Gold Price (XAU/USD), Silver Price (XAG/USD): Charts, Price, and Analysis

- A slight hawkish re-pricing of the Fed’s intentions is weighing on gold and silver.

- US debt ceiling fears grow.

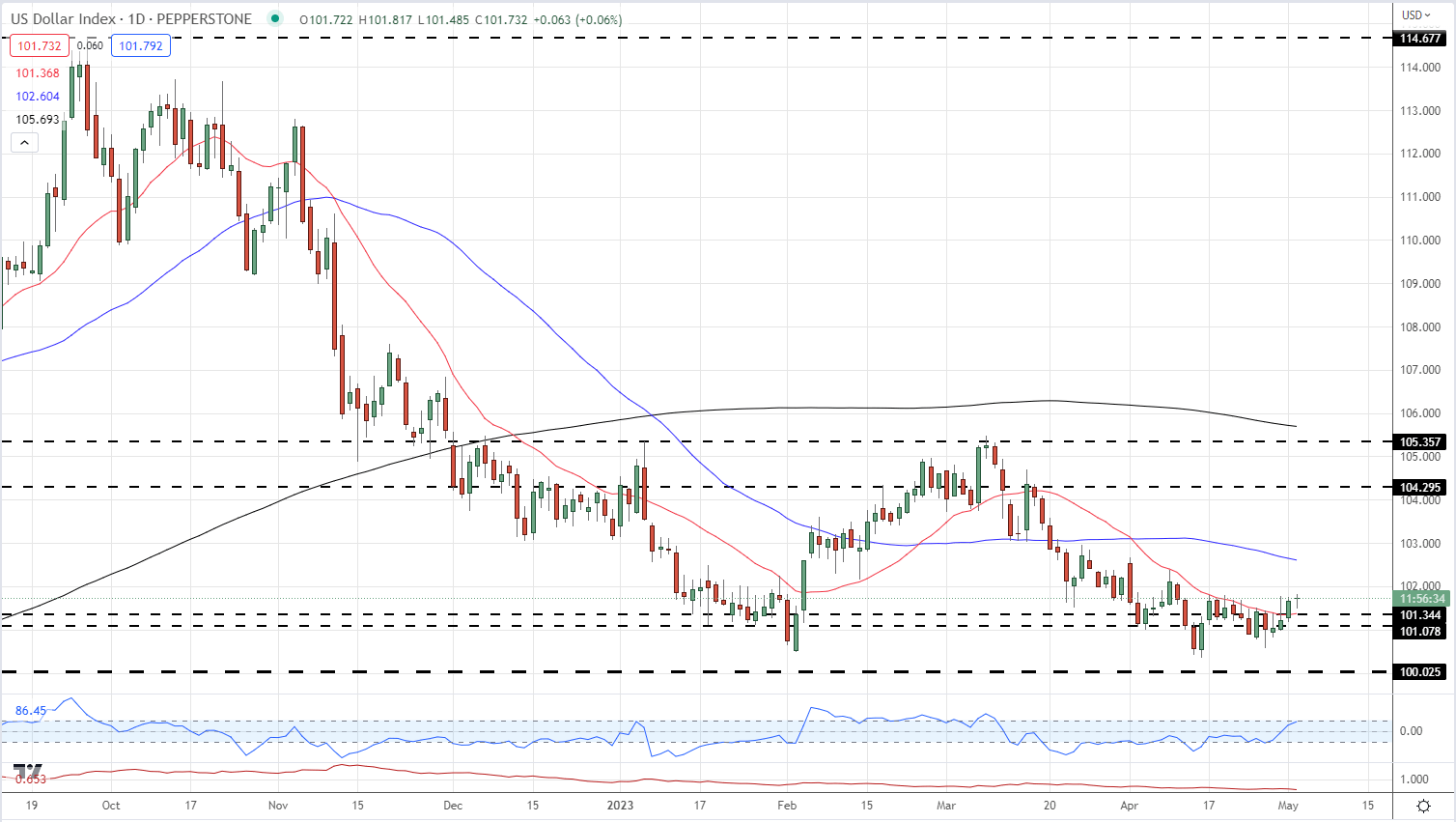

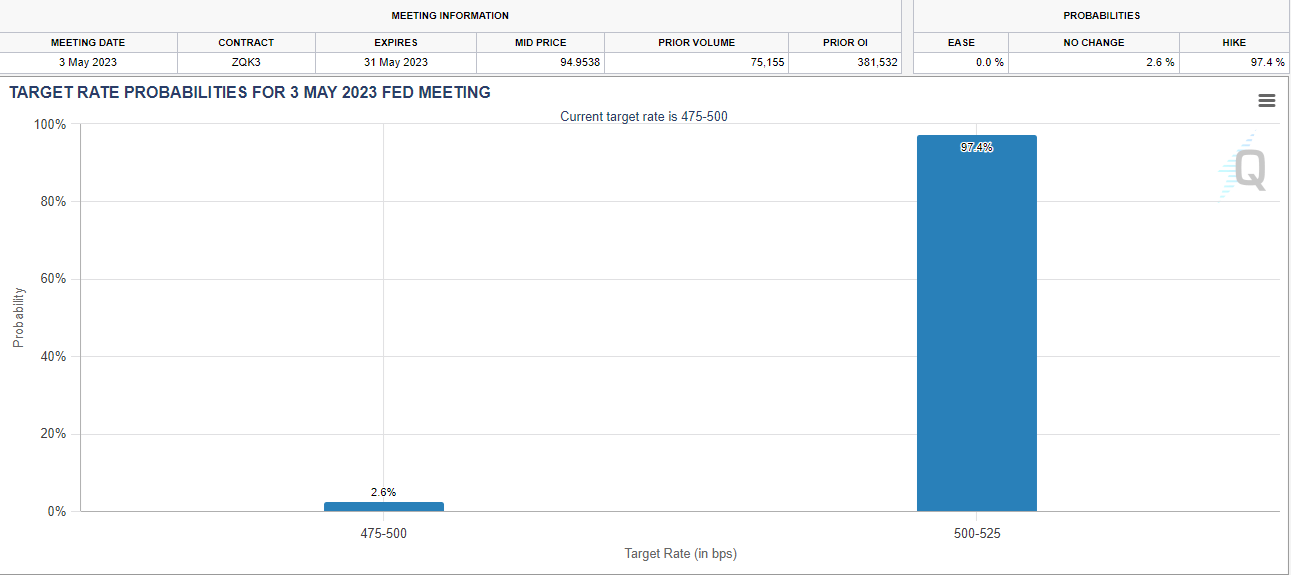

A range of asset classes are on hold today as the market waits for the latest Federal Reserve monetary policy decision, expected at 19:00 UK on Wednesday. The market fully expects and has priced in, a 25 basis point rate hike to 500-525. The press conference, 30 minutes after the decision, will be closely watched by the market for any sign that the US central bank is thinking about the pausing the rate-hiking cycle. The market has recently priced in a slightly hawkish outcome at tomorrow’s FOMC meeting and that has weighed on the short-term outlook of gold and silver. Short-term US bond yields moved higher last week, lending support to the US dollar. The greenback has been under selling pressure for months but it looks to have found support around the 100.50-101.00 area ahead of tomorrow’s meeting. The greenback is pushing further higher today and sits at levels last seen two weeks ago.

US Dollar Index – Daily Chart

For all market-moving data releases and events, see the DailyFX Economic Calendar

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

The CME Fed Funds probabilities now show a 97.4% chance of a 25bp rate hike on Wednesday evening.

