NZD/USD, EUR/NZD, GBP/NZD - Outlook:

- Tentative but unconfirmed signs of base building in NZD/USD.

- False break higher raises downside risks in EUR/NZD.

- Increasing signs that GBP/NZD’s rally may have to pause before resuming the uptrend.

The New Zealand dollar is showing signs of building a base against some of its peers ahead of the Reserve Bank of New Zealand (RBNZ) interest rate decision on Wednesday.

The RBNZ is widely expected to keep its benchmark official cash rate on hold at the 14-year high after signaled in May that NZ interest rates are at their peak. NZ's growth outlook has deteriorated significantly since the second quarter of 2023 as the massive 525 basis points of interest rate hikes spill over to the economy.

However, given inflation is way above the NZ central bank’s target range, the bias for rates remains up if RBNZ follows the renewed hawkishness of global central banks in recent months. This could boost the underperforming NZD, especially given the neutral speculative NZD positioning.

Key focus is also on US CPI data due this week. If price pressures moderate more than expected, USD could take a backseat globally. For now, though, the rate futures market is showing a 95% of a 25-basis-point hike by the US Federal Reserve at its meeting later this month, according to the CME FedWatch tool.

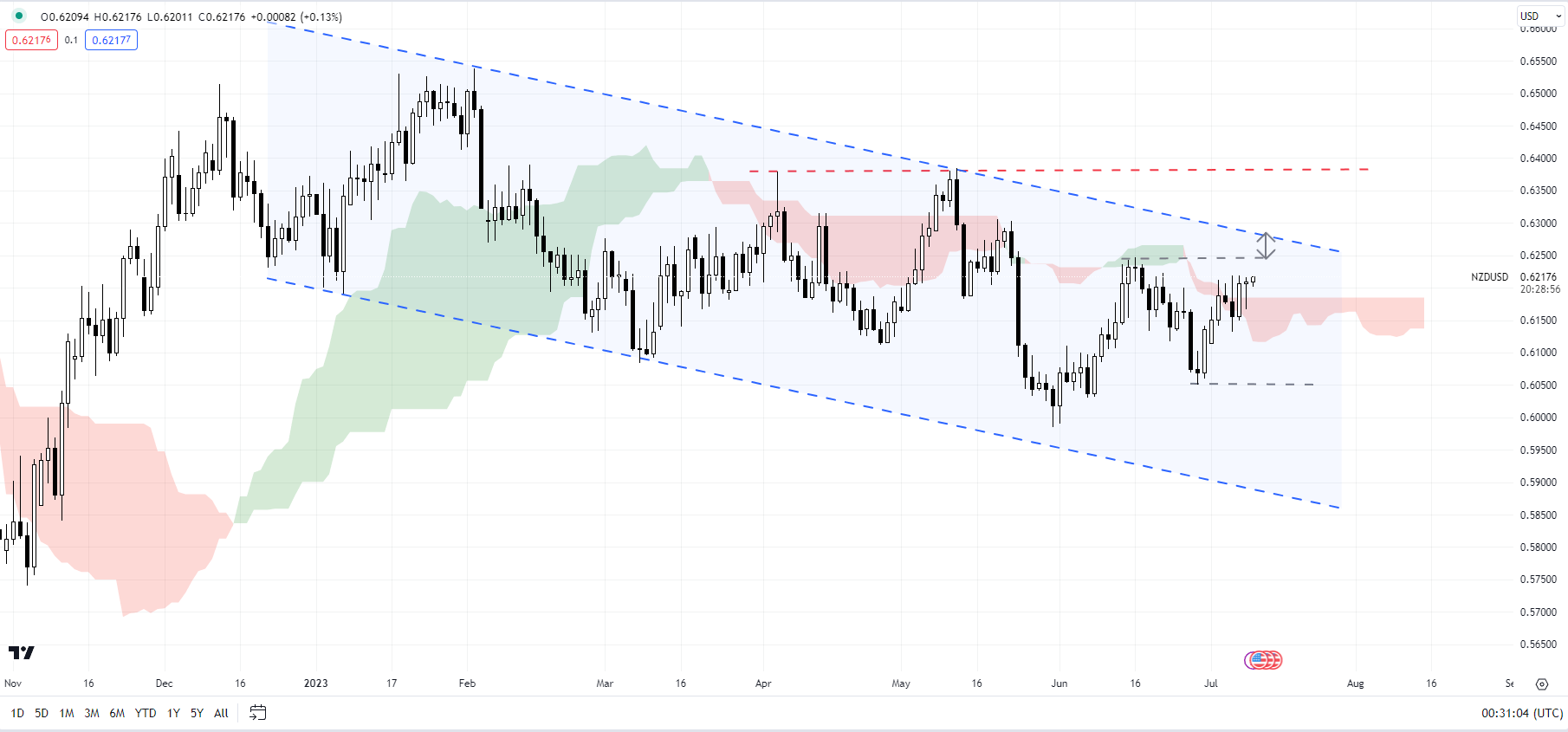

NZD/USD Daily Chart

Chart Created Using TradingView

NZD/USD: Base building?

