Most Read: Gold, EUR/USD, USD/JPY – Price Action Analysis & Technical Outlook

In the dynamic world of trading, it's tempting to follow the masses, buying in bullish cycles, and selling during bearish phases. However, seasoned traders know that substantial opportunities often arise from unconventional strategies. One such strategy involves moving against the dominant market view, which can sometimes lead to favorable outcomes.

Contrarian trading isn't about opposing the crowd for the sake of it. Instead, it's about recognizing moments when the majority might be wrong and seizing those opportunities. Tools like IG client sentiment provide valuable insights into the overall market mood, highlighting periods of extreme optimism or pessimism that could indicate an upcoming reversal.

Yet, relying solely on contrarian signals doesn't guarantee success. Their true value emerges when integrated into a comprehensive trading strategy that combines both technical and fundamental analysis. By merging these perspectives, traders can uncover deeper market dynamics often missed by those who follow the majority.

To illustrate this concept, let's examine IG client sentiment data and what current retail segment positioning indicates for three key Japanese yen FX pairs: USD/JPY, EUR/JPY, and GBP/JPY. Analyzing these examples shows how contrarian thinking can help uncover attractive trading opportunities and navigate market complexities.

For an extensive analysis of the yen’s medium-term prospects, which incorporates insights from fundamental and technical viewpoints, download our Q2 trading forecast now!

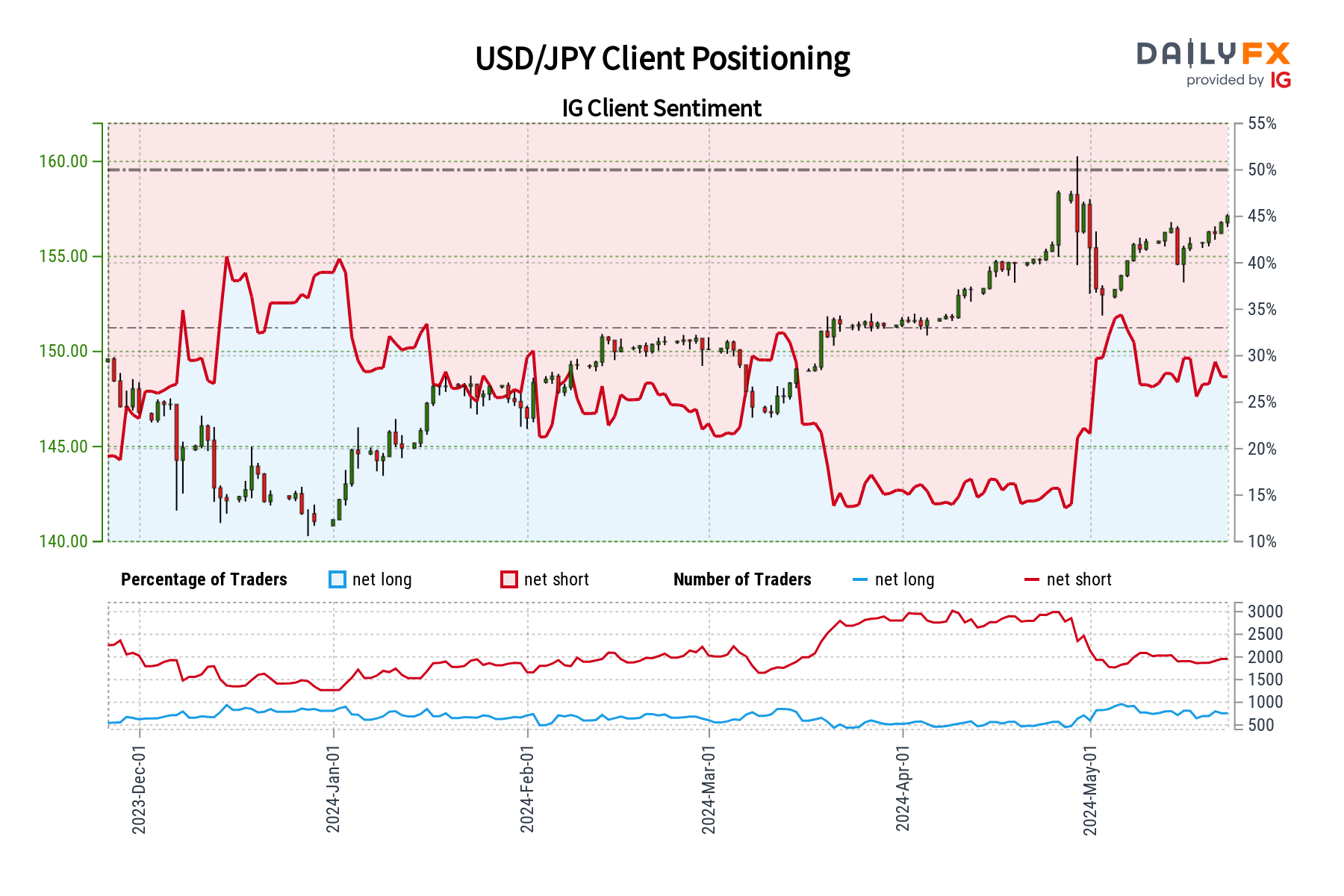

USD/JPY FORECAST – MARKET SENTIMENT

IG data reveals a prevailing bearish sentiment on USD/JPY, with 73.65% of clients holding net-short positions, resulting in a significant short-to-long ratio of 2.80 to 1. The tally of sellers has remained relatively stable since yesterday, but has increased by 4.57% over the past week. Meanwhile, bullish traders have fallen by 5.36% since the previous session and are down 14.21% compared to last week.

Our trading strategy often adopts a contrarian perspective, finding opportunities where the majority disagrees. That said, the widespread pessimism on USD/JPY suggests the potential for further price appreciation in the near future. The persistent net-short positioning over key timeframes reinforces the positive outlook for USD/JPY.

Key Insight: Sentiment data indicates a strong contrarian bullish signal for USD/JPY. However, it is crucial to incorporate both technical and fundamental analysis into your trading strategy to fully understand the pair's potential direction.

Keen to understand how FX retail positioning can offer hints about the short-term direction of major pairs such as EUR/JPY? Our sentiment guide holds valuable insights on this topic. Download it today!

| Change in | Longs | Shorts | OI |

| Daily | 19% | -5% | 1% |

| Weekly | 41% | -13% | -3% |

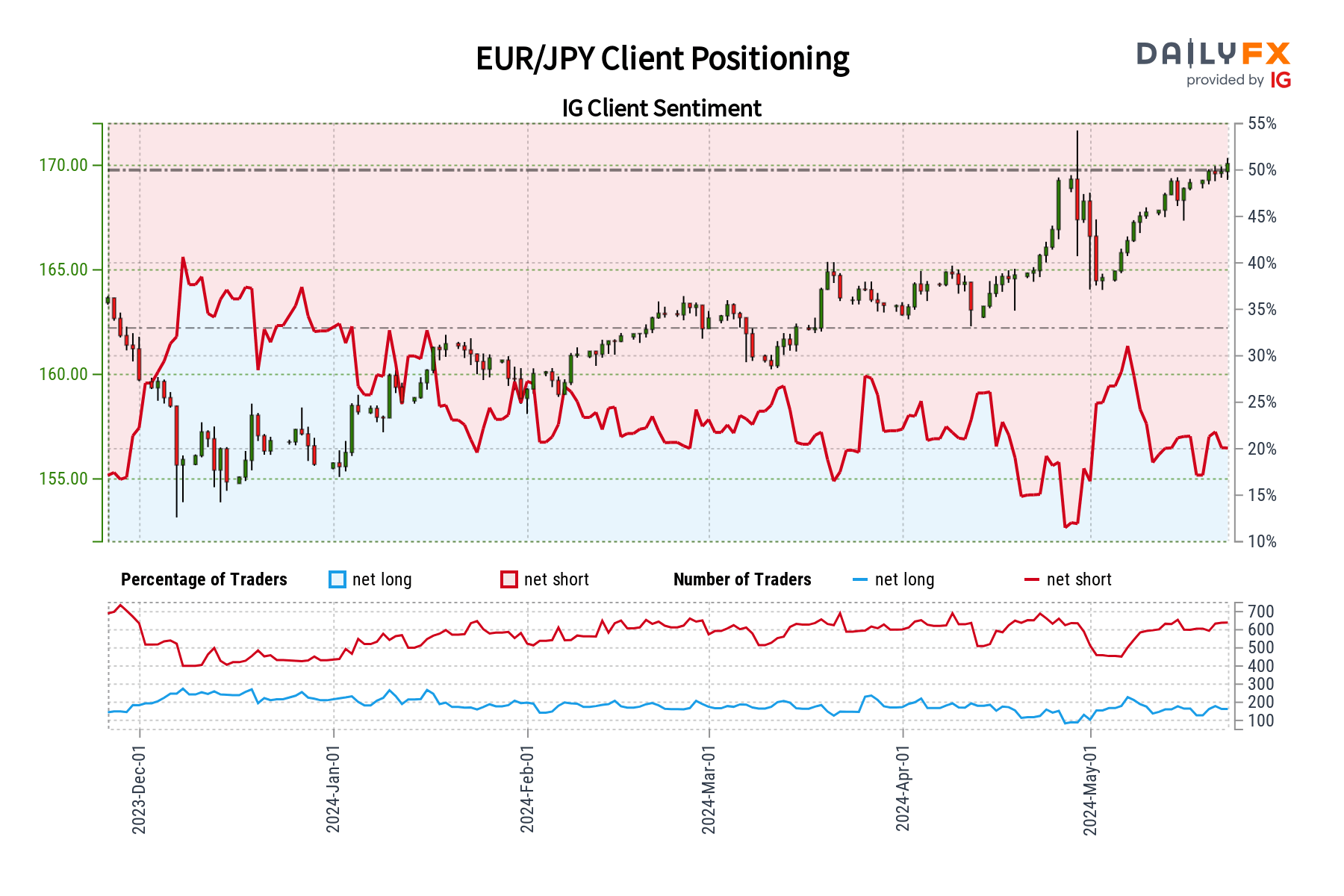

EUR/JPY FORECAST – MARKET SENTIMENT

IG data paints a picture of widespread bearish sentiment towards EUR/JPY, with 78.83% of traders selling the pair (short-to-long ratio of 3.72 to 1). This typically signals potential upside from a contrarian perspective. However, the picture is more nuanced than it seems.

While the overall mood remains bearish, there's been a slight easing in net-short bets compared to yesterday (down 2.05%). On the other hand, the number of sellers has risen compared to last week, with net-short positions increasing by 7.43%.

This creates a mixed contrarian signal. While the overall bearishness hints at possible further gains for EUR/JPY, the recent fluctuations in positioning raise questions about the strength of this contrarian outlook.

Key Insight: The current market sentiment for EUR/JPY presents a complex picture. While a contrarian view suggests potential upside, the recent shifts in positioning warrant caution. A comprehensive approach, integrating technical and fundamental analysis with sentiment data, is crucial for making informed trading decisions.

Disheartened by trading losses? Empower yourself and refine your strategy with our guide, "Traits of Successful Traders." Gain access to crucial tips to help you avoid common pitfalls and costly errors.

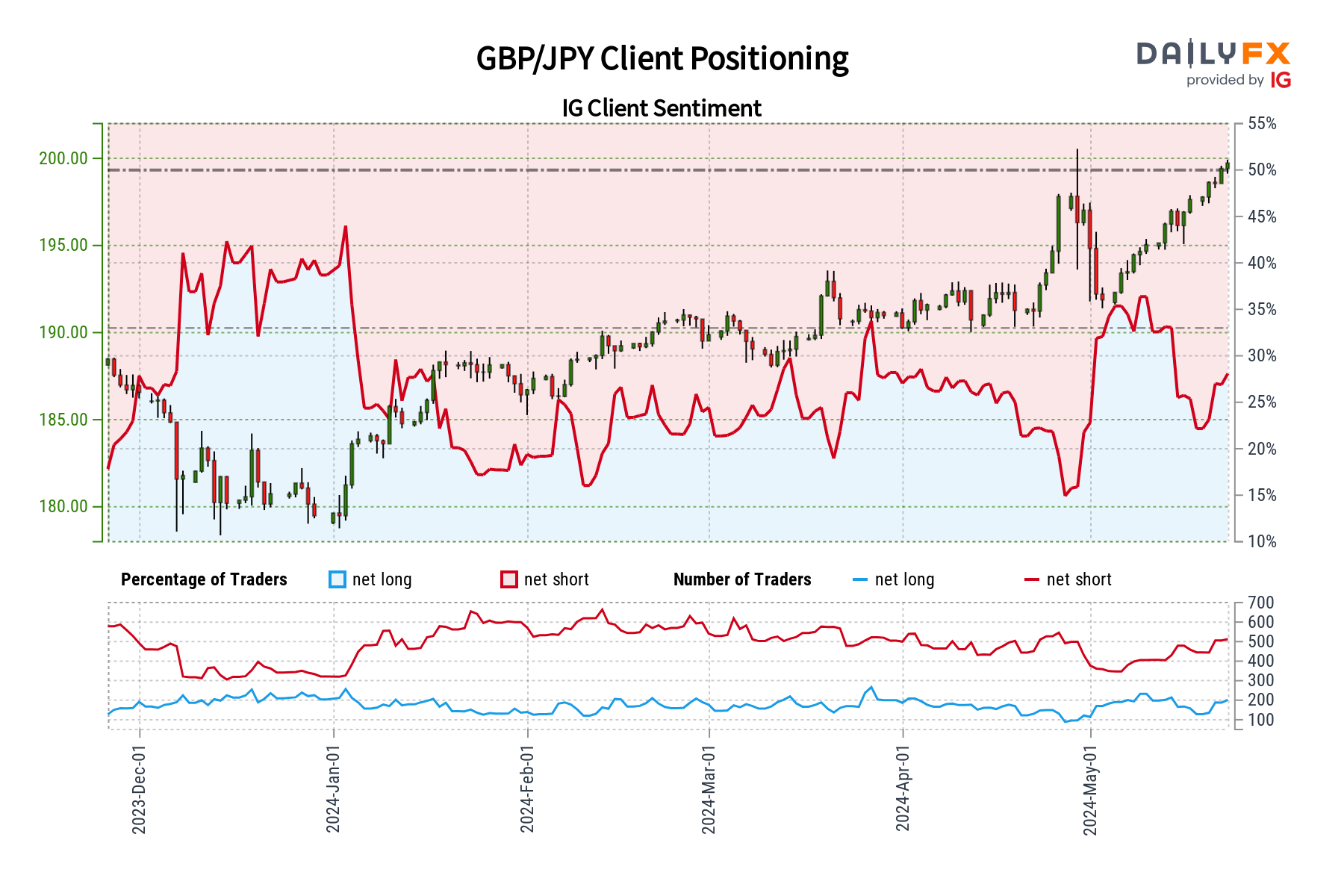

GBP/JPY FORECAST – MARKET SENTIMENT

IG client data reveals a pronounced bearish bias towards GBP/JPY, with 73.82% of traders holding short positions (short-to-long ratio of 2.82 to 1). This pessimism has grown in recent days, with a noticeable increase in short positions compared to both yesterday (up 8.75%) and last week (up 22.37%).

Our trading strategy often leverages a contrarian perspective. This widespread negativity towards GBP/JPY, along with the surge in bearish wagers, hints at the possibility of continued upward momentum for the pair in the near term. The persistent bearishness further reinforces this bullish contrarian outlook.

Key Insight: The current IG client sentiment data points to a strong contrarian bullish signal for GBP/JPY. However, remember that a comprehensive trading strategy should also incorporate technical and fundamental analysis to gain a full picture of the pair's potential path.