RBNZ, AUD, NZD Analysis

- RBNZ expected to keep OCR unchanged as inflation remains stubbornly high

- NZD/USD pullback meets its first challenge

- Aussie tests major resistance after phenomenal run vs the Kiwi

- Get your hands on the AUD Q2 outlook today for exclusive insights into key market catalysts that should be on every trader's radar:

RBNZ Expected to Keep the Official Cash Rate Unchanged

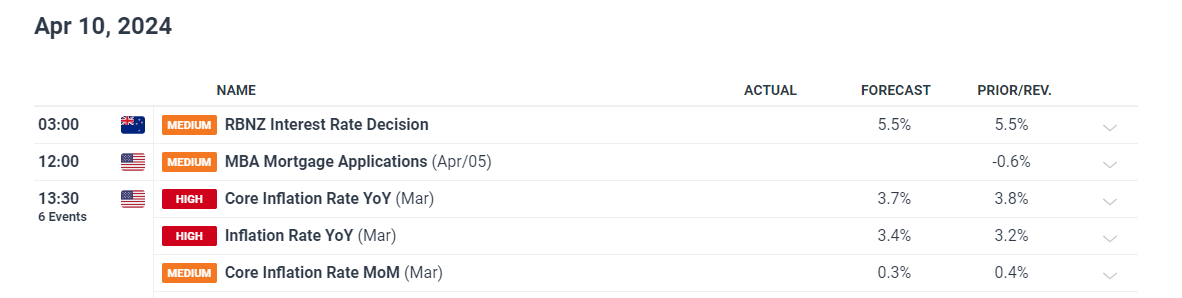

In the early hours of Wednesday morning the RBNZ is likely to announce no change to the official cash rate (OCR). In fact, as early at February this year, the RBNZ were still discussing rate hikes in the face of hot underlying inflation. Currently, markets assign a mere 4% chance of a rate cut meaning interest rates are going to have to remain higher for longer until inflation expectations drop.

Customize and filter live economic data via our DailyFX economic calendar

New Zealand is currently experiencing disinflation – as confirmed by Governor Orr after the February meeting – but more work needs to be done. The RBNZ previously stated that they have an asymmetric risk function (will prioritize inflation risks) and admitted that the economy has limited capacity to absorb further upside inflation surprises.

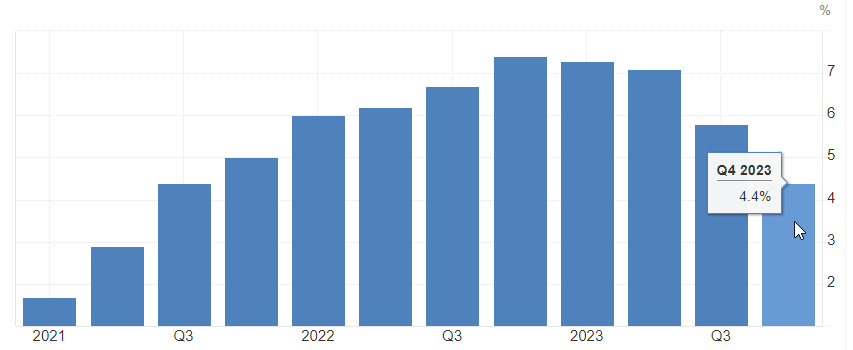

New Zealand Core Inflation Rate (Year-on-year)