On technical charts, within a broader downtrend channel since the start of the year, NZD/USD has created a higher low – a tentative sign that the bearish pressure could be fading. Any break above the immediate converged barrier on the upper edge of the channel, roughly around the mid-June high of 0.6250. Any break above would confirm that the downward pressure had faded, opening the way toward the May high of 0.6385. As mentioned in the previous update, a move above 0.6385 is vital for the broader bearishness to reverse. See “New Zealand Dollar Ahead of US PCE Data; NZD/USD, AUD/NZD, GBP/NZD Price Setups”, published June 28.

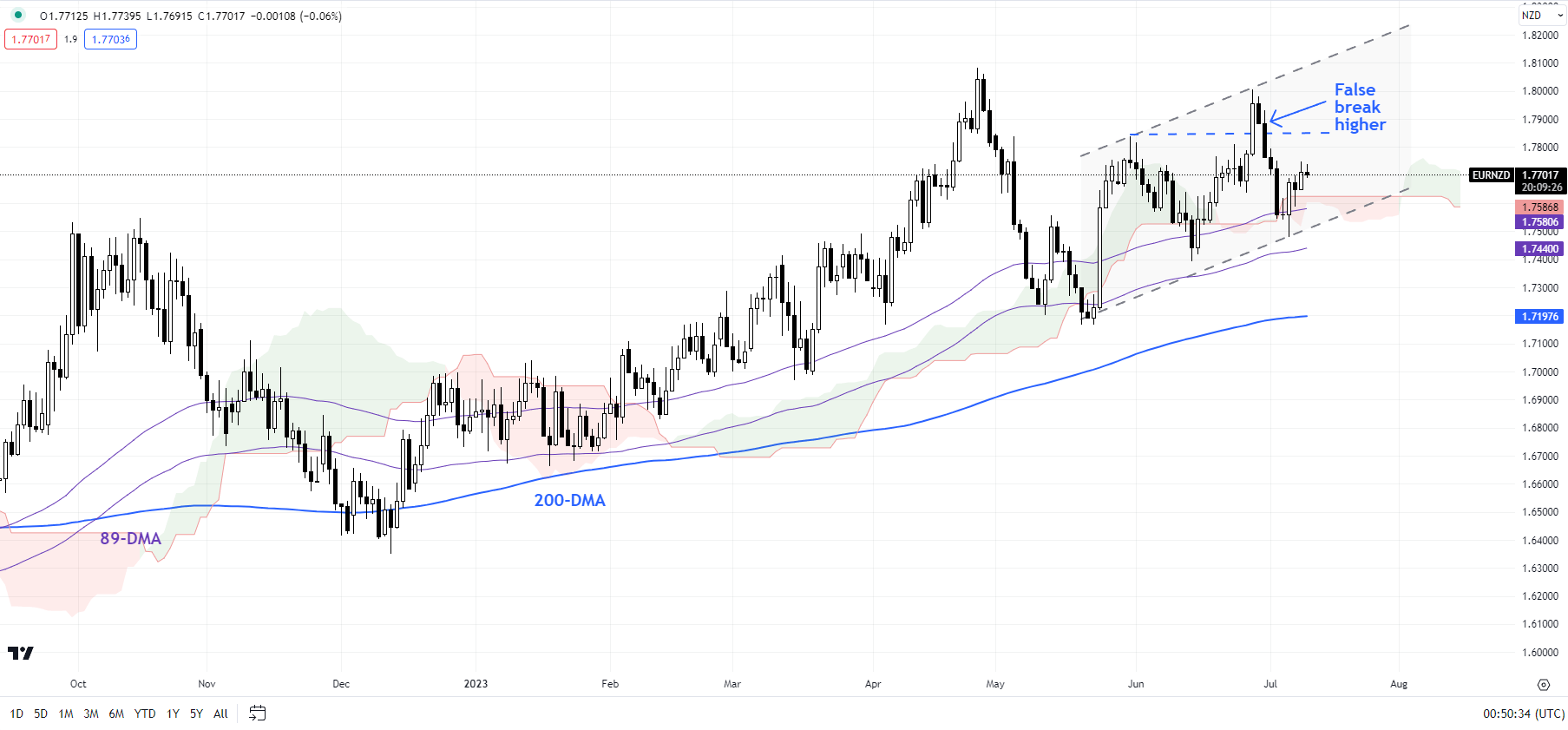

EUR/NZD Daily Chart

Chart Created Using TradingView

EUR/NZD: False break higher raises downside risks

EUR/NZD attempted to break above a cap at the end-May high of 1.7835 but failed to do and subsequently pulled back from the top end of a rising channel from May. The cross has surrendered nearly all of its gains in the process, raising the odds of a fall below the lower edge of the channel (now at about 1.7500). Such a drop could open the road toward the 200-day moving average (now at about 1.7200).

