Euro Vs US Dollar, British Pound, Australian Dollar – Outlook:

- EUR/USD’s range could continue for a bit longer.

- EUR/GBP and EUR/AUD’s rebound could be capped.

- What is the outlook and the key levels to watch in key Euro crosses?

The euro may have recouped some of its recent losses against some of its peers, but it would be premature to read the rebound as the start of a new leg higher for the single currency.

EUR has gained against its peers in June following the European Central Bank’s (ECB) hawkish hike last month and oversold conditions. However, further upside in EUR appears to be limited, particularly against USD, unless Euro area macro data starts to improve, or US jobs data disappoints.

Data published on Monday showed Euro area manufacturing activity contracted faster than initially thought in June, while US ISM manufacturing PMI dropped to the lowest level since mid-2020. However, looking beyond the start of the month manufacturing activity numbers, US macro data have been generally better than expected as reflected in the economic surprise index.In contrast, Euro area macro data has underwhelmed, giving USD a relative advantage on the growth front.

US non-farm payrolls are expected to have grown 225k in June, down from 339k in May, but the unemployment rate is expected to have eased to 3.6% from 3.7%. Better-than-expected jobs data could cement expectations for a Fed rate hike later this month, keeping EUR/USD’s upside capped. Rate futures are currently implying a 90% chance of a 25-basis point hike on July 26.

