Most Read: Gold Price Outlook - Drivers Behind Market Boom, Reversal or New Record Ahead?

Trading often pulls us to mimic the masses – buying in moments of euphoria and selling when panic strikes. However, experienced traders recognize the promise of contrarian approaches. Indicators like IG client sentiment provide a valuable perspective on the market's overall mindset, exposing points where extreme optimism or pessimism hint at a looming trend change.

Naturally, contrarian signals aren't foolproof. They're most effective when integrated into a well-rounded trading plan. By weaving contrarian observations into a framework of technical and fundamental analysis, traders develop a more nuanced picture of market dynamics – dynamics the crowd may be missing. Let's delve into this idea by analyzing IG client sentiment and its potential influence on the U.S. dollar within three significant FX pairs: EUR/USD, GBP/USD and USD/CHF.

Looking to anticipate the next significant shift in EUR/USD? Gain access to our quarterly forecast for in-depth insights. Request your complimentary guide today to stay updated on market trends!

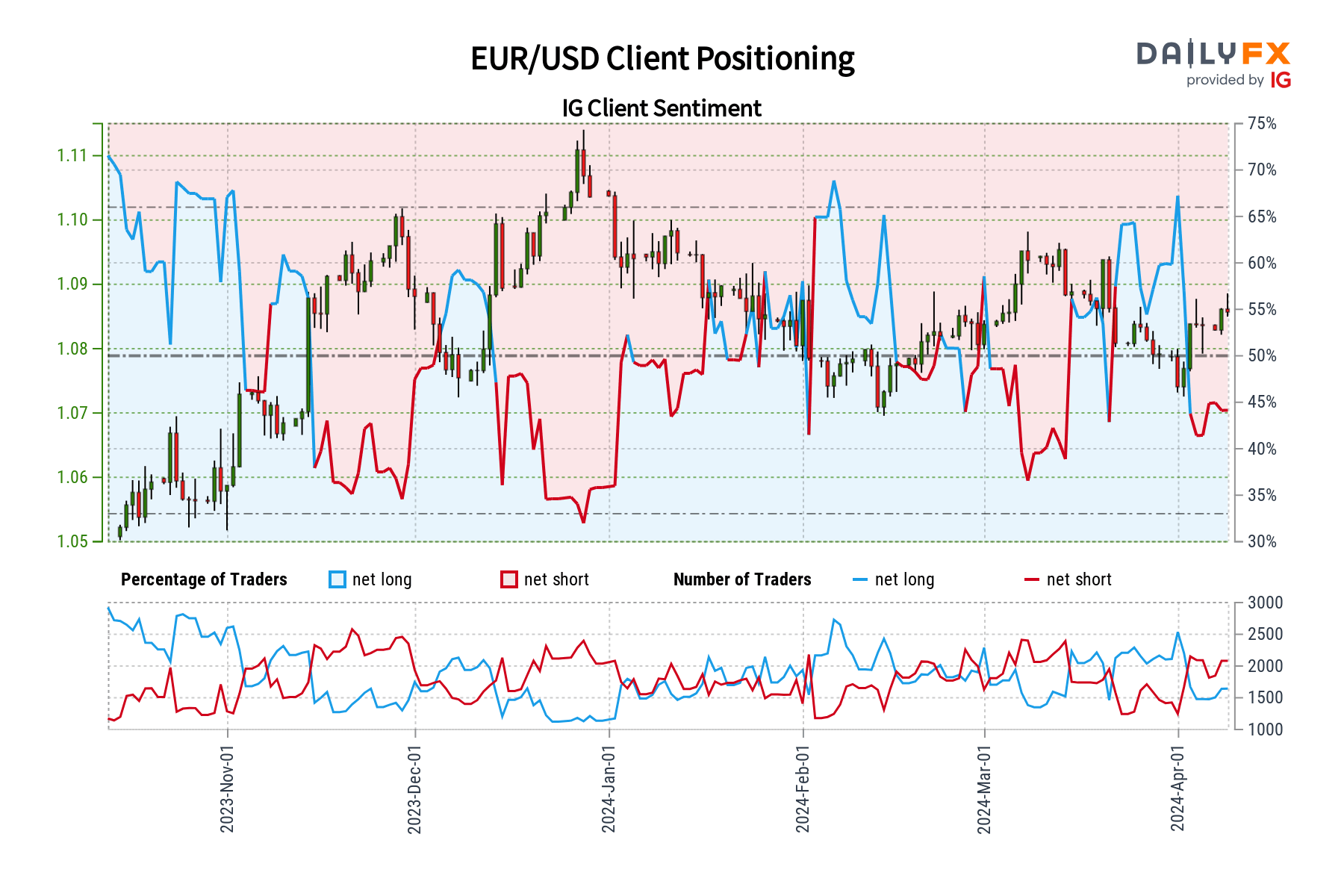

EUR/USD MARKET FORECAST – SENTIMENT ANALYSIS

IG data reveals a distinctly bearish stance on EUR/USD. A substantial 56.93% of traders anticipate a decline, creating a short-to-long ratio of 1.32 to 1. This pessimism is further reflected in the 14.69% increase in net-short positions since yesterday, and a dramatic 54.22% surge compared to last week.

We often take a dissenting stance on prevailing market sentiment in our strategy. The current net-short positioning suggests the EUR/USD might actually hold potential for further gains in the near term, with the increasing number of sellers on aggregate strengthening the case for a bullish contrarian outlook.

Important note: Contrarian signals provide valuable insights but should always be integrated into a broader analysis incorporating technical and fundamental factors for a well-informed trading decision.

Curious about GBP/USD’s path ahead? Dive into our second-quarter outlook for expert analysis and strategies. Don't hesitate—request your free guide today and gain an edge in your trading!

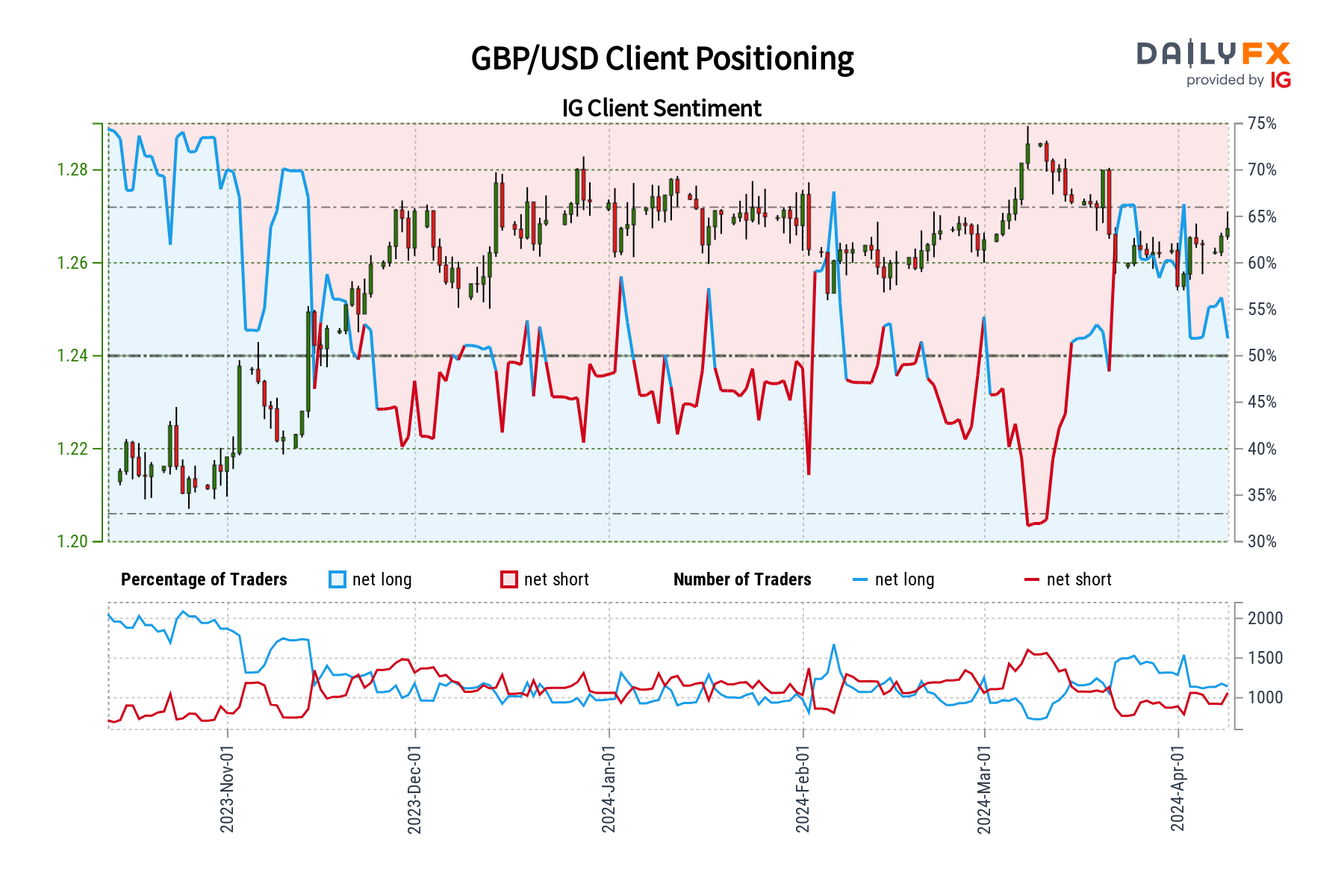

GBP/USD MARKET FORECAST –SENTIMENT ANALYSIS

Recent IG data indicates a shift in sentiment towards the pound, with the market turning bearish for the first time since March 21st. Currently, 52.34% of clients are selling GBP/USD, resulting in a short-to-long ratio of 1.10 to 1. This bearish tilt is further evidenced by a 20.55% increase in net-short positions compared to yesterday and a 33.60% jump from last week.

Our approach often favors a contrarian viewpoint when it comes to crowd behavior. This newfound bearishness among the retail crowd hints at a potential continuation of GBP/USD's upward trajectory, with the combination of current sentiment and recent positioning changes reinforcing our GBP/USD-bullish contrarian trading bias.

Important Note: Remember that contrarian signals are just one tool in a trader's arsenal. They should be considered alongside other technical and fundamental indicators for a more comprehensive market analysis.

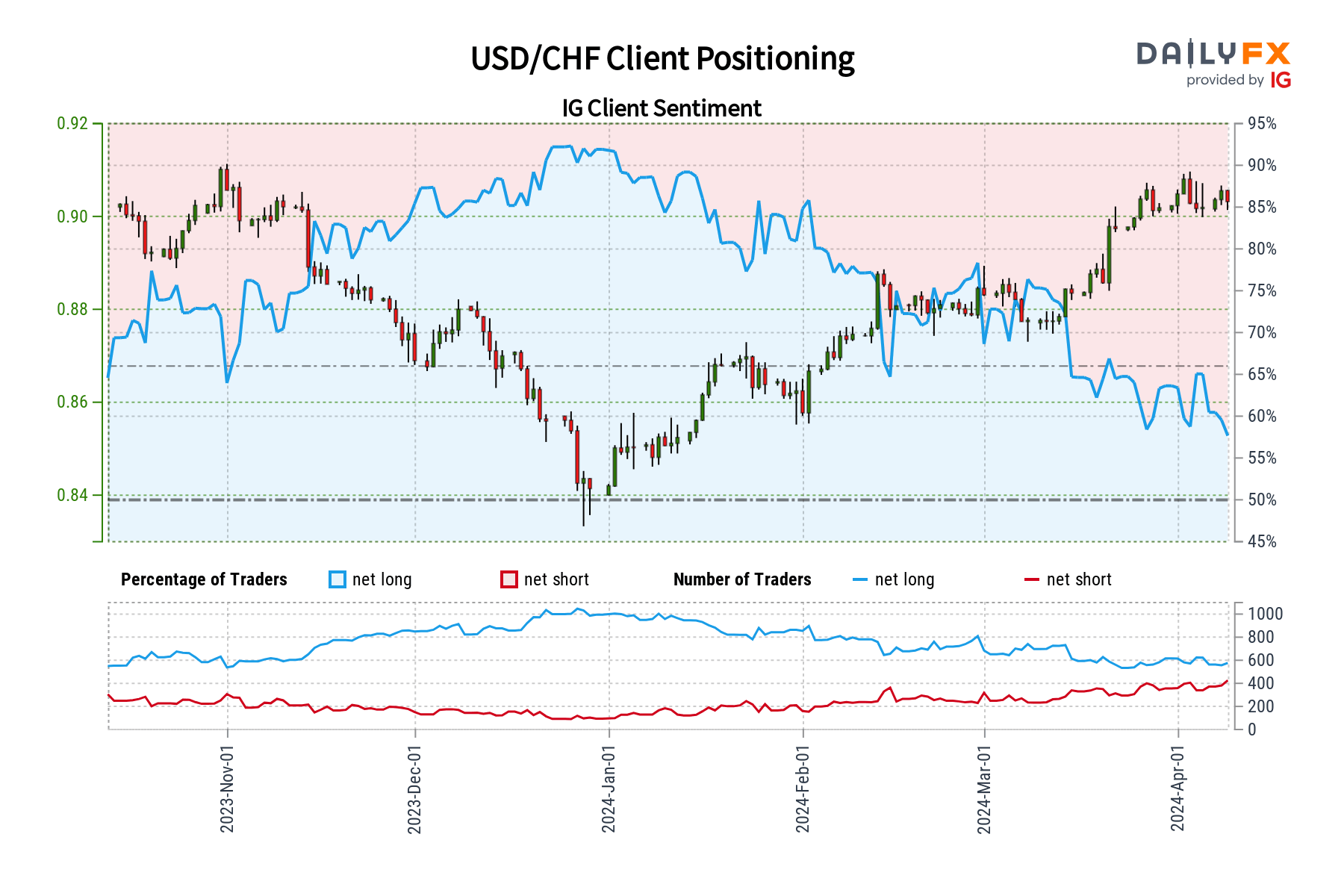

Keen to discover how retail positioning could offer insight into USD/CHF’s trajectory? Delve into our sentiment guide for invaluable insights into market psychology as a trend indicator. Download now!

| Change in | Longs | Shorts | OI |

| Daily | 8% | -7% | 1% |

| Weekly | 1% | -10% | -4% |

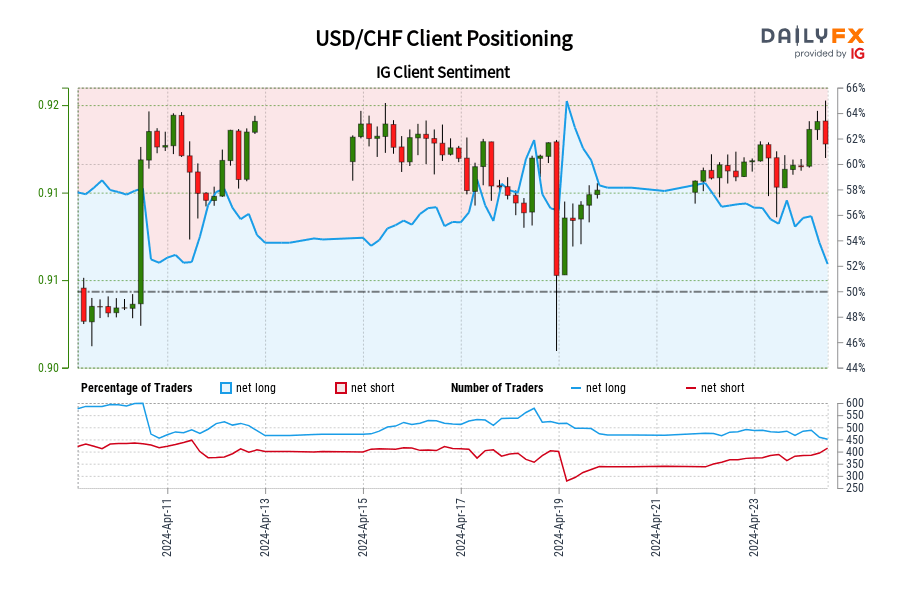

USD/CHF MARKET FORECAST – SENTIMENT ANALYSIS

IG's proprietary data reveals a significant bullish bias among retail clients on USD/CHF. Currently, 58.92% are betting on further upside, resulting in a long-to-short ratio of 1.43 to 1. This optimism has intensified, with net-long positions increasing by 3.50% since yesterday and 10.06% compared to last week.

Our trading philosophy often leans towards a contrarian perspective. That being said, the prevailing optimism among retail traders on the U.S. dollar’s prospects suggests a possible pullback in USD/CHF may be in the offing. The steady growth in net-long positions over different timeframes strengthens this bearish contrarian viewpoint.

Important note: While contrarian signals are insightful, it's crucial to integrate them into a broader trading approach that considers additional technical and fundamental factors.