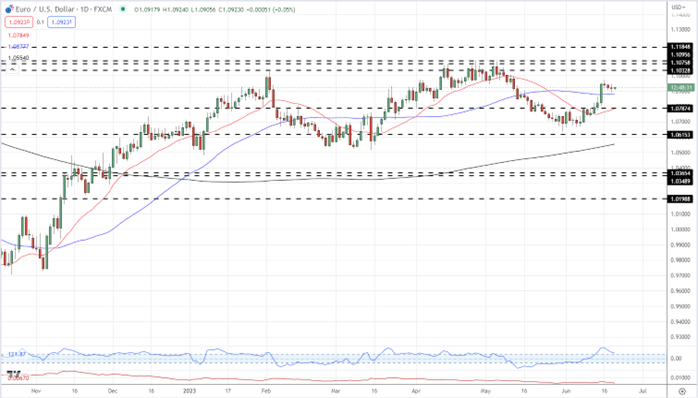

A look at the US dollar against the Euro also shows the pair in a wave formation and rangebound. EUR/USD has the potential to move higher with a cluster of highs made in mid-April to early May all the way up to 1.1095 the next target. It may also be that the pair break this zone of resistance which would bring the March 2022 swing high at 1.1185 into play. The pair is currently supported by all three moving averages. Any move above here is likely to be driven by fundamental forces more than technical analysis.

EUR/USD Daily Price Chart

All charts prepared using TradingView