POUND STERLING ANALYSIS & TALKING POINTS

- BoE sentiments linger in favor of sterling.

- US NFP and services PMI to dominate headlines later today.

- GBP/USD eyes symmetrical triangle breakout.

Elevate your trading skills and gain a competitive edge. Get your hands on the British Pound Q4 outlook today for exclusive insights into key market catalysts that should be on every trader's radar.

GBPUSD FUNDAMENTAL BACKDROP

The British pound has held onto yesterday’s gains after the Bank of England (BoE) decided to keep interest rates on hold. A quick summary of the meeting included BoE Governor Andrew Bailey reiterating the need to maintain rates at current levels for a longer period of time to bring down inflation in the UK. With lagged effects from prior hikes, keeping monetary policy conditions tight can ensure further declines in inflation and the UK jobs market respectively.

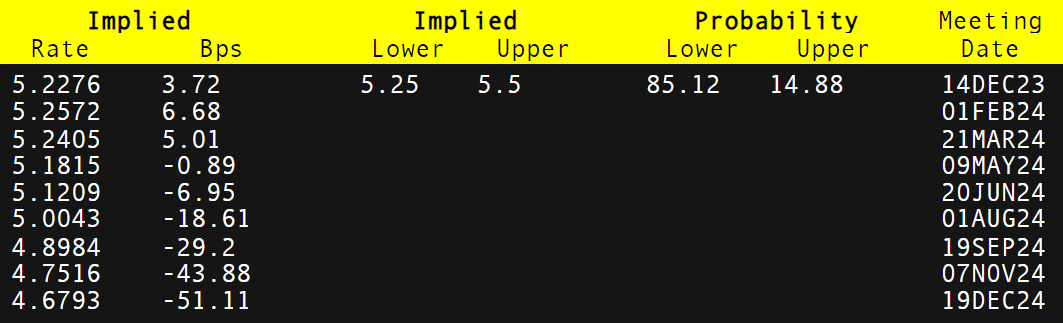

Money market pricing (see table below) shows December 2024 expectations for additional rate cuts being increased to 51bps from 40bps earlier this week. This pricing is incongruent with Governor Bailey’s messaging as well as the BoE’s inflation forecasts. Time and more data will give traders a more accurate picture of the potential trajectory of the BoE.

BOE INTEREST RATE PROBABILITIES

Source: Refinitiv

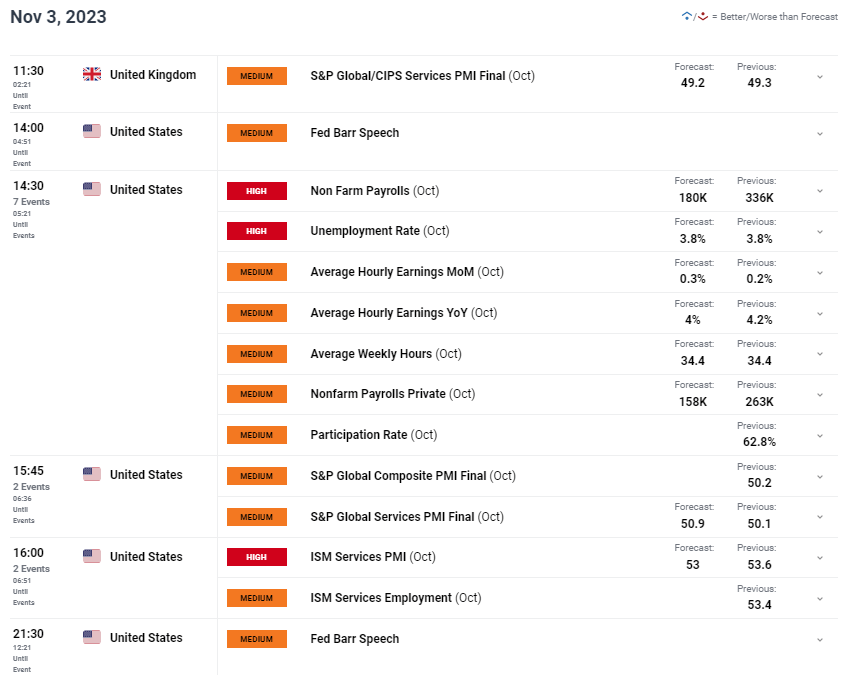

The economic calendar (below) is largely centered around US specific data but UK services PMI will impact cable first. Moving into contractionary territory over the last two months, forecasts suggest this may remain below the 50 mark for October and shouldn’t have much of an influence on the pair. Volatility will likely pick up later in the trading session via the Non-Farm Payroll (NFP) report after weaker jobs data through ADP employment change and jobless claims earlier this week. Average earnings will be monitored closely to see whether or not recent declines continue or not.

ISM services PMI is another crucial statistic for the US being a primarily services driven economy. Unlike the UK, the US has managed to remain within the expansionary zone for this metric. Fed speakers are also scattered throughout the day and will provide their thoughts post-FOMC.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

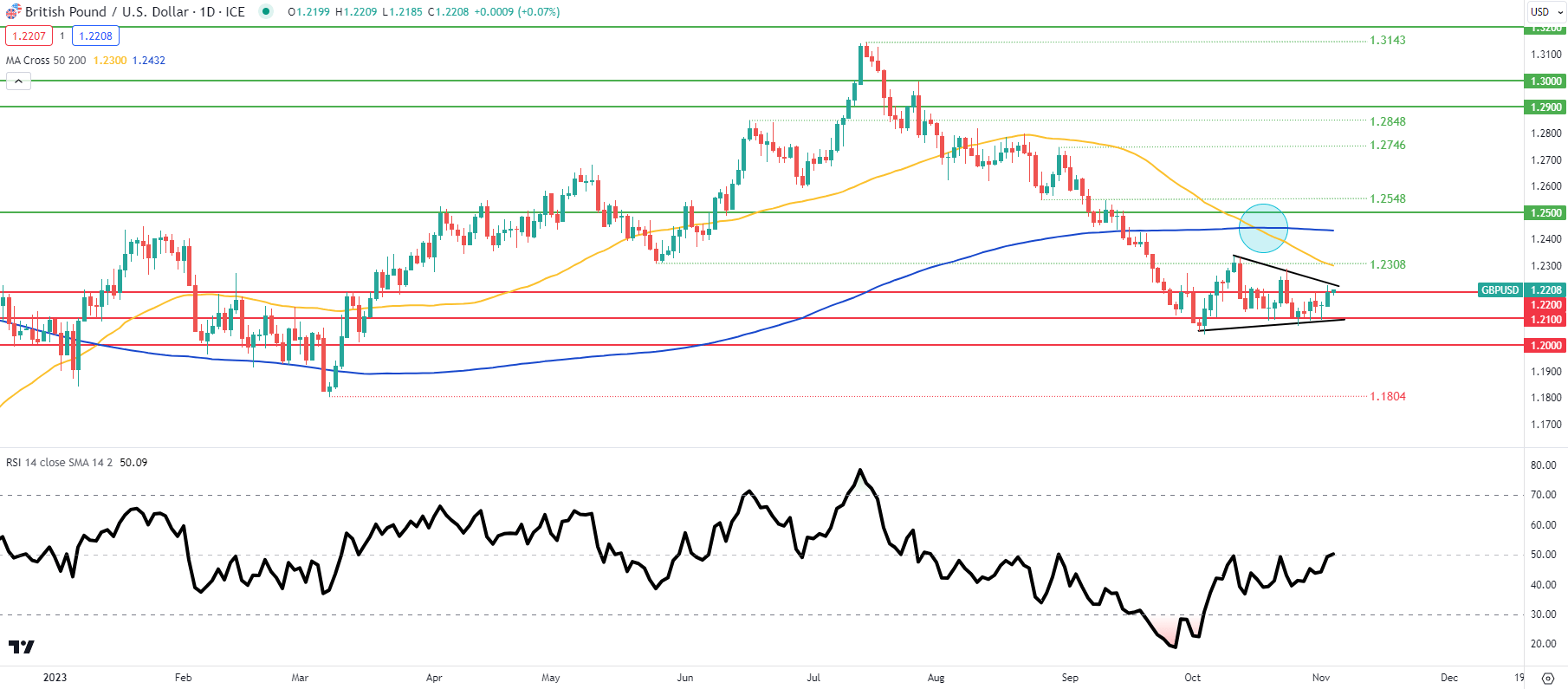

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

GBP/USD price action above shows the pair trading within a symmetrical triangle pattern (black) that traditionally tends to follow the preceding trend – downtrend in this case. That being said, a confirmation close and breakout above triangle resistance could invalidate this outlook. The short-term directional bias will likely be determined by the aforementioned US data which should keep investors cautious ahead of the announcements. The Relative Strength Index (RSI) supplements this viewpoint as the 50 level suggests market hesitancy favoring neither bullish nor bearish momentum.

Key resistance levels:

- 200-day MA (blue)

- 1.2308/50-day MA (yellow)

- Triangle resistance

Key support levels:

- 1.2200

- 1.2100/Triangle support

- Trendline support

- 1.2000

- 1.1804

BULLISH IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 67% of traders holding long positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas