U.S. DOLLAR ANALYSIS & TALKING POINTS

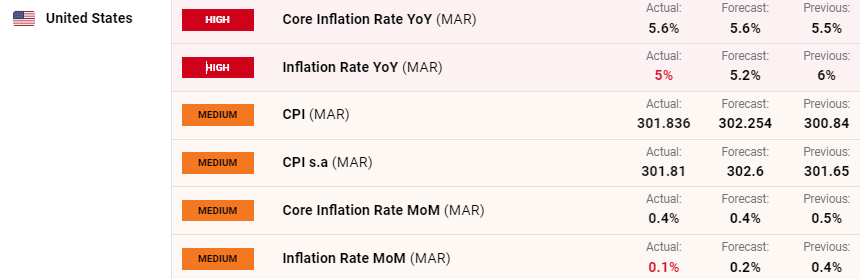

- US CPI: Headline – 5%; EST: 5.2%

- US CPI: Core – 5.6%; EST: 5.6%

- FOMC Minutes in focus later today.

- Money markets exhibit dovish re-pricing minimizing the chance of a rate hike in June.

DOLLAR FUNDAMENTAL BACKDROP

“The all items index increased 5.0 percent for the 12 months ending March; this was the smallest 12-month increase since the period ending May 2021“

US CPI data missed headline estimates (see economic calendar below) while core inflation which excludes food and energy increased to 5.6% reflecting the stick inflationary pressures in the services sector. Key contributors within the core inflation figure include shelter, motor vehicle insurance, airline fares, household furnishings and operations, and new vehicles; while the index for medical care and the index for used cars and trucks were among those that decreased over the month – Source: U.S. Bureau of Labor Statistics.

US ECONOMIC CALENDAR

Source: DailyFX economic calendar

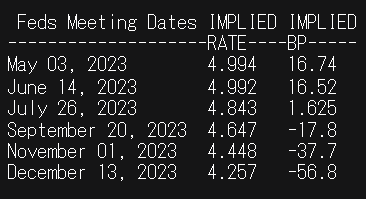

The Fed funds futures (refer to table below) have fallen in terms of overall conviction for a 25bps interest rate hike in May down to 67% from roughly 74% pre-CPI. The call for an additional rate hike in June is now losing steam and the terminal rate looks likely to peak at 5% for the current tightening cycle. Considering the recent banking crisis and tight credit conditions, another headline beat may have added to the already tough environment for the Federal Reserve. That being said, the day doesn’t end here as the FOMC minutes for the prior meeting is due and could give us further insight into the Fed’s thinking moving forward.

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

FED RATE HIKE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

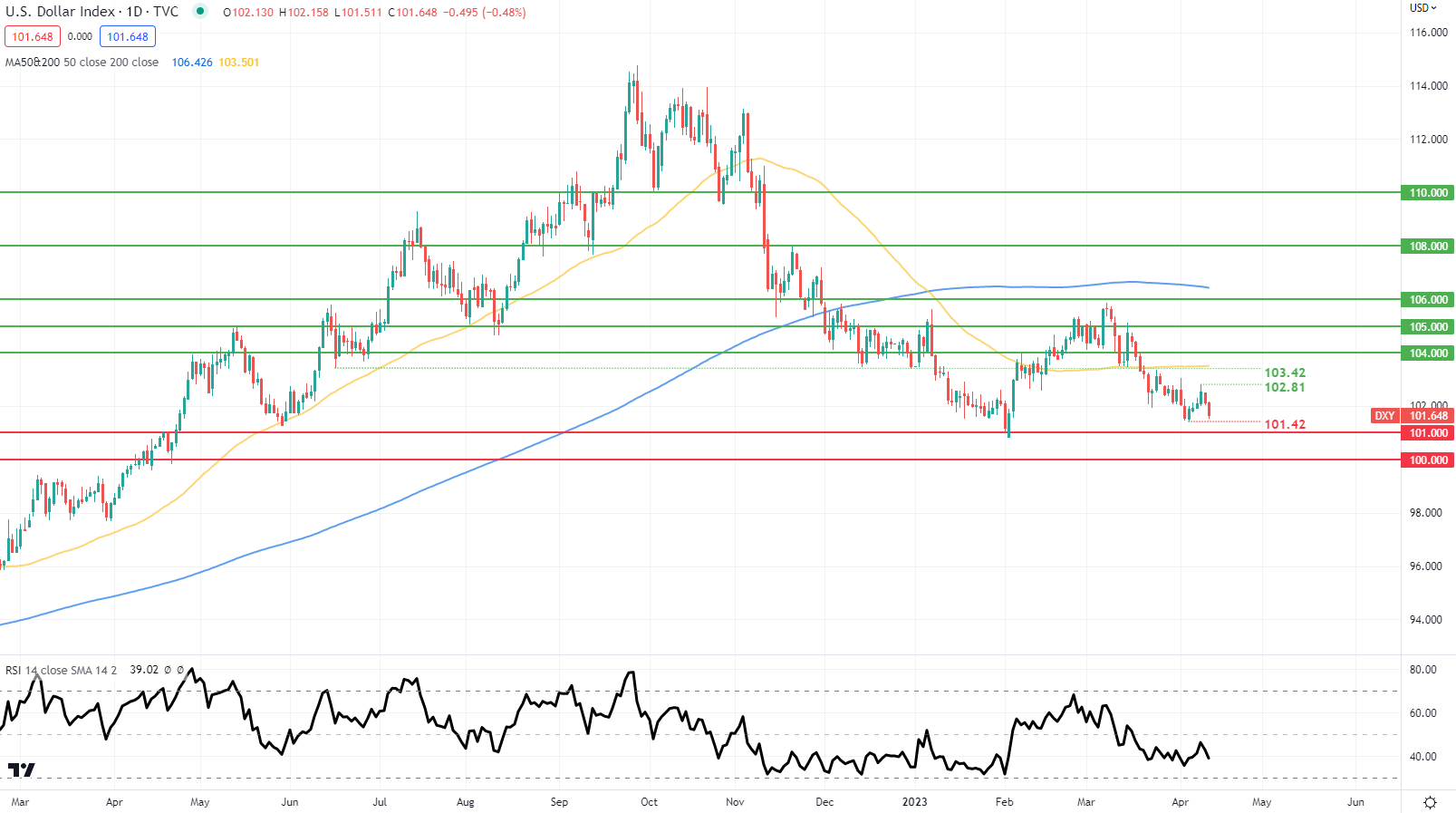

U.S. DOLLAR INDEX DAILY CHART

Chart prepared by Warren Venketas, IG

The daily Dollar Index (DXY) chart above immediately sold-off after the inflation release towards the 101.42 swing low, with 101.00 psychological support handle very much a possibility ahead of the US trading session open.

Resistance levels:

- 103.42

- 102.81

Support levels:

- 101.42

- 101.00

- 100.00

--- Written byWarren Venketasfor DailyFX.com

Contact and followWarrenon Twitter:@WVenketas