JAPANESE YEN PRICE, CHARTS AND ANALYSIS:

- Japanese Officials Ramp Up Intervention Talk as EUR/JPY Trades at 2008 Highs.

- USD/JPY Approaching Key 145.00 Level. 150.00 Handle Sparked the BoJ into Action Last Year, Will They Act Sooner?

- On a Positive Note, the BoJ Summary of Opinions Kept Hopes of a Tweak to the Yield Curve Control (YCC) Policy Alive.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Read More: Japanese Yen Weakens Further: USD/JPY, GBP/JPY, and CAD/JPY Latest

JAPANESE YEN BACKDROP AND INTERVENTION TALK

The Japanese Yen has seen losses accelerate of late against G10 counterparts as other Central Banks double down on hawkish guidance. Developments elsewhere have coincided with a supportive rhetoric in regard to the unorthodox monetary policy approach by the Bank of Japan (BoJ), forming a perfect cocktail for Yen losses.

Comments had been filtering through since the backend of last week with currency diplomat Masato Kanda stated they are keeping a close eye on developments as one-sided FX moves are undesirable. This comes as EUR/JPY in particular trades at levels last seen during the 2008 financial crisis with the European Central Bank (ECB) holding the hawkish line aggressively as evidenced by comments at the ECB Forum this week in Sintra.

Kazuo Ueda, Governor of the Bank of Japan

This morning brought comments from Japanese Finance Minister Suzuki who echoed Mr. Kanda stating that there are one-sided movements seen in the current FX market while confirming their readiness to respond appropriately to excessive moves. The move saw the Yen strengthen again but as has been the case of late the Yen selloff continued as the European session gained traction.

The only positive for the Yen at the moment came from the BoJ summary of opinions released on Monday, which showed that a tweak to the Yield Curve Control (YCC) policy remains a hot topic of debate. Some analysts see a potential tweak to the YCC policy as early as the July meeting despite repeated attempts by BoJ Governor Ueda to downplay the likelihood. Given where the Yen is heading now there is a real possibility of a BoJ surprise which could have a larger impact than the intervention measures carried out in 2022.

For all market-moving economic releases and events, see the DailyFX Calendar

Foundational Trading Knowledge

DailyFX Education Walkthrough

Recommended by Zain Vawda

PRICE ACTION AND POTENTIAL SETUPS

EURJPY

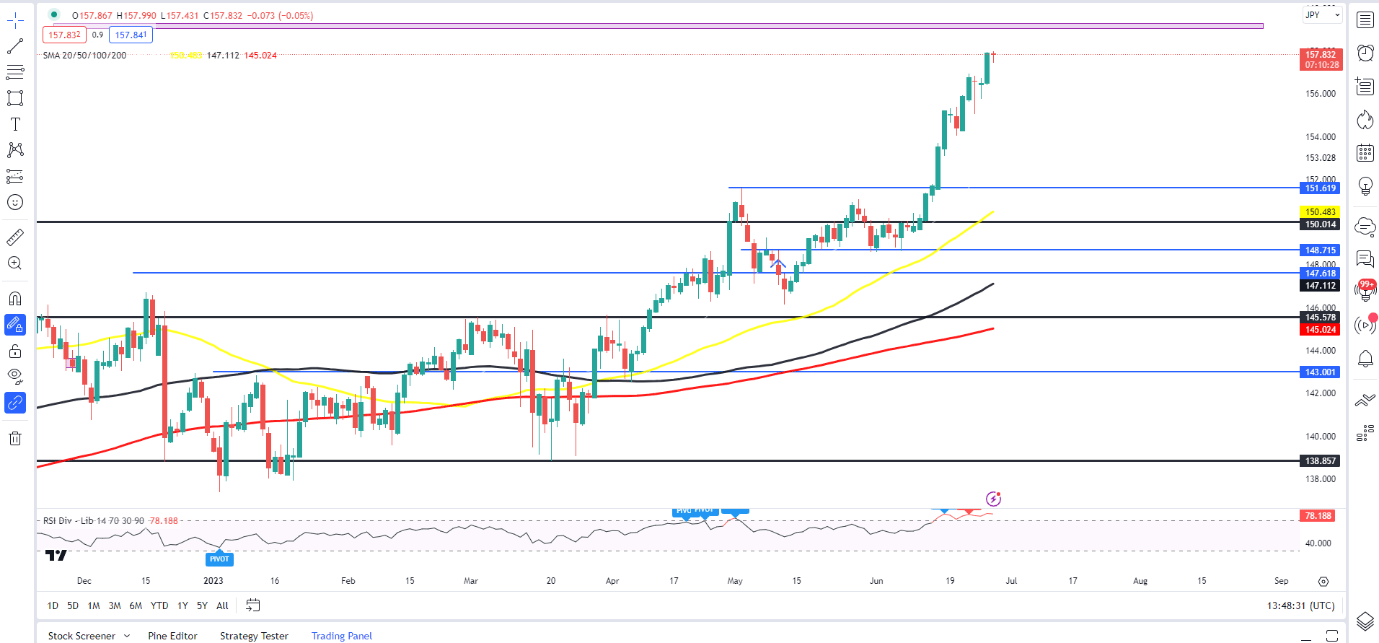

EUR/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

Analysis of EURJPY at present is tricky as we trade at levels last seen in 2008. Given the failure of the Yen to sustain any sot of strength, going against the overall bullish trend does not seem like a smart play. EURJPY is currently approaching a previous gap in price around the 159.00 level which could serve as a form of resistance with the psychological 160.00 slightly higher.

