Talking Points

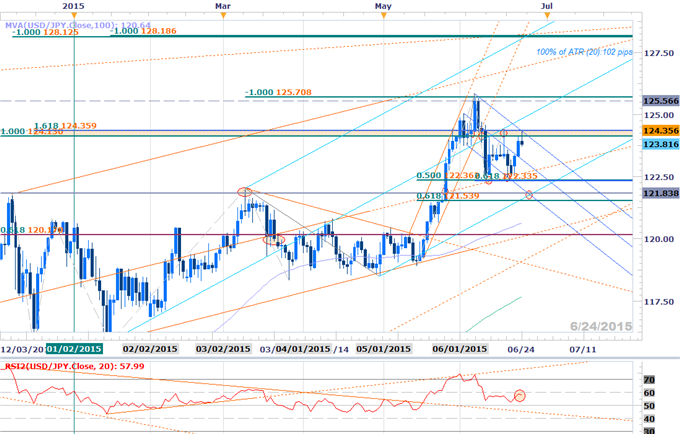

- USDJPY stalls at key resistance confluence- longs vulnerable sub 124.35

- Updated targets & invalidation levels

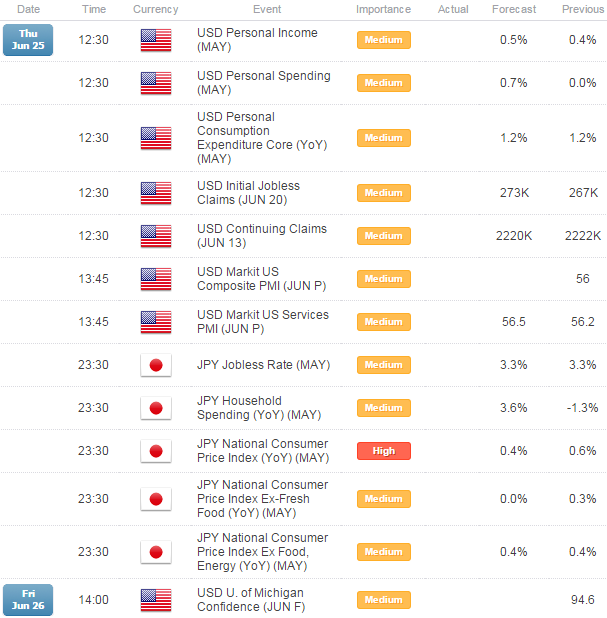

- Event Riskon TapThis Week

USDJPY Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

- USDJPY tests key resistance confluence at 124.13/35- Longs at risk below this level

- Interim support at the ML backed by key support at 122.33/36

- Subsequent support objectives at 121.83 & the lower MLP / 121.54

- Resistance breach targets the ML off the yearly low backed by 125.56/70

- Daily RSI holding sub 60 – 50 break would be bearish

- Event Risk Ahead: Japanese CPI tonight & U.S. Personal Income/Spending, Core PCE tomorrow

USDJPY 30min

Notes: USDJPY tested confluence resistance at the upper median-line parallel (MLP) today in New York with the pair reversing sharply to close the session lower on the day. Momentum divergence into the highs alongside a 5min support trigger break triggered shorts against this region this morning. Initial support comes in at 123.75 backed by 123.46/50. A break below this level is needed to confirm the reversal with such a scenario targeting the broader ML off the highs (blue) backed by the weekly/monthly lows. Note that momentum has yet to break sub-40 this week and we’ll be looking for this development for added conviction on our near-term directional bias.

Bottom line: we’ll be looking lower near-term while below the highlighted region with a break below near-term MLP support targeting subsequent support targets. Keep in mind we would inevitably be looking to buy this pullback with the broader bias weighted to the topside above TL support dating back to the yearly lows (~120.50).

A breach of the highs puts us neutral with a close above 124.55 needed to shift the broader uptrend back into focus. Caution is warranted ahead of Japanese & US data with the releases likely to fuel added volatility in yen & dollar based pairs. A quarter of the daily average true range yields profit targets of 24-27pips per scalp.

For updates on this scalp and more setups throughout the week subscribe to SB Trade Desk

Relevant Data Releases

Other Setups in Play:

- GBPJPY Opening Range Setup- Long Scalps Vulnerable Sub 195.50

- GBPUSD Pullback to Offer Favorable Long Entries- 1.57 Key Support

- USD Shorts Remained Favored on FOMC Sell Off- Key Support 11,731

- Scalp Webinar: Bearish USD Technical Outlook to Face Upbeat FOMC

- USDCAD Breakdown at Initial Support- Short Scalps Favored Sub 1.24

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex,contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video