USD/JPY Analysis, Price, and Chart

- USD/JPY bounced as a new trading week got started

- The banking sector looked a little more comfortable, stabilizing US yields

- The week’s economic news is back-loaded

The United States Dollar enjoyed a little bounce against the Japanese Yen on Monday, but the move looks corrective and comes on the back of scant economic news.

There has been a little relaxation of banking-sector jitters, which may have supported the greenback via a bit more stability in Treasury yields. Last week investors worried that European titan Deutsche Bank might be unpleasantly exposed to tightening monetary conditions, but those concerns seem to have waned as a new trading week gets underway, with that lender joining the sector in broad-based gains.

Reports that First Citizen Bank will acquire what’s left of troubled Silicon Valley Bank seem to have been taken well by stock markets.

Minneapolis Federal Reserve President Neel Kashkari said over the weekend that a credit crunch might slow the economy and that the Fed was watching this closely, but it’s unlikely that this was great news to markets.

USD/JPY has inched above the psychologically important 131.00 handle in European trading Monday but doesn’t yet look very comfortable up there. The day doesn’t promise many data-related trading opportunities. These will likely have to await Thursday, when we’ll get the final official look at US Gross Domestic Product data for the old year’s last three months, along with plentiful Japanese numbers from retail sales to industrial production. China’s manufacturing Purchasing Managers Index might also be relevant for the pair, given its bearing on Japan’s huge export sector.

Still, the lasting impact of all of these is likely to be short on USD/JPY. Interest-rate prospects and the health of the banking sector will continue to provide the background music for this pair.

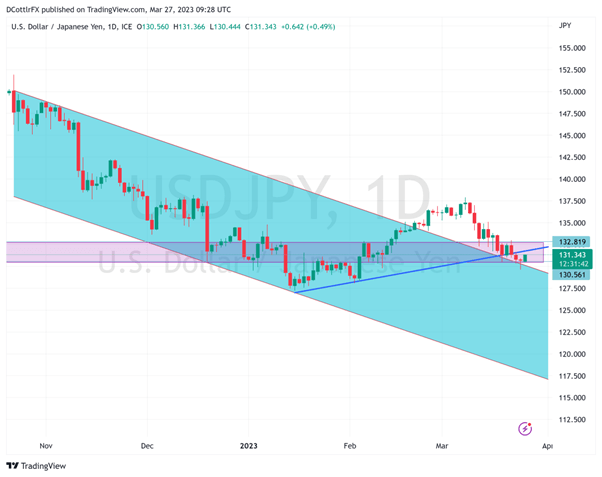

USD/JPY Technical Analysis

Chart Compiled Using TradingView

It’s hard to avoid the suspicion that USD/JPY has reached an interesting technical juncture on its daily chart. Having risen quite convincingly above its medium-term downtrend channel on February 14, it appears to have run out of steam and is now flirting with re-entry. The pair remains in a band of support and resistance bounded by February 6’s open at 132.82 and the following session’s intraday low of 130.49.

While bears appear keen to break the lower boundary of this band, they’ve yet to do so on a daily closing basis and it seems certain to herald further falls should they do so.

There seems to be some risk of a ‘head and shoulders’ chart formation forming on the chart, which would also likely presage further falls. The modest uptrend line from January 16’s low has been broken, and Dollar bulls will need to get back above it in short order to press their case. It now provides resistance at 131.94. That doesn’t look like a huge ask at present, but it will if 131.00 gives way.

Retail Sentiment is Mixed

| Change in | Longs | Shorts | OI |

| Daily | -2% | 2% | 0% |

| Weekly | 12% | -16% | -6% |

It is perhaps notable that Morgan Stanley have reportedly shifted their stance on the pair to neutral when they had previously recommended going long. This neutrality finds an echo in IG’s own sentiment data which finds the trading community uncertain as to the direction from here. 51% of trades are long, and 49% short.

---By David Cottle for DailyFX