Talking Points:

- USD/JPY Range Vulnerable to Upbeat Bank of Japan (BoJ) Minutes.

- AUD/USD Rebound at Risk on Dovish Reserve Bank of Australia (RBA).

- USDOLLAR Downside Targets Remains in Focus on Mixed U.S. Data.

For more updates, sign up for David's e-mail distribution list.

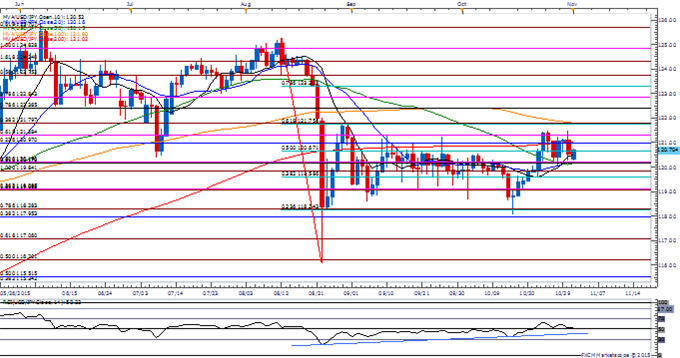

Chart - Created Using FXCM Marketscope 2.0

- With the failed attempts to close below the Fibonacci overlap around 120.10 (61.8% retracement) to 120.20 (50% expansion), USD/JPY may race range-bound prices in the days ahead as market participants continue to weigh the outlook for monetary policy; will stay constructive on the pair as the Relative Strength Index (RSI) largely retains the bullish formation from back in August.

- However, as the Bank of Japan (BoJ) pushes out its forecast of achieving the 2% inflation target, seems as though Governor Haruhiko Kuroda will continue to endorse a wait-and-see approach as the central bank remains reluctant to further embark on its easing cycle at the current juncture.

- DailyFX Speculative Sentiment Index (SSI) shows retail crowd remains net-long USD/JPY since June 8, but the ratio appears to be coming off of recent extremes as it narrows to +2.08, with 68% of traders long.

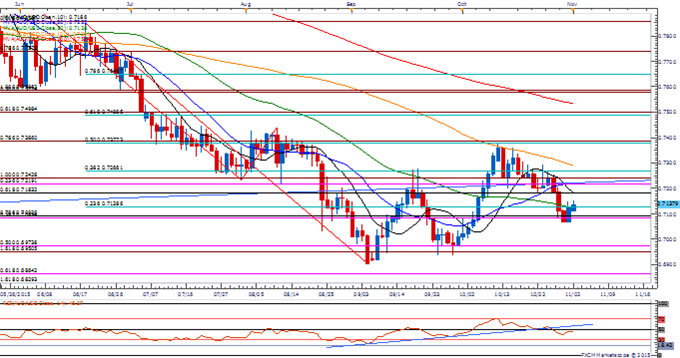

AUD/USD

- Despite the dismal data prints out of China – Australia’s largest trading partner – AUD/USD continues to pare the decline from the previous week, with former support around 0.7180 (61.8% retracement) in focus ahead of the Reserve Bank of Australia (RBA) interest rate decision.

- Even though the RBA is widely expected to retain its currently policy in November, the aussie may struggle to hold its ground should Governor Glenn Stevens toughen the verbal intervention or show a greater willingness to further embark on the easing cycle.

- Downside targets remain in focus following the bearish RSI trigger, with the next region of interest coming in around 0.6950 (161.8% expansion) to 0.6970 (50% expansion).