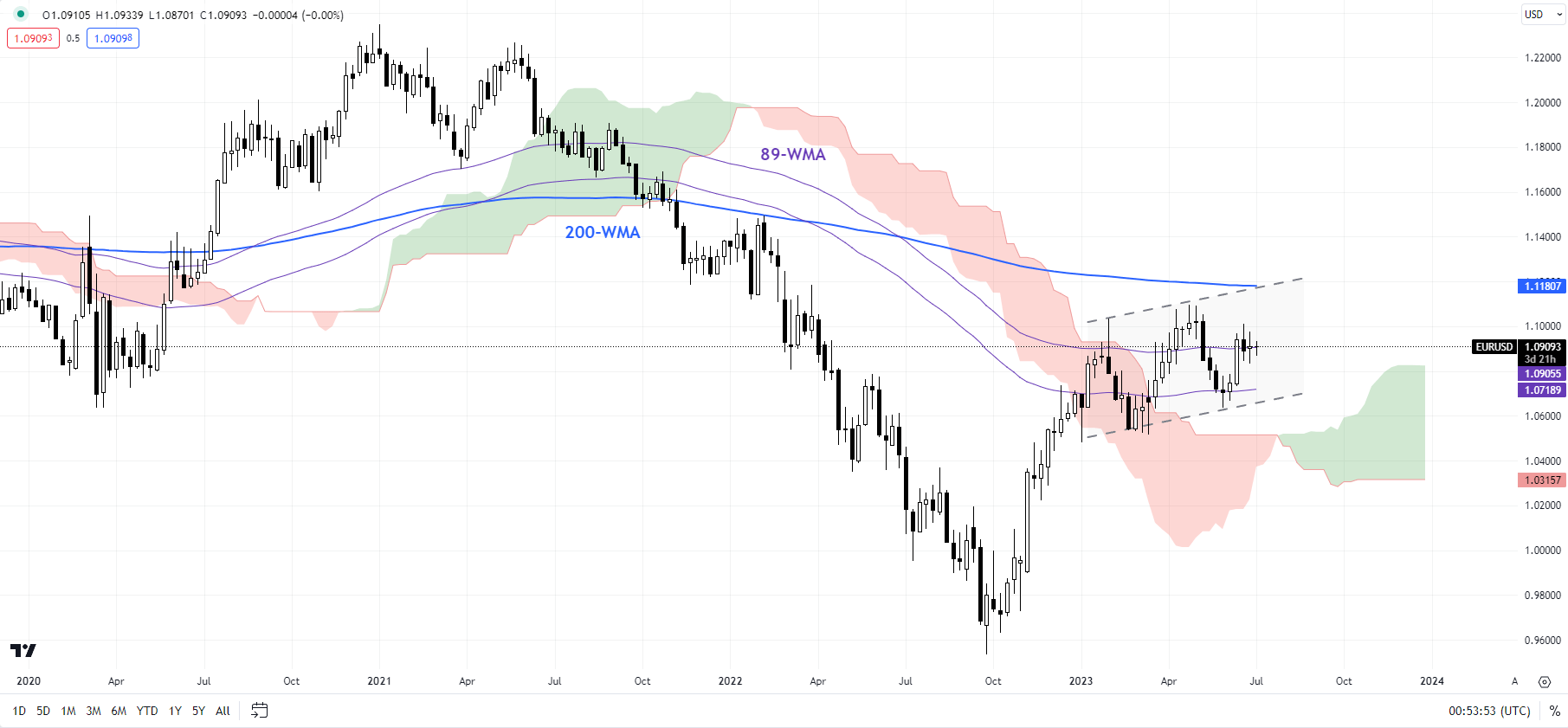

EUR/USD Weekly Chart

Chart Created by Manish Jaradi Using TradingView

EUR/USD: Broader upward bias unchanged

On technical charts, the broader trend for EUR/USD remains up. However, the range price action could extend a bit further. The top end of the range is marked by the May high of 1.1100, while the bottom edge of the range is a horizontal trendline from January, at about 1.0480. A break below 1.0480 is needed for the broader upward pressure to ease.

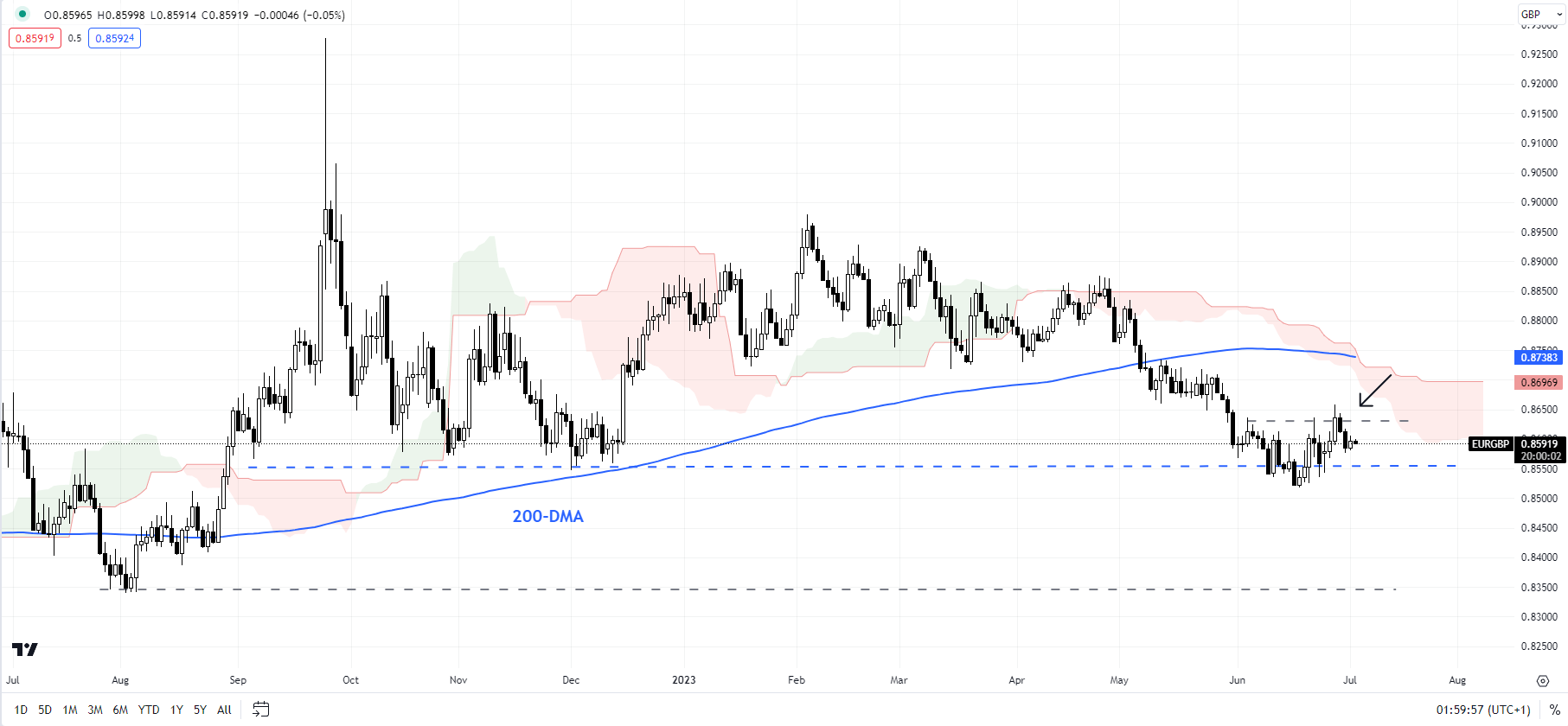

EUR/GBP Daily Chart

Chart Created by Manish Jaradi Using TradingView

EUR/GBP: Upside capped

EUR/GBP has rebounded from oversold conditions – a possibility highlighted in the previous update “Euro After ECB Rate Hike: EUR/USD, EUR/AUD, EUR/GBP Price Setups”, published June 19. However, the upside in the cross could be capped given stiff hurdles at the mid-May low of 0.8660, roughly coinciding with the 89-day moving average. On the downside, a decisive break below 0.8545 could pave the way toward the August low of 0.8340.

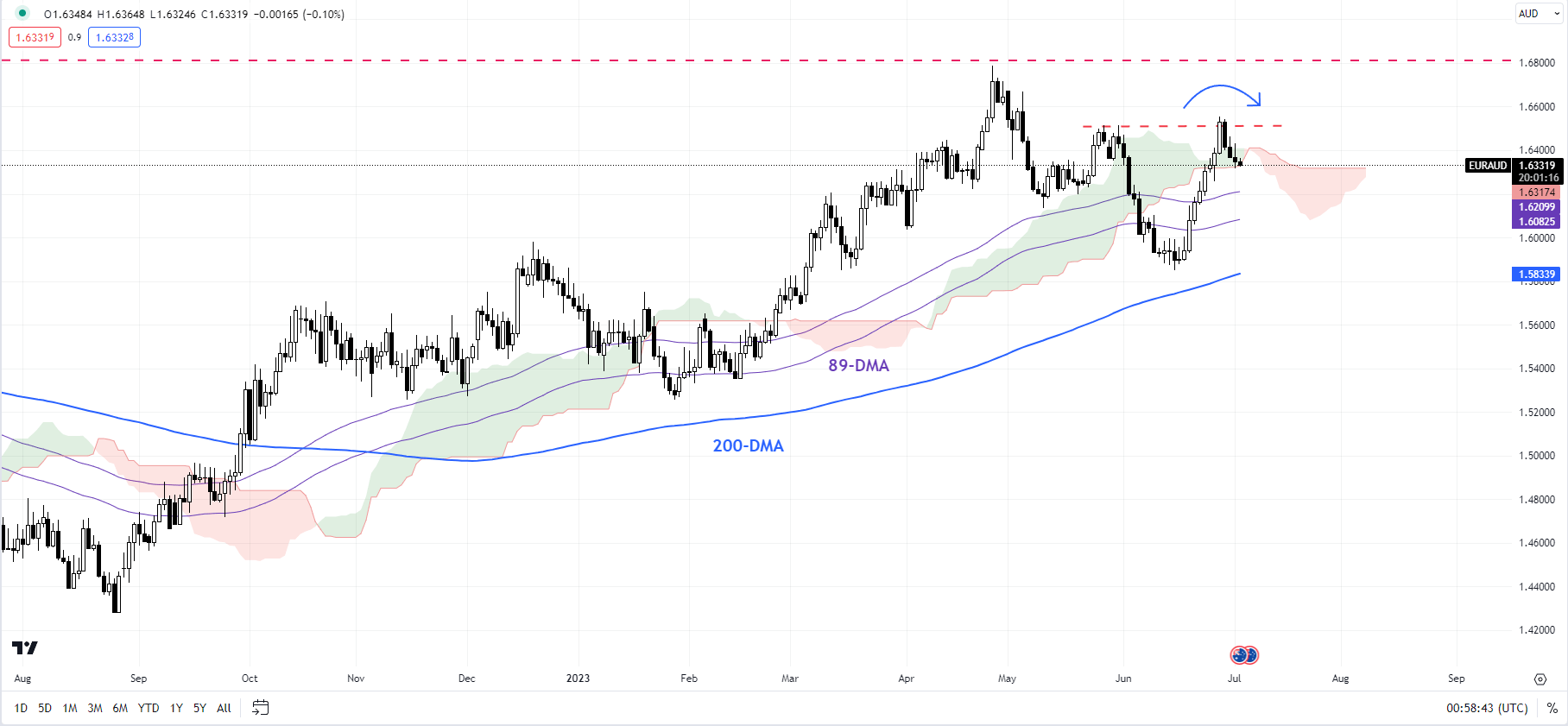

EUR/AUD Daily Chart

Chart Created by Manish Jaradi Using TradingView

EUR/AUD: Due for a retreat?

EUR/AUD has rebounded from near-strong support on the 200-day moving average – a possibility highlighted in the previous update “Euro After ECB Rate Hike: EUR/USD, EUR/AUD, EUR/GBP Price Setups”, published June 19. However, the cross has now run into a tough barrier at the end-May high of 1.6515, raising the prospect of a turn lower that could extend toward the 200-day moving average (now at about 1.5850).

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

--- Written by Manish Jaradi, Strategist for DailyFX.com

--- Contact and follow Jaradi on Twitter: @JaradiManish