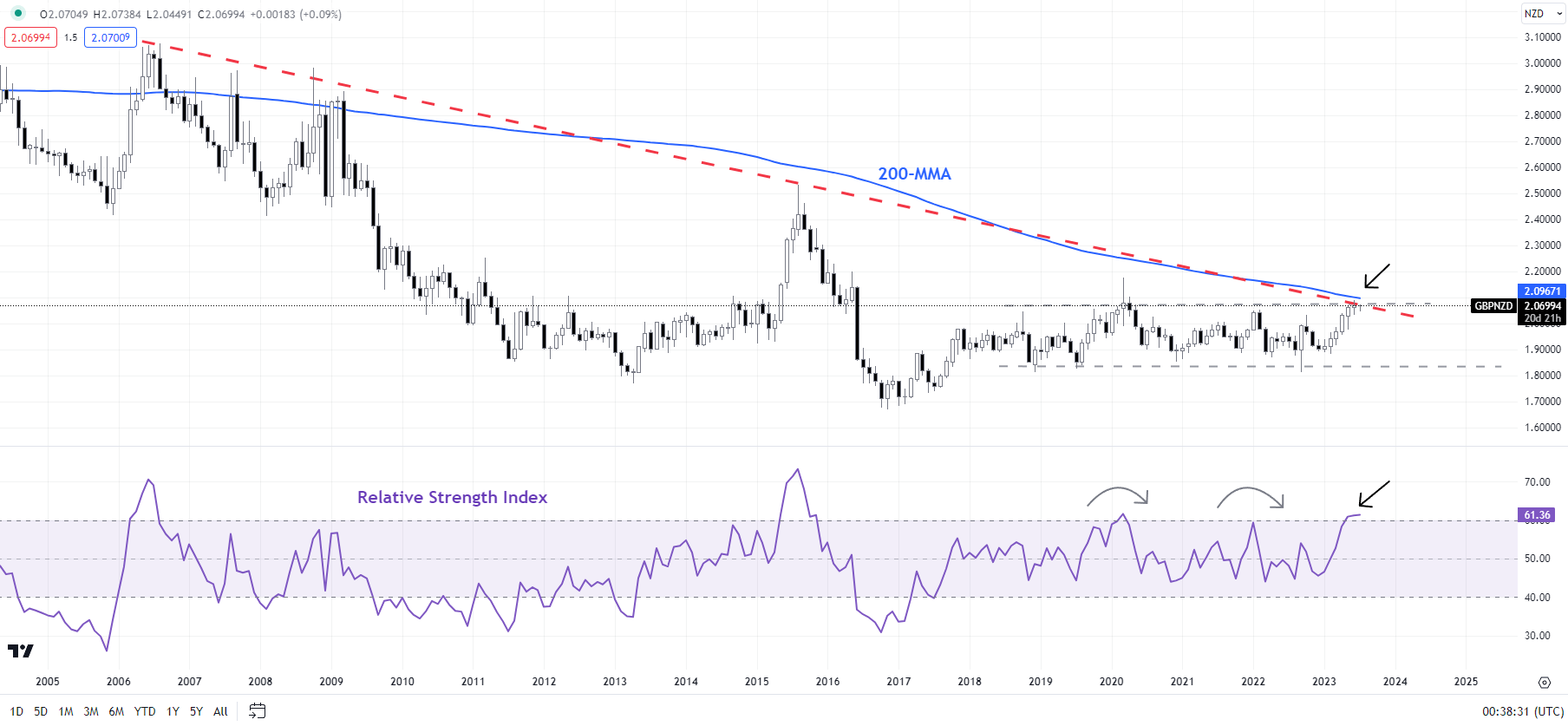

GBP/NZD Monthly Chart

Chart Created Using TradingView

GBP/NZD: Could find it tough to crack resistance

GBP/NZD could find it tough to crack the immediate ceiling at the early-June high of 2.0735, coinciding with the 200-month moving average. The 14-month Relative Strength Index appears to be rolling over – similar to the previous two instances in 2020 and 2022, which were associated with a retreat in the cross. While there is no sign of a reversal of the uptrend, chances are GBP/NZD may have to consolidate before it embarks on a new leg higher.

--- Written by Manish Jaradi, Strategist for DailyFX.com

--- Contact and follow Jaradi on Twitter: @JaradiManish