Source: Tradingeconomics, prepared by Richard Snow

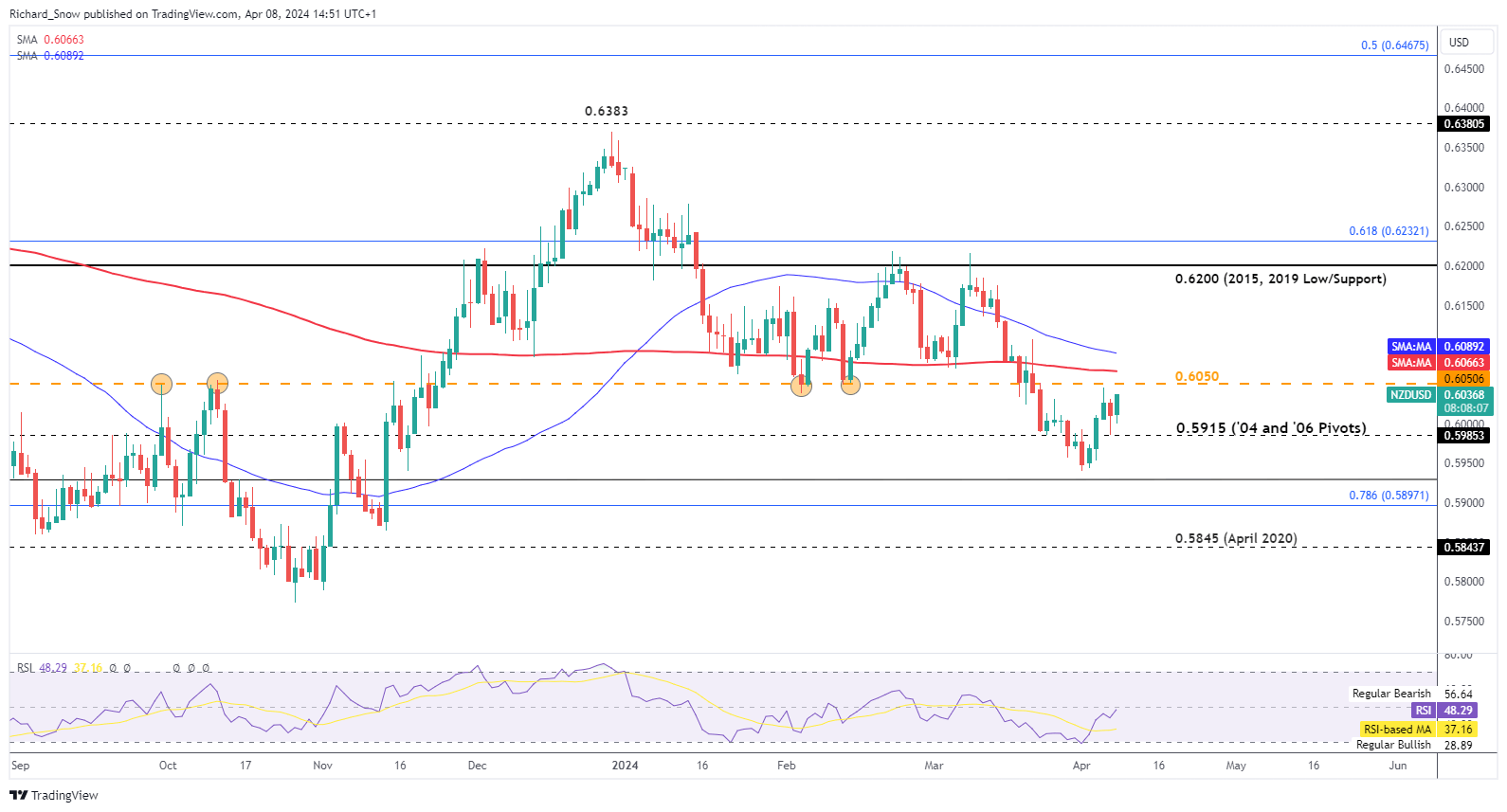

NZD/USD Pullback Meets its First Challenge

The NZD/USD decline found support at 0.5930, rising above 0.5915 (a major long-term pivot point) and now has 0.6050 in sight. The Kiwi dollar has struggled to achieve upside momentum as the US dollar appears to have a floor underneath it in the form of hotter US data.

While the Kiwi dollar boasts a slightly better interest rate differential, it has not managed to get one over the greenback. Kiwi bulls now face 0.6050 and the 200-day simple moving average if the bullish directional move has the legs to extend further. Support comes in at 0.5915.