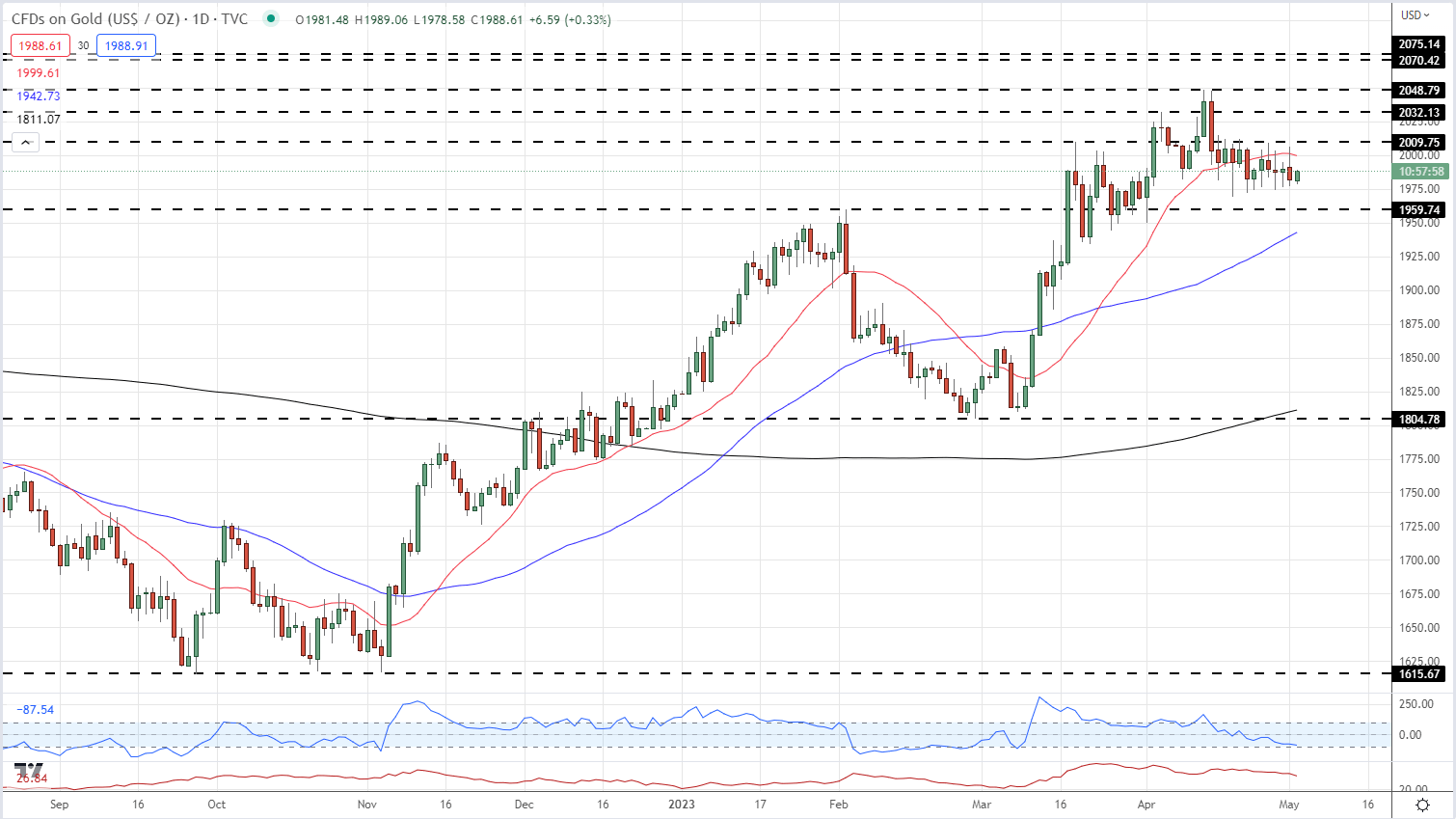

Against this backdrop of a slightly firmer US dollar and thoughts that the Federal Reserve may not roll back on interest rates as soon as previously thought, gold has come under pressure and is struggling to regain the $2,000/oz. marker. Short-term support starts around $1,970/oz. with $2,009/oz. the first line of resistance. Gold’s short-term future will be set out by Fed chair Powell tomorrow.

Gold Price Daily Chart – May 2, 2023

Chart via TradingView

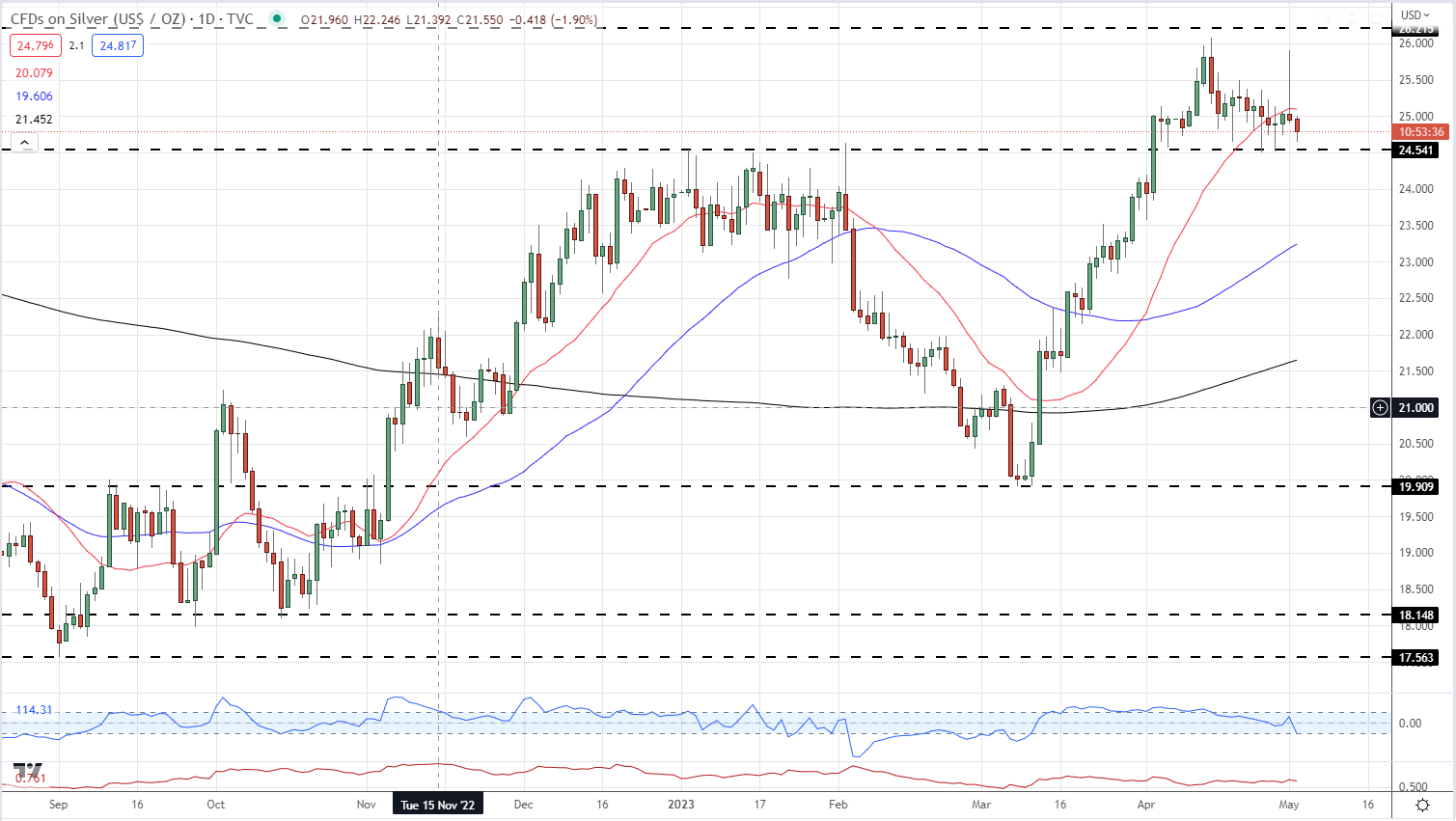

The daily silver chart looks very similar to gold’s with the precious metal now stuck between $24.50 and $26.25. Monday’s ‘spike’ was retraced quickly, with thin market conditions likely behind the move. Support around $25.50 may come under pressure soon with silver posting a series of lower highs and lower lows lately. As with gold, chair Powell will control silver’s next move.

Silver Daily Price Chart – May 2, 2023

What is your view on Gold and Silver – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.