Looking at the IG Client Sentiment data for cues and we can see that retail traders are currently netSHORTonEURJPYwith79%of traders holding short positions (as of this writing). Not surprising at all given that Yen has been unable to hold on to any gains of late. At DailyFX we typically take a contrarian view to crowd sentiment meaning we could see EURJPY prices continue to rise.

Key Levels to Keep an Eye On:

Support levels:

- 148.70

- 147.60

- 145.50

Resistance levels:

- 159.00 (price gap all the way back to 2008)

- 160.00 (Psychological level)

- 161.50

USDJPY

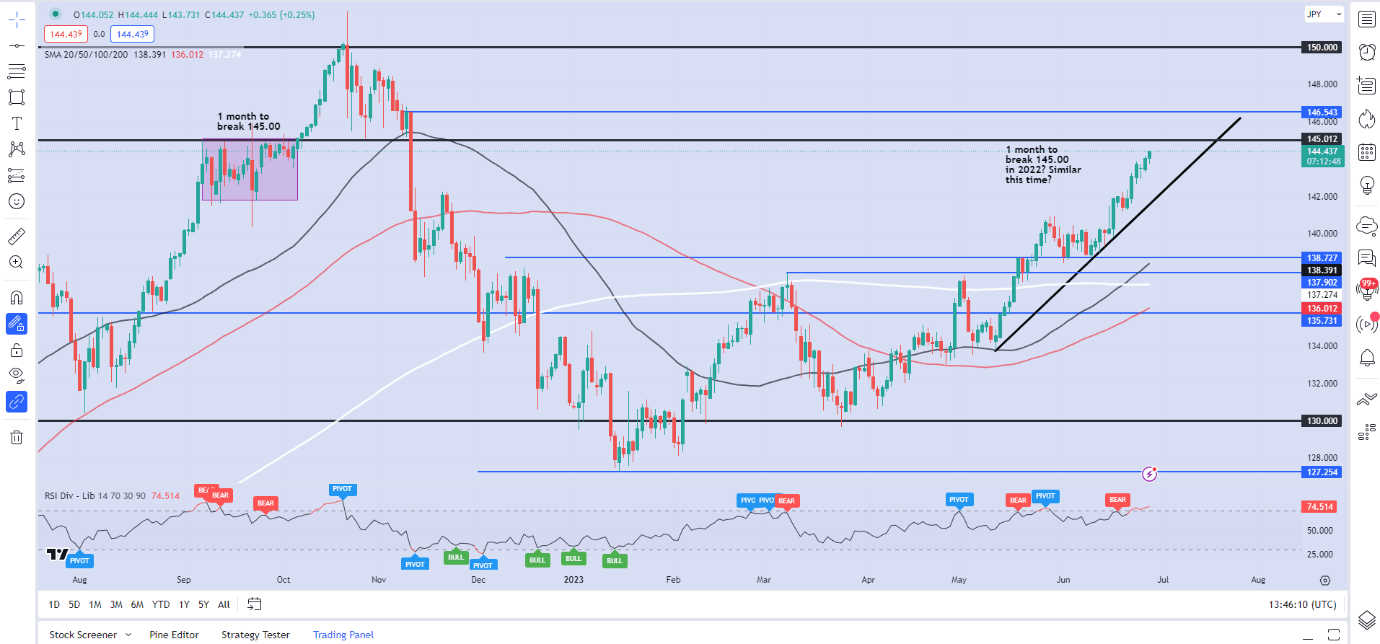

USD/JPY Daily Chart

Source: TradingView, prepared by Zain Vawda

From a technical perspective, USD/JPY has been on a tear since consolidating below the 141.00 handle for the first half of June. We have since rallied over 300 pips toward the psychological 145.00 handle

The 145.00 handle held firm last year for about a full month (highlighted by pink box on the chart) between September 7 and October 6, 2022, before breaking higher toward the 150.00 handle. It was at this level which the Bank of Japan stepped in, is history set to repeat itself? Personally given that we have seen more and more mentions of intervention of late that it could come at just about anytime even though it is unlikely to be sustainable as a long-term solution.

For now, though it is intervention that is on the table and requires a close watch as the volatility last time out was quite severe. Heading toward the BoJ meeting the question of tweaks to the YCC policy still remain up in the air with a surprise certainly a possible although, unlikely outcome.

Key Levels to Keep an Eye On:

Support levels:

- 143.80

- 142.40

- 140.00 (psychological level)

Resistance levels:

- 145.00 (Psychological level)

- 146.50

- 148.40

Introduction to Technical Analysis

Technical Analysis Tools

Recommended by Zain Vawda

--- Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda