To receive Tyler’s analysis directly via email, please SIGN UP HERE

Talking Points:

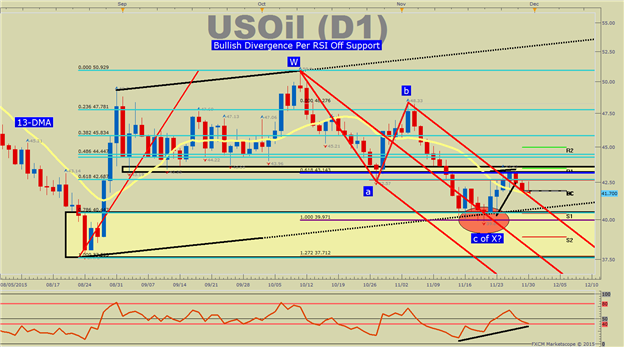

- Crude Oil Technical Strategy: Close > 43.43 helps validate a base signals a base

- 13-DMA Holding Today’s Low So Far

- RSI (5) Showing Bullish Divergence Into a Higher-Low

Oil looks to finish off its worst month of price performance since July by falling nearly 11%. The fundamental cause of this drop is due to doubt that OPEC will find the willingness from Non-OPEC producers to stop producing at such high levels. In a world where nobody wants to lose market share if the price of oil rebounds, there is no one willing to be the first to volunteer to cut production. This unwillingness could ironically send some producers over the edge and to the point of no return (read: bankruptcy) should their rigs fail or the price stay lower for longer such that the banks are not willing to refinance their current debt or provide adequate financing to meet production’s needs. As a ripple effect, we continue to hear stories of commodities based hedge funds closing down due to the rout in materials, metals, and oil. However, the idea that Oil could soon be bottoming is still lingering with credibility on the charts. The upcoming wildcard to all of this is the December 4th meeting where OPEC will make an announcement on production going forward with low prices where they are today.

After peaking out last week at $43.43bbl, the price has retreated but remains above the 13-DMA AT $41.68. If price can remain above the November low of $39.87, we will still hold out for a break above $43.43 to validate a breakout and the potential for a double-bottom price pattern. A double-bottom pattern is a reversal pattern that sees a second price failure within the price range of the first bounce. Given the August 24th range of $40.45bbl-$39.87 (red oval), we’ve currently met that requirement. What is currently missing is a breakout to the upside. The key level to validate the breakout is also the R1 Resistance level. Should any of the fundamental data bring out weakness in the US Dollar, which is inversely correlated to US Oil, we may soon turn our attention to the R2 Weekly pivot that currently sits higher near $45bbl. Also, FXCM's trading book, used as a sentiment reading, is also showing that clients are now net-short, whch can, but not necessarily does precede higher prices are on the horizon. We use our SSI as a contrarian indicator to price action, and the fact that the majority of traders are selling gives a signal that US Oil may continue higher.

RSI continues to show us that a strong move higher could be underway, which is helpful because momentum can be seen as a leading indicator. Currently, the recovery of the mid-November lows have been mild, but the small victory is that recent dollar strength and macroeconomic announcement haven’t dragged the price lower. Given the interest in upside, a clear breakout could be aggressive. Any break below the mid-November low would immediately send focus lower towards the August 24th low, followed by the $35bbl region. T.Y.

We hope you enjoyed this short-term Oil Outlook, be sure to sign up for our free oil guide here.