ISM SERVICES KEY POINTS:

- ISM Services PMI at 56.7 in September versus 56.00 expected

- Resilient services sector activity data backs case for Fed to remain on a hawkish path

- U.S. dollar extends gains on better-than-forecast results

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Most Read: How Record Inflation Will Impact the US Midterm Elections

A gauge of broad U.S. business services activity remained resilient and moderated less-than-expected at the end of the third quarter, a sign that the economy is holding up well despite growing risks such as high-sky inflation and rising interest rates.

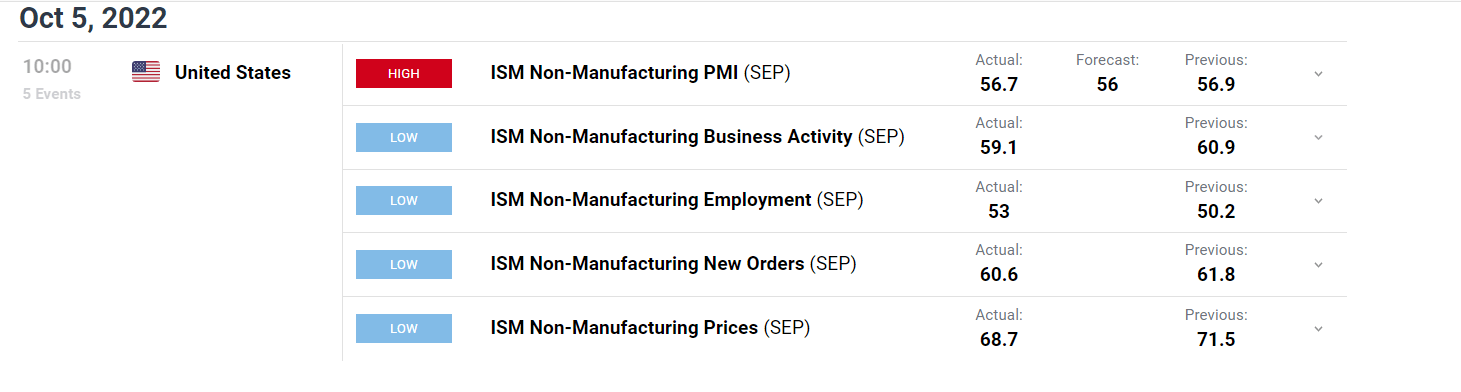

According to the Institute for Supply Management (ISM), September services PMI eased to 56.7 from August's 56.9 print, versus a forecast of 56.00, expanding for the 28th consecutive month. For context, any figure above 50 indicates growth, while readings below that threshold denote a contraction in the sector.

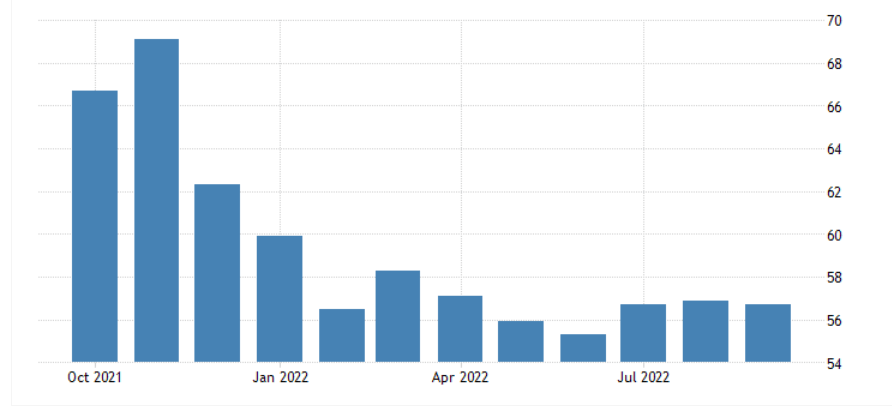

ISM SERVICES PMI

Source: Trading Economics

Looking under the hood, the non-manufacturing sector was restrained by a small drop in new orders and production. Both indicators softened on a month-over-month basis, but the retrenchment was not substantial, indicating that demand, while weakening, is not yet falling off the cliff.

On the bright side, the employment index jumped 2.8 points to 53.00, notching its best reading since March, signaling that hiring remains robust despite the Fed’s best efforts to cool the labor market via tighter financial conditions.

