USD/JPY News and Analysis

- BoJ minutes discuss concerns around inevitable policy change

- USD/JPY testing prior intervention level, 150

- Risk events of the week: US NFP, ISM services

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

BoJ Minutes Discuss Concerns Around Inevitable Policy Change

In the early hours of this morning the BoJ minutes were released wherein a discussion about an exit from negative interest rates took place. One board member raised concerns from a risk management point of view with respect to the major policy change, as the Bank of Japan could have enough data on hand to make a decision on negative rates in the first quarter of next year.

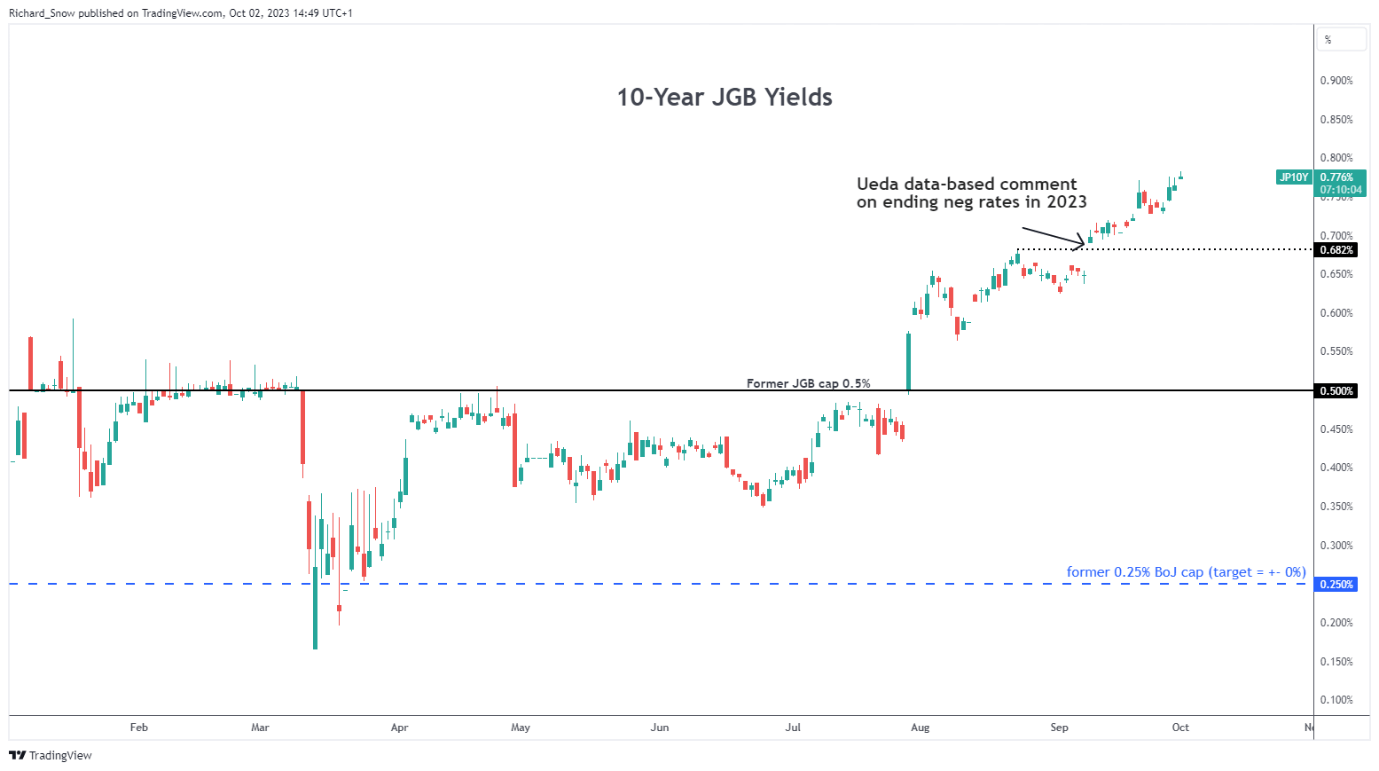

The prospect of withdrawing form negative interest rates resulted in another push higher in 10-year Japanese Government bond yields – necessitating unplanned bond purchases from the bank. Bond yields have previously been the release valve for a period of above target inflation and growing wages – two key determinants surrounding the historic policy change. Yields on the 10-year are now allowed to move steadily above 0.5% with an upside limit thought to be around the 1% marker.

Japanese Government Bond 10-Year Yield

Source: TradingView, prepared by Richard Snow

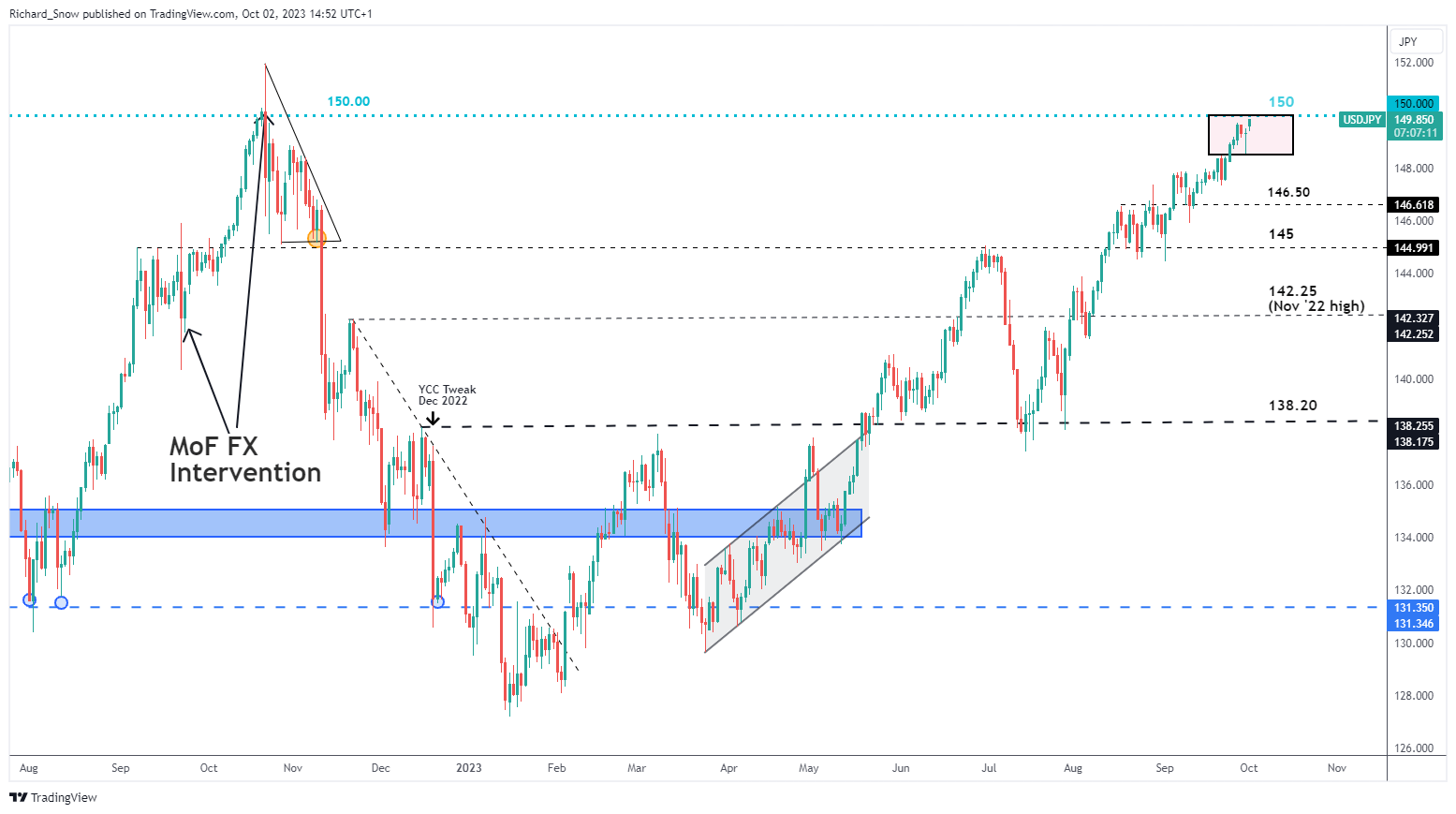

USD/JPY Testing Prior Intervention Level, 150

The counter-trend move at the end of last week has already been clawed back at the start of this week. The US dollar, buoyed by US yields continues higher and the pair now tests a level that could force Tokyo’s hand.

For weeks now, Japanese officials had been warning markets about speculative FX moves that it sees as undesirable. However, we have not seen the same level of volatility witnessed in 2022 when Japan previously intervened in the FX market to defend the value of the yen. Nevertheless, higher import costs for local businesses are being passed on to consumers, contributing to general price pressures.

150 remains the major level of resistance, with 152 the prior swing high on the day of the October intervention (21st). Downside levels of note include 146.50, followed by 145.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

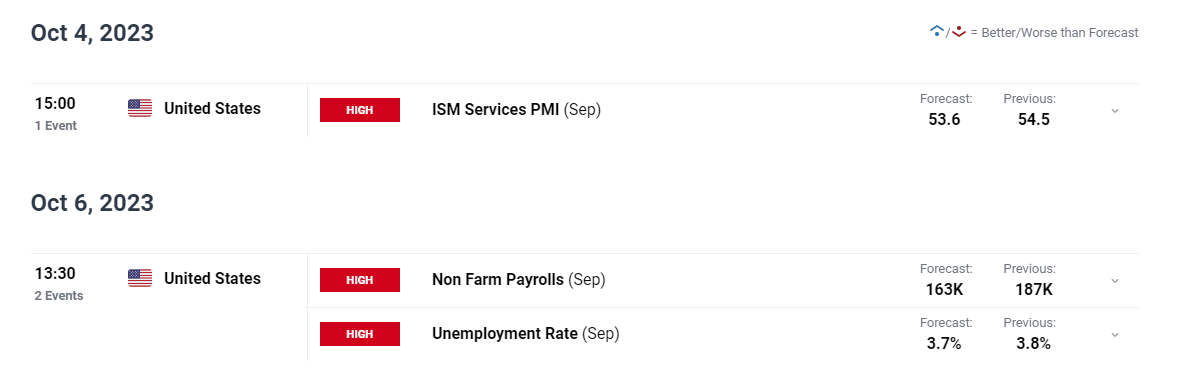

Risk Events of the Week

This week is rather quiet apart from the final US ISM services print and US non-farm payroll data for September on Friday. The quiet week offers little resistance to the current trend meaning Tokyo may soon be forced into a decision.

Customize and filter live economic data via our DailyFX economic calendar

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX