FOMC INTEREST RATE DECISION KEY POINTS

- The Fed holds interest rates steady at its January meeting, in line with expectations

- Policymakers drop their tightening bias in favor of a more neutral stance, but signal a rate cut is not imminent

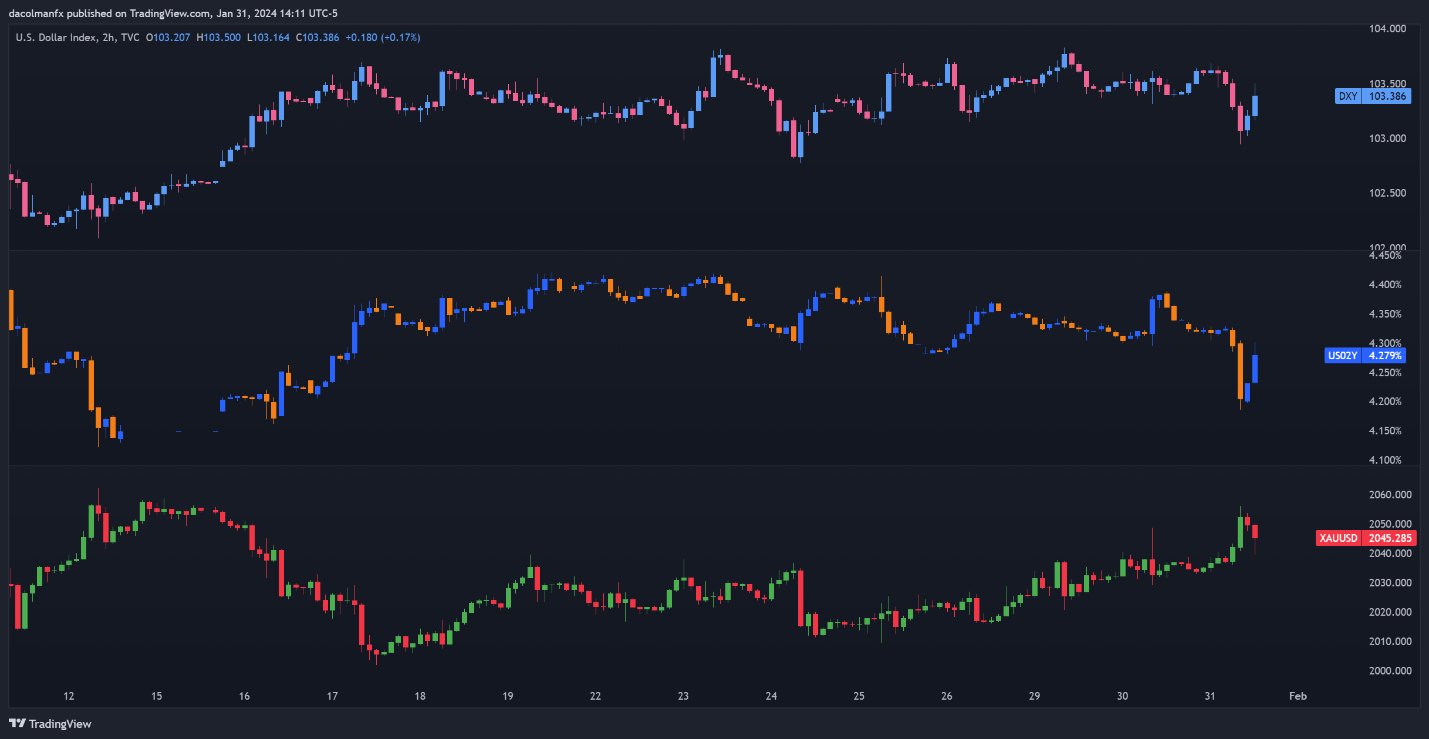

- Gold price trim gains as the U.S. dollar and yields attempt to mount a recovery

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Most Read: US Dollar Tech Setups– EUR/USD, GBP/USD, USD/JPY, USD/CAD; Volatility Ahead

The Federal Reserve concluded its first monetary policy gathering of 2024 today and voted by unanimous decision to maintain its benchmark interest rate unchanged within in its current range of 5.25% to 5.50%, in line with consensus expectations.

Almost two years ago, the Fed initiated one of its most aggressive hiking cycles in decades to tackle runaway inflation, delivering 525 basis points of rate increases in process. However, over the past four meetings, the institution has remained on hold due to softening price pressures in the economy.

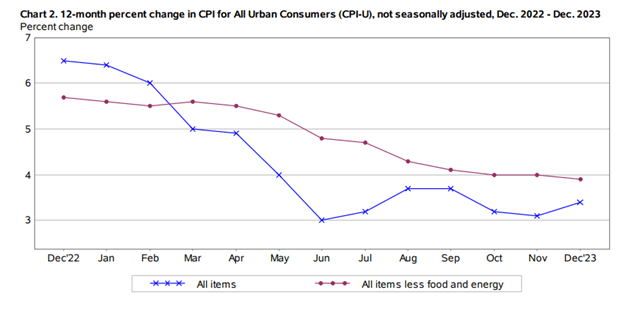

For context, headline CPI peaked above at 9% y-o-y in 2022, but has since fallen sharply, clocking in at 3.4% y-o-y last month. While still above the 2% target established by the central bank, progress on disinflation argues for a more cautious approach, as risks have become more two-sided.

US HEADLINE AND CORE CPI

Source: BLS

Want to know more about the U.S. dollar's outlook? Find all the insights in our Q1 trading forecast. Request a free copy now!

Focusing on the FOMC communique, the institution offered a constructive view of the economy, acknowledging that economic activity has been expanding at a solid pace, while reaffirming confidence in the labor market by noting that employment gains have been strong despite some moderation.

Regarding the evolution of consumer prices, policymakers maintained the wording from the previous statement, repeating that inflation has eased over the past year, but persists at elevated levels.

Turning attention to forward guidance, the central bank conveyed a slightly dovish outlook by dropping its tightening bias in favor of a more neutral message, with the central bank recognizing that the risks to “achieving its employment and inflation goals are moving into better balance”.

While the overall tone was a bit more dovish, the Fed also indicated that it does not expect to reduce borrowing costs “until it has gained greater confidence that inflation is moving sustainably toward 2%. This may be a sign that the FOMC is not yet ready to pull the trigger and ease its stance at the March meeting.

Immediately after the FOMC announcement was released, gold prices pared some of their early session gains as Treasury yields and the U.S. dollar attempted to stage a comeback. Powell is likely to offer more clues on the path of monetary policy, so traders should pay attention to his comments during the press conference.

Eager to gain insights into gold's future path? Discover the answers in our complimentary quarterly trading guide. Request a copy now!

US DOLLAR, YIELDS AND GOLD PRICES REACTION