On the inflation front, prices paid eased to 68.7 from 71.5, extending the recent pullback that started in mid-summer. While the directional improvement is welcome, cost burdens remained elevated for service providers, a situation that could prevent CPI numbers from downshifting significantly in the coming months.

ISM SERVICES DATA AT A GLANCE

Source: DailyFX Economic Calendar

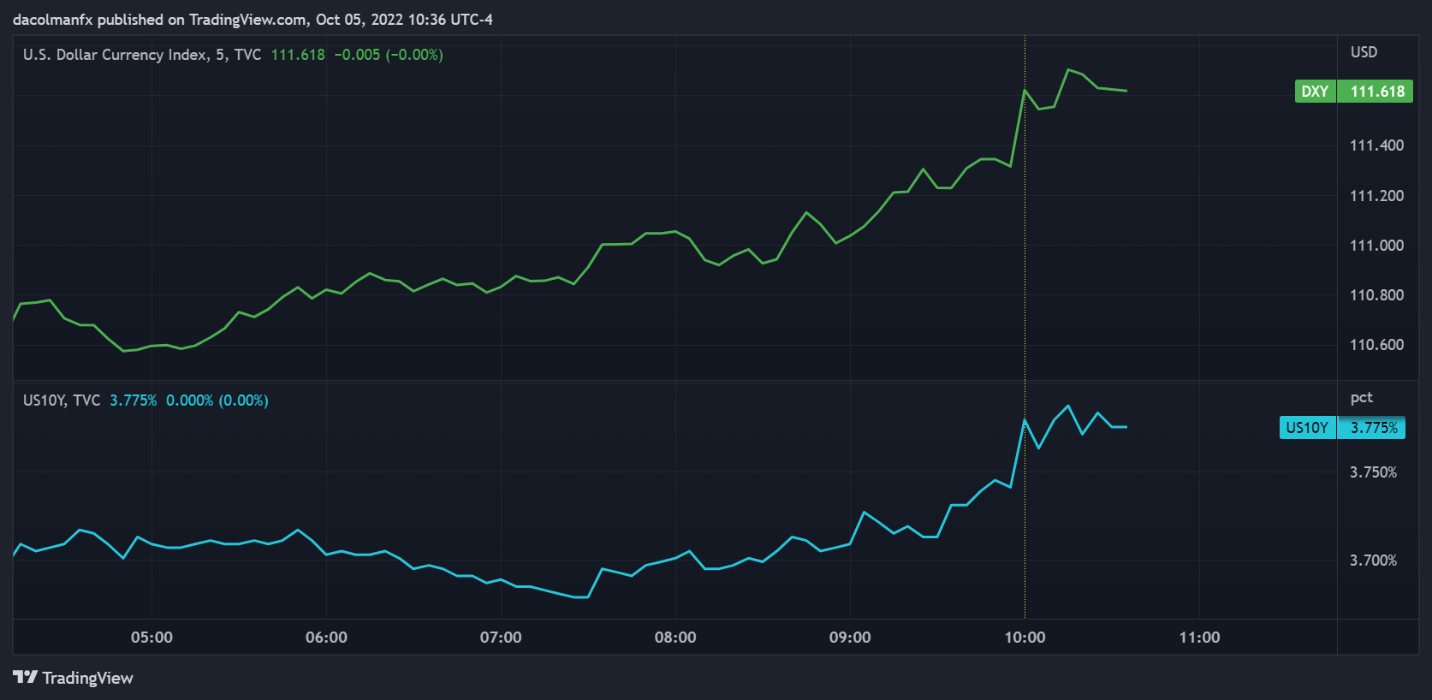

Immediately following the ISM data, the U.S. dollar, as measured by the DXY index, accelerated its advance, bolstered by rising U.S. Treasury yields. The resilience of activity in the most important sector for the economy, together with the strength of the jobs market, should lead policymakers to maintain an aggressive posture, delivering further interest rate hikes at upcoming FOMC meetings to bring inflation down to the 2% target over the forecast horizon. Against this backdrop, the U.S. dollar is likely to maintain an upward bias in the near term.

US DOLLAR REACTION TO ISM SERVICES DATA

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG's client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

---Written by Diego Colman, Market Strategist for DailyFX