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

Price & Time: EUR/JPY - BoJ Out of the Way But Big Week For EUR/JPY

COT - Change in Euro Positioning is a Record

USDOLLAR(Ticker: USDollar):

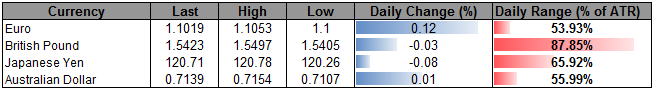

| Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

|---|---|---|---|---|---|

| DJ-FXCM Dollar Index | 12038.81 | 12041.29 | 12021.16 | 0.00 | 41.17% |

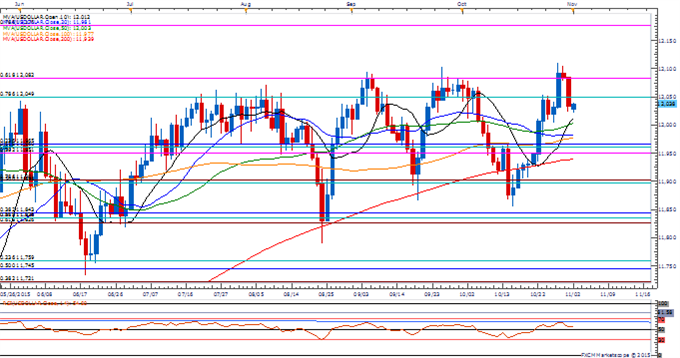

Chart - Created Using FXCM Marketscope 2.0

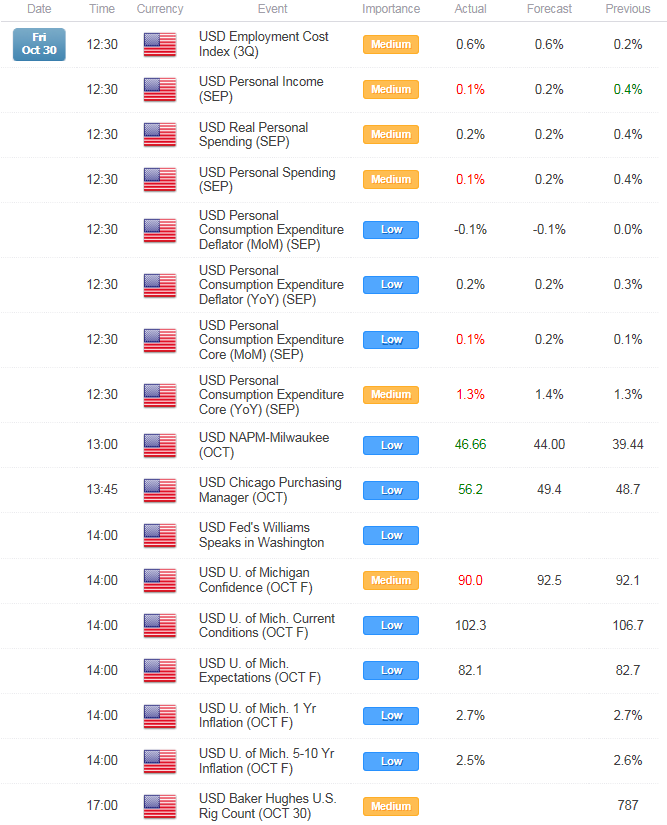

- Despite the rebound in the Dow Jones-FXCM U.S. Dollar, the ongoing batch of mixed data coming out of the U.S. economy accompanied by the recent series of lower highs & lows raises the risk for a larger pullback ahead of the highly anticipated Non-Farm Payrolls (NFP) on tap for Friday.

- With Fed Chair Janet Yellen, Vice-Chair Stanley Fischer, Governor Lael Brainard, Governor Daniel Tarullo, New York Fed President William Dudley, Atlanta Fed President Dennis Lockhart and St. Louis Fed President James Bullard on the wires, will keep a close eye on the fresh batch of central bank rhetoric especially as the committee keeps the door open for a 2015 liftoff.

- Will keep a close eye around the Fibonacci overlap around 11,951 (38.2% expansion) to 11,965 (23.6% retracement) as the dollar carves a bearish pattern and continues to search for support.

Join DailyFX on Demand for Real-Time SSI Updates!

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

New to FX? Watch this Video