South Africa Top 40 (SA 40) Index Latest

- South African Rand (USD/ZAR) remains volatile as Fed decision looms

- SA40 holds above 60000 but trendline resistance caps the upside move.

- Major stock indexes resilient despite elevated geopolitical risks

Emerging market currencies have suffered the wrath of USD strength while the safe-haven Dollar benefits from higher interest rates and its safe-haven appeal.

As market participants gear up for the fourth consecutive 75 basis point rate hike expected to be announced by Fed Chair Jerome Powell later today, major stock indices remains at the mercy of risk sentiment.

Looking back at the implications of lockdowns on the global economy, the decision to reduce interest rates to a near-zero rate of 0.25% in April 2020 supported a swift economic recovery in the United States before price pressures soared.

With the volatile Rand benefiting from an increase in risk appetite and higher commodity prices up until the second quarter of last year, SA’s inability to provide sufficient electricity to support growth throughout the manufacturing and industrial sector has remained a major hinderance for the South African economy..

South Africa Top 40 (SA40) Technical Analysis

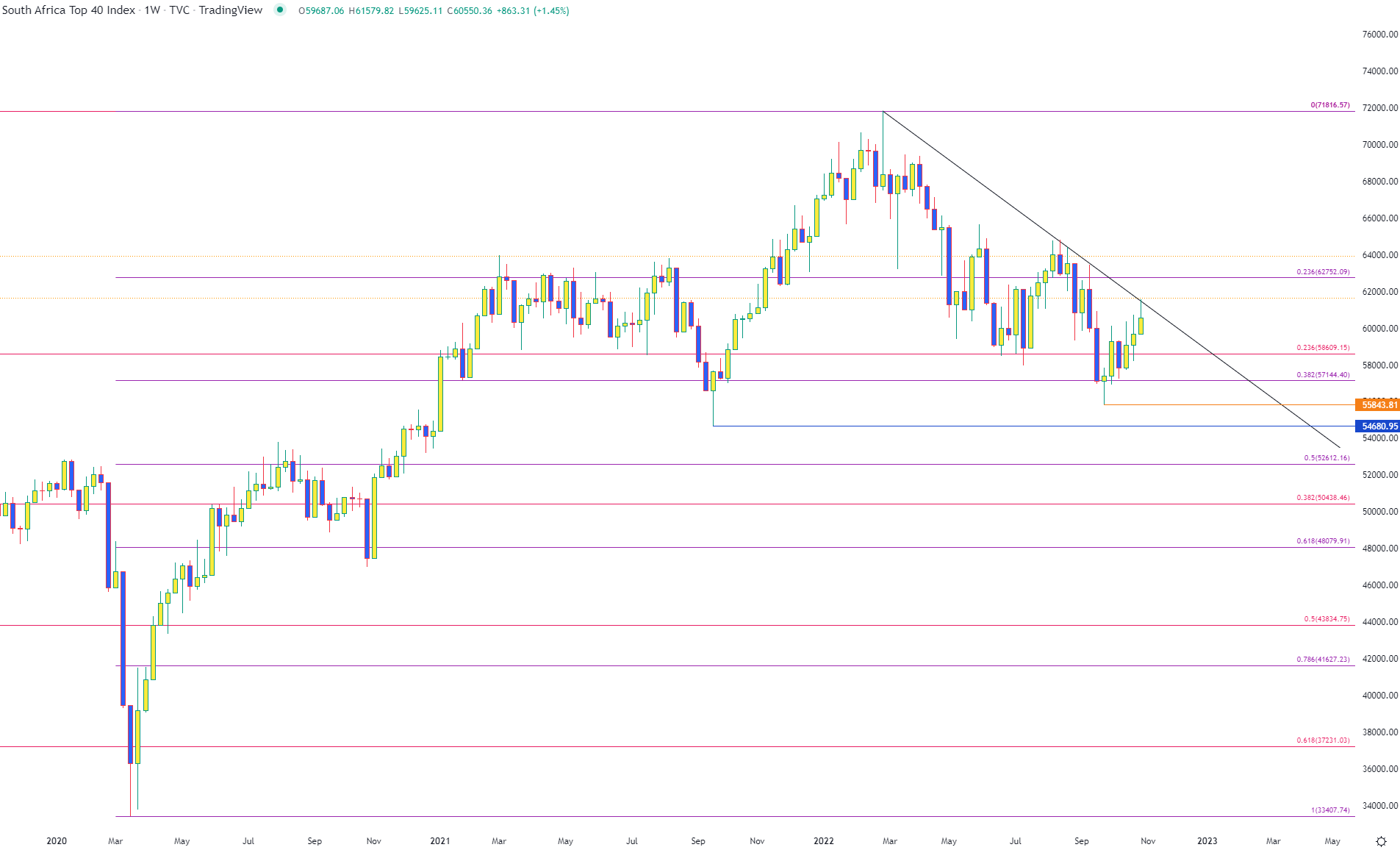

Although the SA 40 (South Africa Top 40 Index) has rapidly gained traction over the past two years, failure to maintain bullish momentum above the March 2022 high of 7186.57 allowed bears to drive price action lower before sliding to low of 55843.81 in September this year.

As buyers retaliated and drove prices higher, a hold above the 38.2% Fibonacci retracement of the 2020 - 2022 move assisted with temporarily muting the downward move by providing support at 57144.

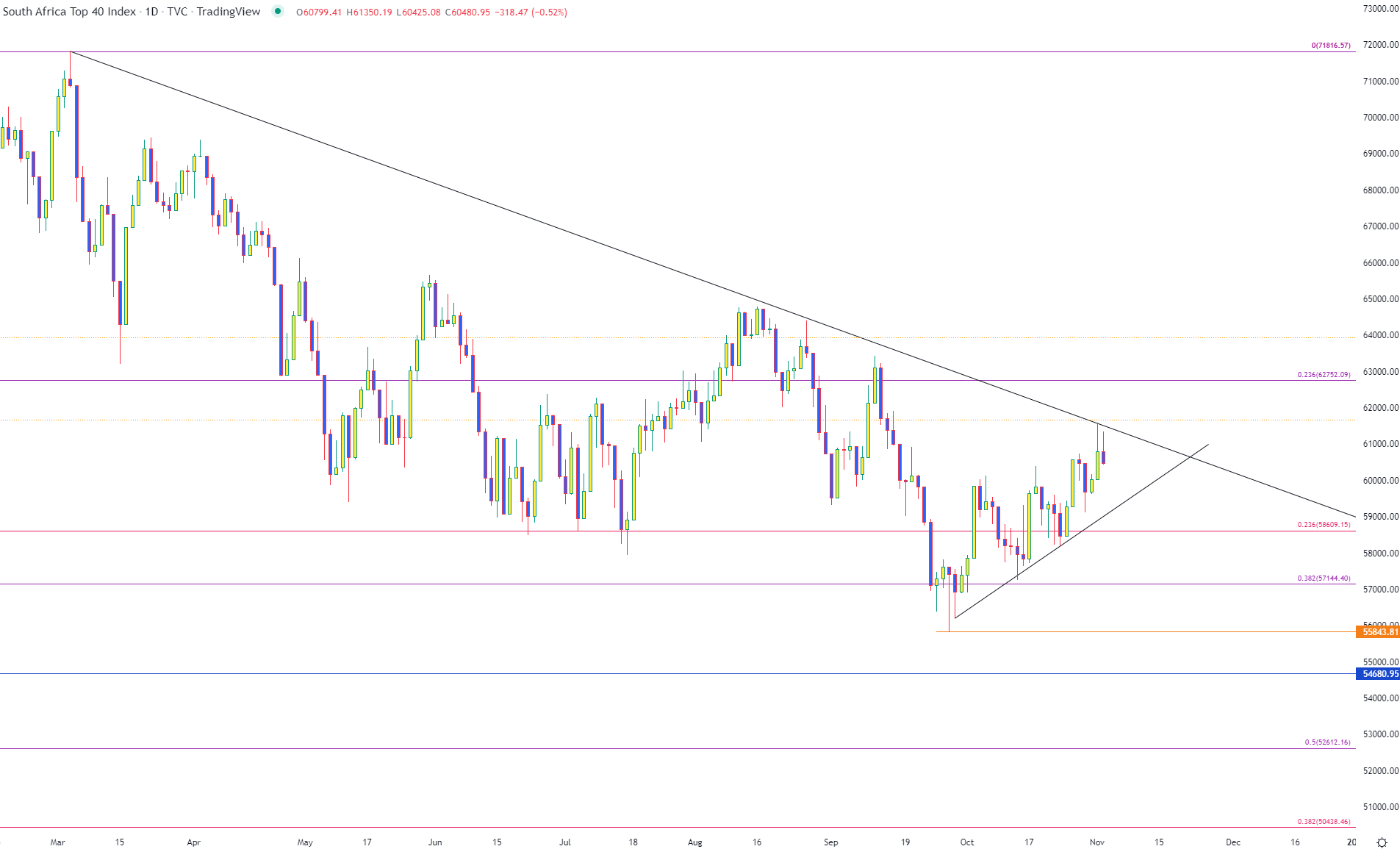

With the South Africa Top 40 currently heading towards the next zone of psychological resistance at 62000, the descending trendline has formed an additional barrier of resistance at around 61580.

SA40 Weekly Chart

Chart prepared by Tammy Da Costa using TradingView

For the upside to prevail, the next challenge will be for buyers to drive prices above 62000. A break above psychological resistance could see a retest of the 23.6% retracement of the 2020 – 2022 move at 62752 opening the door for bullish continuation back towards 64000.

South Africa Top 40 Index (SA40) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

However, a rejection of 62000 and a move below 58609 could see prices drop back towards 55843.

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707