NZD/USD Daily Chart

Source: TradingView, prepared by Richard Snow

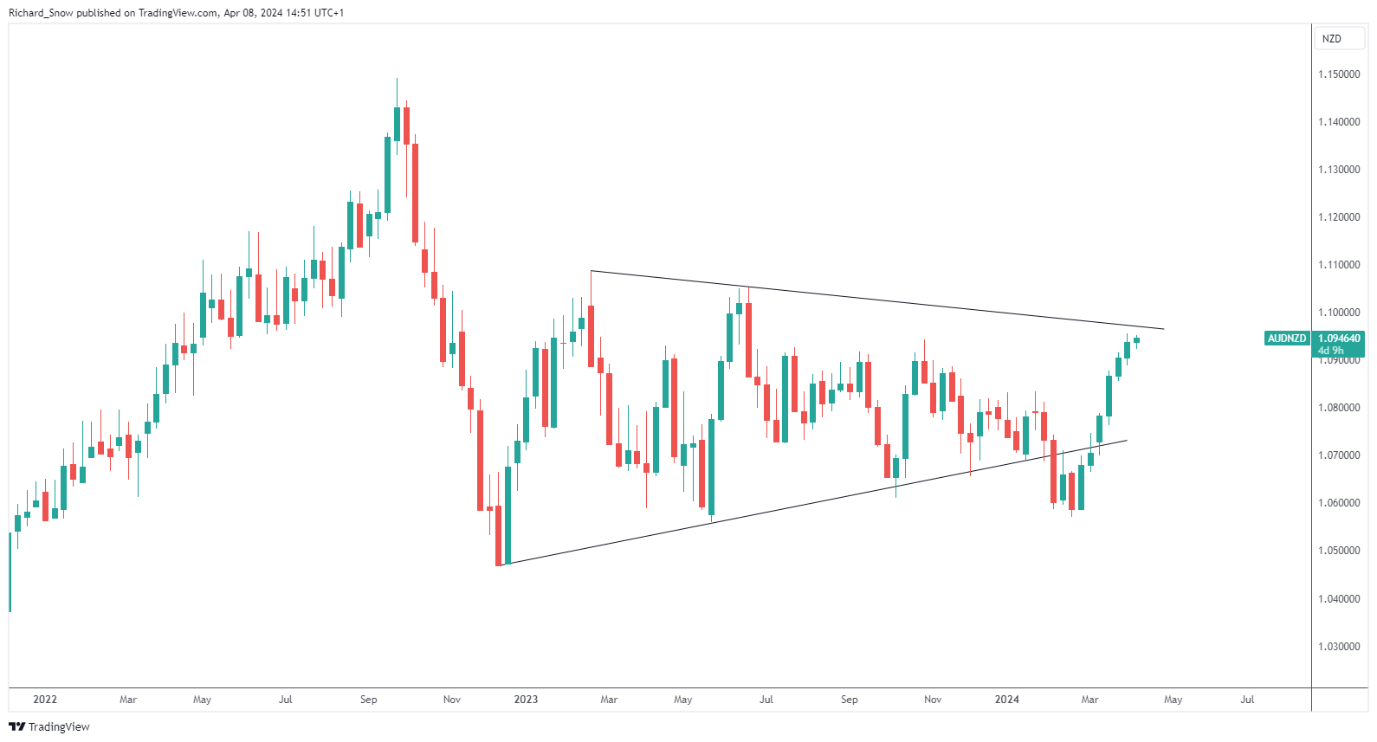

Aussie Tests Major Resistance After Phenomenal Run vs the Kiwi

The Aussie dollar has enjoyed a prolonged stint of gains against the Kiwi dollar which is showing signs of potential fatigue ahead of long-term resistance which connects the highs going all the way back to early 2023.

The Australian dollar has not performed as well against major currencies, suffering to some degree due to its proximity to and reliance on China. AUD has struggled to maintain it’s former correlation to the S&P 500 which has enjoyed an impressive risk rally up until the end of last week.

AUD/NZD Weekly Chart

Source: TradingView, prepared by Richard Snow

Stay up to date with the latest breaking news and themes driving the market by signing up to our weekly newsletter:

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX